How Is Web Scraping Real Estate Data Changing Property Market Predictions?

Introduction

In the modern digital landscape, data is the cornerstone of informed decision-making across every industry. Once dominated by intuition and limited local insights, the real estate market is now embracing a new era of intelligence. With the advent of advanced data collection techniques, Web Scraping Real Estate Data has become a transformative tool. It empowers investors, brokers, and analysts to access extensive property data seamlessly, enabling faster, more accurate evaluations and strategic decision-making.

The Data Revolution in Real Estate

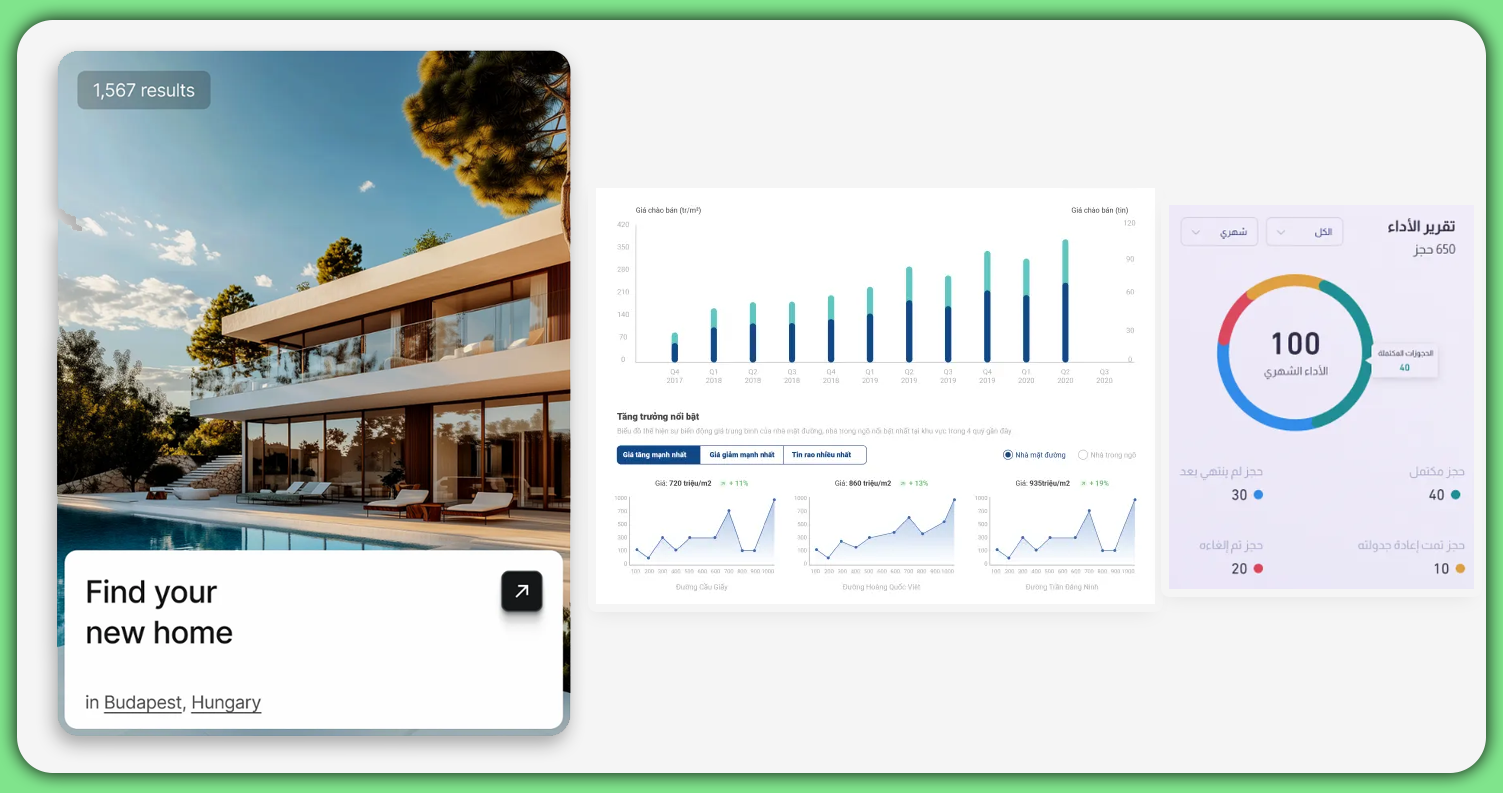

The real estate industry has undergone a profound transformation in recent years, driven by the increasing availability and sophistication of Real Estate Market Prediction Data. No longer limited to intuition or fragmented local insights, professionals now leverage comprehensive datasets that include property listings, historical pricing trends, neighborhood attributes, and broader economic metrics.

This shift has been accelerated by the rise of digital platforms—online property portals, real estate mobile apps, and the digitization of public records. Every property listing, price adjustment, and amenity detail is now available online, forming a vast digital ecosystem.

However, accessing and consolidating this wealth of information poses a significant challenge. That’s where the power of web scraping becomes essential. It enables efficient and systematic data extraction to fuel smarter, data-driven real estate decisions.

Understanding Web Scraping in Real Estate

Real Estate Data Scraping is the automated process of gathering vital property-related data from websites, mobile apps, and digital platforms. This technique leverages advanced scraping tools to seamlessly browse online sources, extract relevant details, and organize the information into structured datasets suitable for in-depth analysis.

The process generally includes:

- Identifying data sources: These include Multiple Listing Services (MLS), property listing platforms, government real estate databases, and mobile real estate apps.

- Creating scrapers: Tailor-made programs are developed to interact with specific platforms and accurately pull predefined data fields.

- Data extraction: Key details such as listing prices, property size, amenities, geographic coordinates, and neighborhood information are automatically collected.

- Data structuring: The scraped data is then transformed into clean, structured formats—ready for analysis, visualization, or integration into analytics platforms.

- Predictive modeling: With large volumes of real-time data, businesses can identify trends, forecast pricing shifts, and gain actionable insights into property market behavior.

What sets Real Estate Property Listing Datasets apart is their scale and depth. Thanks to the efficiency of automated scrapers, it's now possible to compile comprehensive data on hundreds of thousands of listings in a fraction of the time it would take manually—enabling faster decision-making and more innovative market strategies.

The Evolution of Market Predictions

In the past, traditional real estate market analysis was primarily driven by lagging indicators—data such as past sales figures that were often outdated by the time they were analyzed. Property valuations were typically based on comparable sales, or “comps,” offering a retrospective view that could not anticipate market changes.

Today, the landscape of Real Estate Market Predictions has evolved dramatically. With access to vast, real-time data enabled by web scraping, analysts are now equipped to:

- Track price changes in real-time across multiple markets.

- Identify emerging neighborhood trends before they become widely recognized.

- Assess the impact of new developments on surrounding property values.

- Forecast market movements based on current listing patterns and consumer behavior.

This transition from reactive to data-driven, forward-looking analysis marks a significant leap in how professionals interpret and forecast real estate trends—transforming market predictions from static estimations to dynamic, real-time insights.

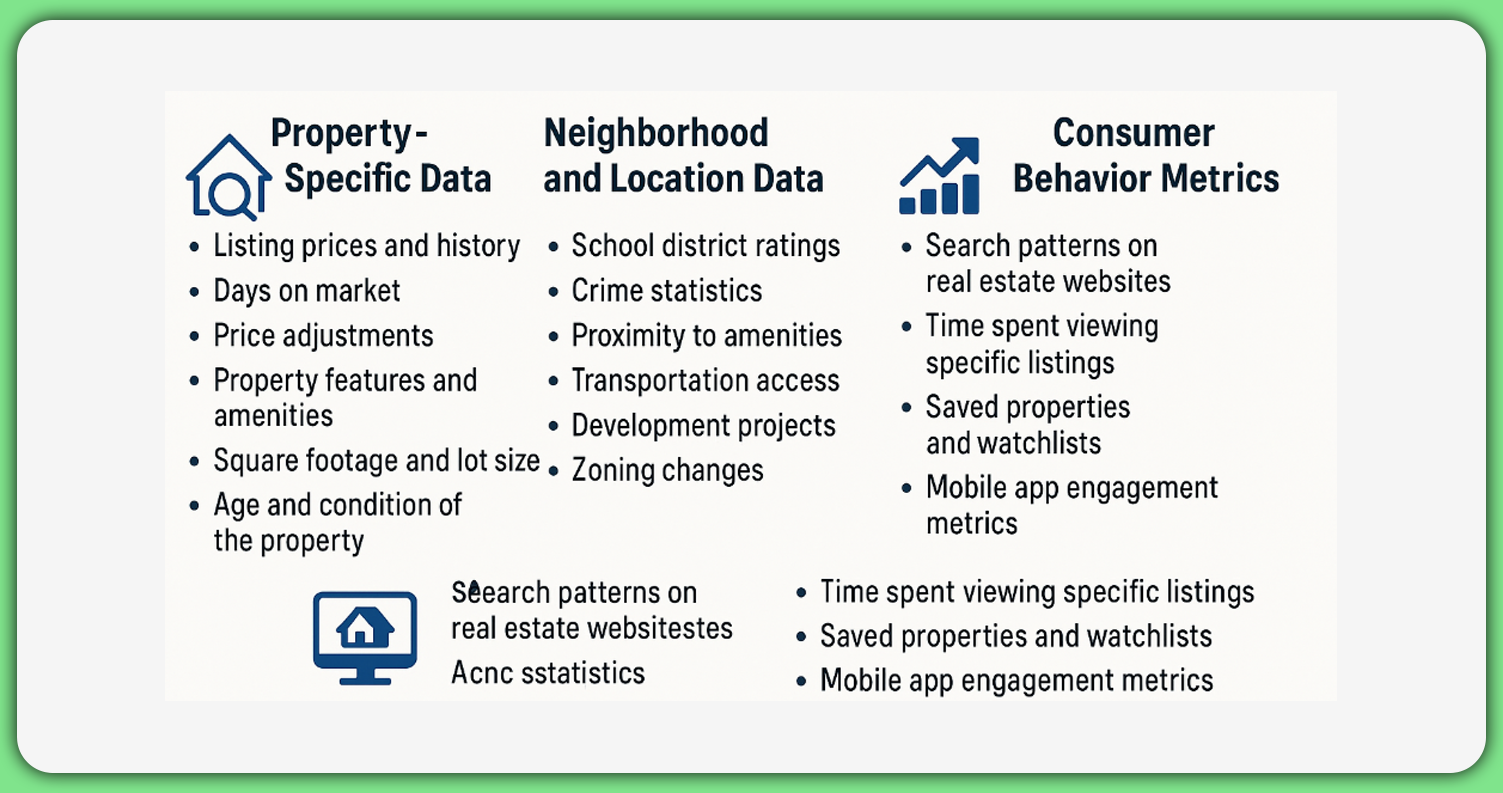

Key Data Points Transforming Predictions

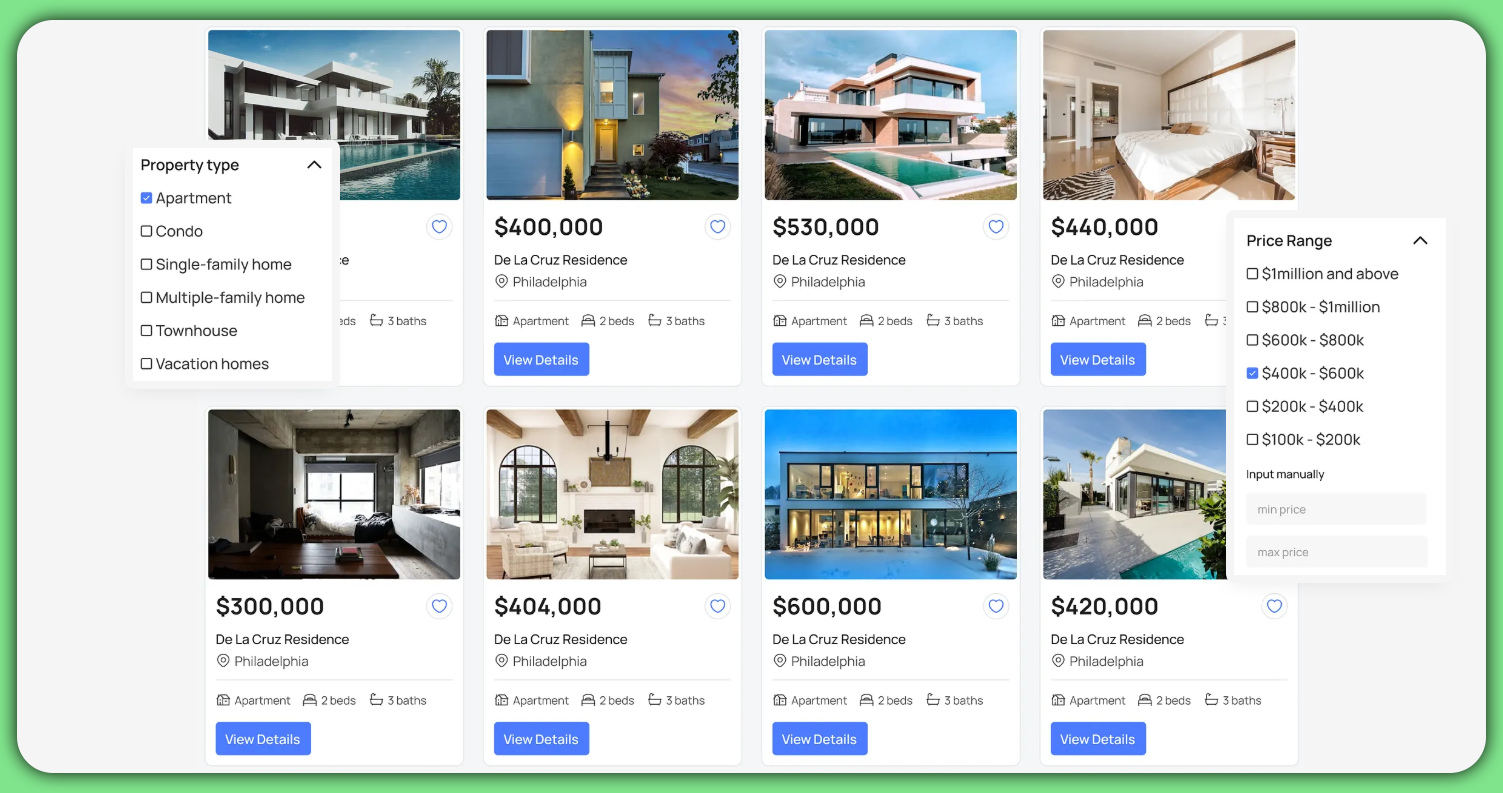

Today’s advanced Real Estate Property Price Prediction Data models leverage various data sources to deliver highly accurate forecasts. These models synthesize information across four core categories:

Property-Specific Data

Understanding a property's unique characteristics is critical to assessing its value and predicting future performance. Key indicators include:

- Listing prices and history: Tracking initial listing prices, subsequent changes, and sales history helps reveal pricing trends over time.

- Days on market: This metric highlights demand levels and potential pricing mismatches.

- Price adjustments: Frequent price changes may signal overpricing or shifting market sentiment.

- Property features and amenities: Details such as the number of bedrooms, swimming pools, or smart home integrations contribute significantly to the value.

- Square footage and lot size: These fundamentals offer a baseline for evaluating price per square foot.

- Age and condition of the property: Older homes or those needing repair may be valued differently than newer, move-in-ready listings.

Neighborhood and Location Data

The surrounding environment plays a substantial role in property valuation and market potential. Key neighborhood and location data points include:

- School district ratings: High-performing schools tend to attract more buyers and elevate home values.

- Crime statistics: Safety metrics can influence buyer demand and long-term investment potential.

- Proximity to amenities: Locations near grocery stores, parks, and restaurants are typically in higher demand.

- Transportation access: Easy access to public transit or major highways enhances desirability.

- Development projects: Planned infrastructure or commercial developments can boost future property value.

- Zoning changes: Shifting laws may open redevelopment opportunities or new usage scenarios.

Economic Indicators

Broader economic conditions also shape market forecasts. Core economic indicators to monitor include:

- Employment rates: Job growth often translates to increased housing demand.

- Population growth: Expanding populations signal rising demand for housing inventory.

- Income levels: Higher household incomes generally support stronger purchasing power.

- Interest rates: Fluctuating borrowing costs directly impact buyer activity.

- Mortgage approval rates: Loan availability reflects market liquidity and buyer accessibility.

- Stock market performance: Consumer confidence and investment behavior are often linked to equity market trends.

Consumer Behavior Metrics

Digital platforms offer real-time insight into buyer intent and engagement. These consumer behavior metrics can uncover emerging demand patterns:

- Search patterns on real estate websites: Based on search volume and trends, popular locations and property types can be identified.

- Time spent viewing specific listings: High engagement may point to properties priced well or in desirable areas.

- Saved properties and watchlists: These indicate buyer preferences and shortlist priorities.

- Mobile app engagement metrics: Usage patterns from mobile platforms offer granular insight into buyer journeys.

Real estate professionals and data analysts can craft refined, data-driven predictions by synthesizing these multifaceted key data points. These models balance macroeconomic forces and micro-market behaviors, enabling more strategic and responsive decision-making.

How Companies Are Leveraging Scraped Data?

The ability to Extract Real Estate Forecast Data transforms how different sectors within the property industry operate, driving more innovative strategies and enhanced decision-making.

Institutional Investors

Leading investment firms use advanced algorithms to process scraped property data, identifying undervalued assets and emerging market opportunities. These systems can analyze thousands of properties daily, applying intricate investment criteria that enable quick decision-making and provide a competitive edge.

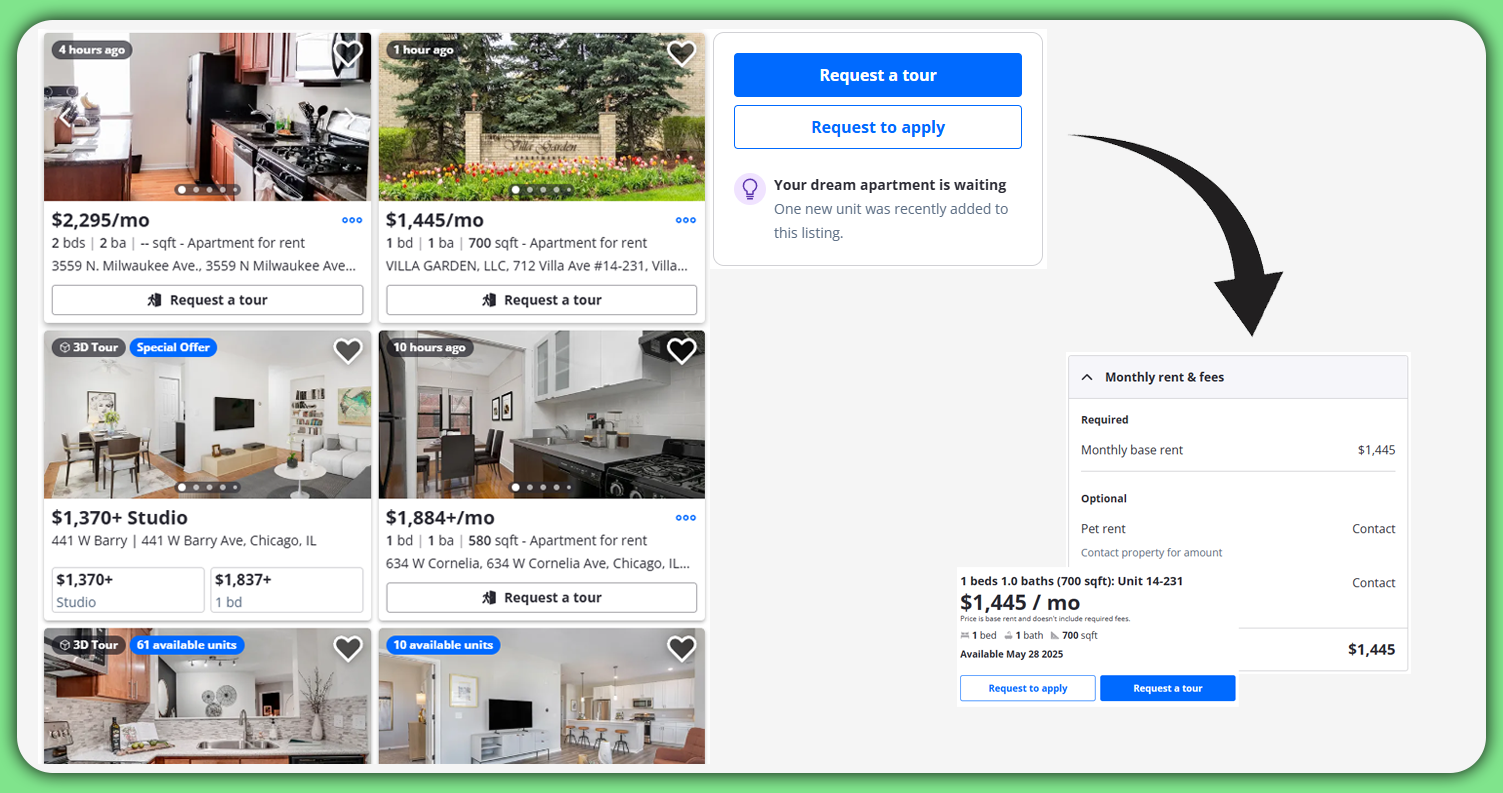

Real Estate Platforms

Industry giants like Zillow and Redfin have constructed their business models around extensive property databases, which are constantly updated through ongoing data scraping. Their predictive pricing models, such as Zillow's "Zestimate," are fueled by real-time data from millions of properties, ensuring the accuracy and reliability of their insights.

Mortgage Lenders

Financial institutions leverage trends in property data to assess lending risks, fine-tune regional lending criteria, and predict default rates. This strategic use of data allows them to make more informed decisions about where and to whom they extend financing, improving overall lending efficiency.

Development Companies

Construction and development firms Analyze Property Demand Data to pinpoint the most profitable locations, property types, and price points for new developments. By relying on data-driven insights, these companies reduce the risks associated with large-scale development projects and enhance their investment outcomes.

Understanding Real Estate App Price Trends

Mobile applications are crucial for both real estate professionals and consumers. They serve as a key tool in capturing essential market data and offer valuable insights through user interactions, adding new layers of intelligence to the real estate landscape.

Real Estate App Price Trends uncover critical data on:

- Consumer perceptions of value across different neighborhoods.

- The premium pricing of specific property features.

- The speed at which listings attract attention across various price ranges.

- Seasonal fluctuations in property searches and transactions.

Data generated by real estate apps is especially beneficial as it reflects consumer intent and interest before actual transactions, making it a leading indicator. This allows for predicting market shifts well in advance, potentially forecasting changes months before they occur.

The Technical Side of Scraping

To fully grasp the significance of Scraping Real Estate Predictions Data, it's essential to appreciate the technical complexities involved:

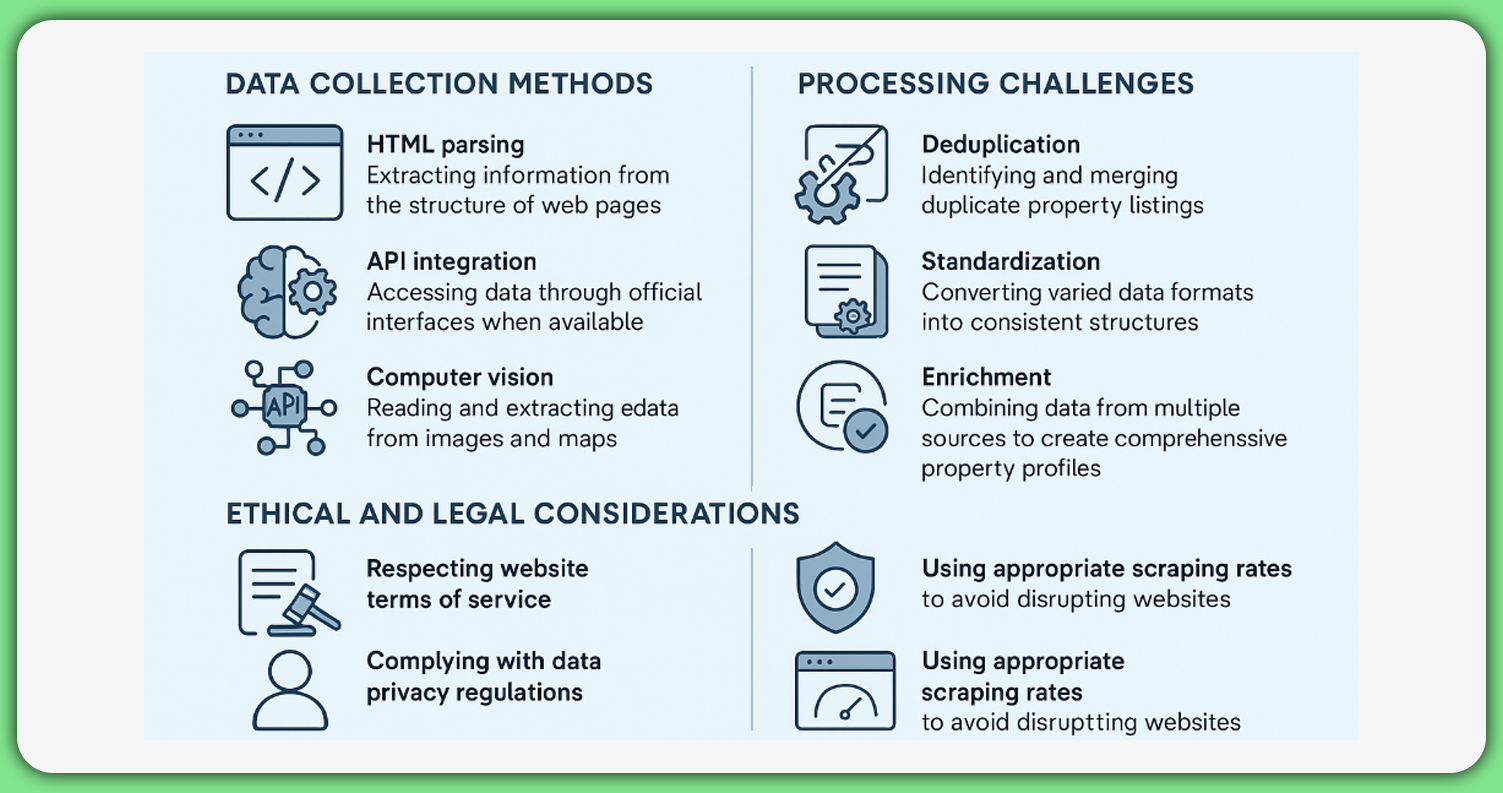

Data Collection Methods

Modern scraping systems leverage a variety of techniques:

- HTML parsing: Extracting information from the structure of web pages.

- API integration: Accessing data through official interfaces when available.

- Computer vision: Reading and extracting data from images and maps.

- Natural language processing: Interpreting textual descriptions to extract property features.

Processing Challenges

The raw data collected undergoes rigorous processing to ensure its value:

- Deduplication: Identifying and merging duplicate property listings.

- Standardization: Converting varied data formats into consistent structures.

- Enrichment: Combining data from multiple sources to create comprehensive property profiles.

- Validation: Ensuring accuracy by cross-referencing data.

Ethical and Legal Considerations

Companies involved in Real Estate Land Data Scraping must adhere to strict legal and ethical standards:

- Respecting website terms of service.

- Complying with data privacy regulations.

- Managing data security responsibly.

- Using appropriate scraping rates to avoid disrupting websites.

Real Estate Investment App Data: The Mobile Revolution

The rise of mobile applications has fostered the emergence of new data ecosystems within the real estate sector. Real Estate Investment App Data offers unmatched insights into:

- Investor property evaluation methods.

- Neighborhoods with the highest investor interest.

- Variations in investment criteria across different user demographics.

- The correlation between app engagement and actual property transactions.

This data, generated through mobile platforms, plays a crucial role in predicting potential investment hot spots and providing a deeper understanding of the factors influencing investor decision-making.

Emerging Trends in Real Estate Data Analytics

The real estate industry is transforming as innovative Real Estate Data Scraping techniques continue to evolve. Several emerging trends are reshaping how professionals approach data analysis:

- AI-Powered Valuation

- Predictive Maintenance Modeling

- Climate Risk Assessment

- Hyperlocal Market Analysis

Artificial intelligence algorithms integrate hundreds of variables to assess property values accurately. These systems consider factors that traditional appraisal methods may overlook, such as a property's aesthetic appeal based on listing photos.

Real Estate Data Scraping reveals essential information about building materials, construction dates, and maintenance records for commercial properties and multi-family developments. This data helps predict future repair needs and associated costs, providing valuable insights for property managers and investors.

Increasingly, property data includes climate and environmental risk factors. This allows for developing more sophisticated long-term valuation models, accounting for risks such as floods, wildfires, and other climate-related threats that impact property value.

With Real Estate Data Scraping, analysis can now reach unprecedented levels of granularity. Professionals can move beyond general zip codes or neighborhoods, enabling precise price trend predictions at a block-by-block or property-by-property level.

How Mobile App Scraping Can Help You?

We provide targeted data solutions to give real estate professionals a competitive edge. Our services offer distinct advantages to help you stay ahead in the dynamic market:

- Tailored Data Collection: We focus on precisely gathering data that aligns with your business needs, whether you are targeting commercial properties, residential investments, or land development projects.

- Regulatory Adherence: Our data scraping methods fully comply with legal and ethical standards, ensuring that your data acquisition process meets industry regulations.

- Seamless Data Integration: We don't just deliver raw data; we provide datasets that seamlessly integrate with your existing analytical tools, ensuring that your data works effortlessly within your current platforms.

- Predictive Model Creation: Our experienced data scientists can collaborate with you to develop custom predictive models that leverage your scraped data to pinpoint investment opportunities aligned with your goals.

- Ongoing Market Monitoring: Real estate markets are fast-moving, and our continuous monitoring services guarantee that you never miss emerging trends or opportunities.

By leveraging our tailored data solutions, you can enhance your decision-making, optimize investments, and stay ahead in the competitive real estate landscape.

Conclusion

The revolution in Real Estate Property Price Prediction Data is just beginning. As data collection techniques become more sophisticated and predictive models more accurate, the competitive advantage will increasingly belong to those who can effectively harness these technological capabilities.

Are you ready to transform your real estate investment strategy with data-driven insights? Don't let valuable market opportunities pass you while competitors leverage advanced data analytics. Web Scraping Real Estate Data is quickly becoming essential for staying competitive in today's fast-moving property markets. Contact Mobile App Scraping today to discover how our customized data solutions can enhance your market predictions and investment outcomes.