How Analyzing Online Seller Performance Using Scraped Data Shows 37% Trends on Snapdeal and Meesho?

Introduction

India’s fast-growing online marketplaces are becoming increasingly competitive as sellers race to improve visibility, pricing efficiency, and conversion performance. Platforms like Snapdeal and Meesho now host millions of sellers, making it difficult to understand what truly drives consistent sales growth. Brands, aggregators, and marketplace strategists are shifting from intuition-based decisions to data-driven evaluations powered by structured intelligence extracted directly from ecommerce platforms.

This shift has made Ecommerce App Scraping Services a practical approach for businesses that want visibility into seller rankings, pricing movements, review velocity, catalog expansion, and category-wise demand. Instead of relying on surface-level dashboards, scraped marketplace data reveals seller-level patterns that explain why some accounts grow faster than others.

By studying seller listings, historical pricing changes, product availability, and customer feedback across Snapdeal and Meesho, organizations can identify performance gaps and growth indicators. When done correctly, Analyzing Online Seller Performance Using Scraped Data helps stakeholders move beyond isolated metrics and focus on marketplace behavior at scale.

Identifying Seller Growth Signals Through Structured Data Analysis

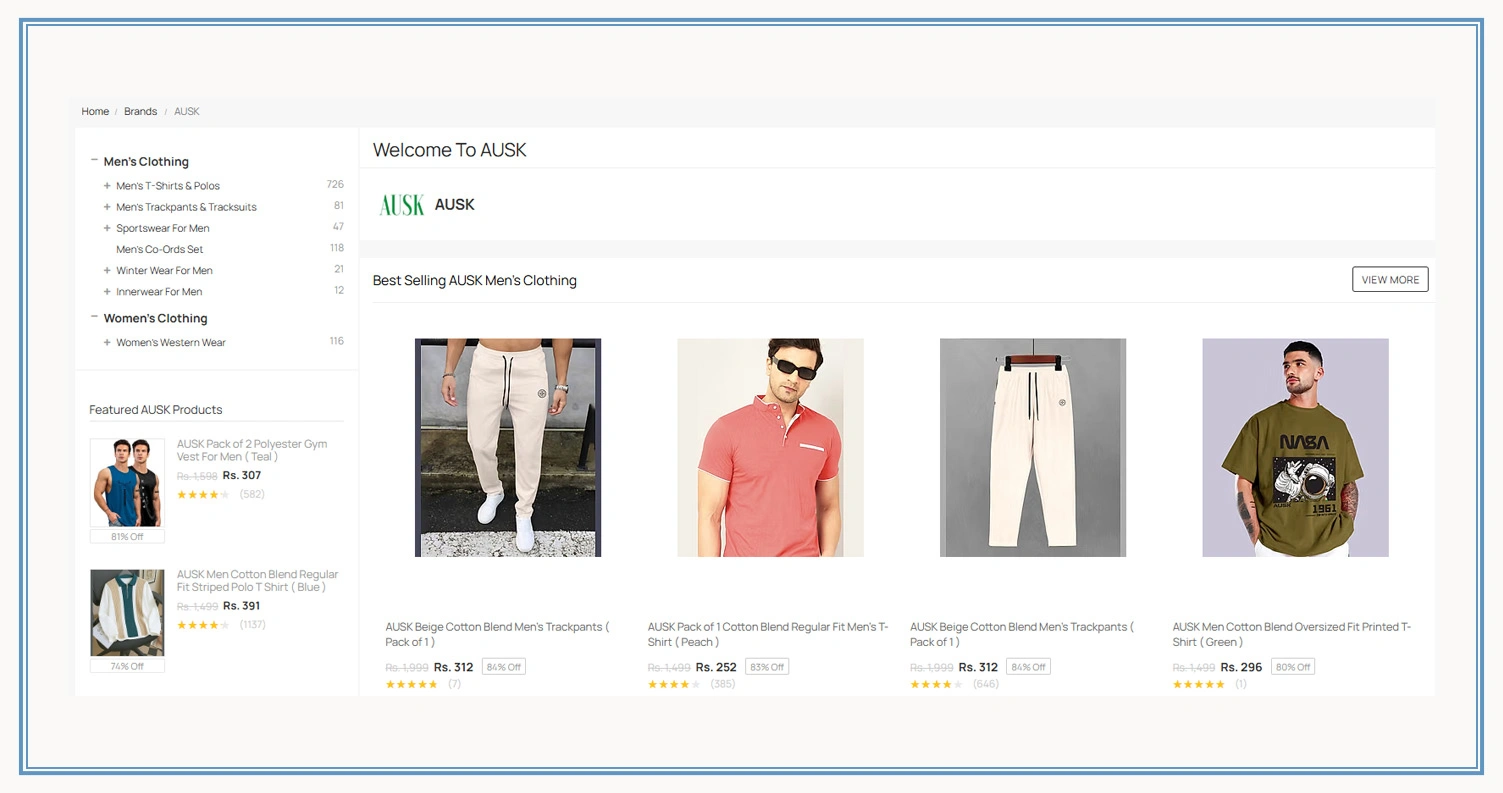

Data-driven evaluation shows that sellers achieving consistent growth typically follow measurable behavioral patterns related to pricing discipline, inventory reliability, and listing optimization. On Snapdeal, scraped datasets highlight that sellers with stable catalog maintenance and active price adjustments experience up to 37% higher visibility growth within six months compared to passive competitors.

One of the strongest indicators is pricing responsiveness. Sellers who adjust prices during demand spikes, festive periods, or category-level promotions maintain stronger ranking stability. This behavior becomes visible only when pricing movements are tracked continuously through Real-Time Price Scraping, allowing analysts to measure reaction time and competitive alignment.

Using Analyzing Snapdeal Seller Performance Using Scraped Data, businesses can further isolate metrics such as listing freshness, image updates, and rating consistency. Sellers updating titles and attributes bi-weekly show significantly better retention than those making quarterly updates. Scraped performance data also reveals that sellers with controlled discounting avoid long-term margin erosion while sustaining sales velocity.

| Performance Metric | High-Growth Sellers | Low-Growth Sellers |

|---|---|---|

| Monthly Price Adjustments | 6–8 | 1–2 |

| Stock Availability | 96% | 78% |

| Listing Update Cycle | Bi-weekly | Quarterly |

| Average Rating Stability | 4.3+ | Below 4.0 |

These indicators allow stakeholders to identify sellers with scalable operational discipline and predict category leadership shifts before they become visible at the surface level.

Understanding Platform-Specific Seller Behavior Patterns at Scale

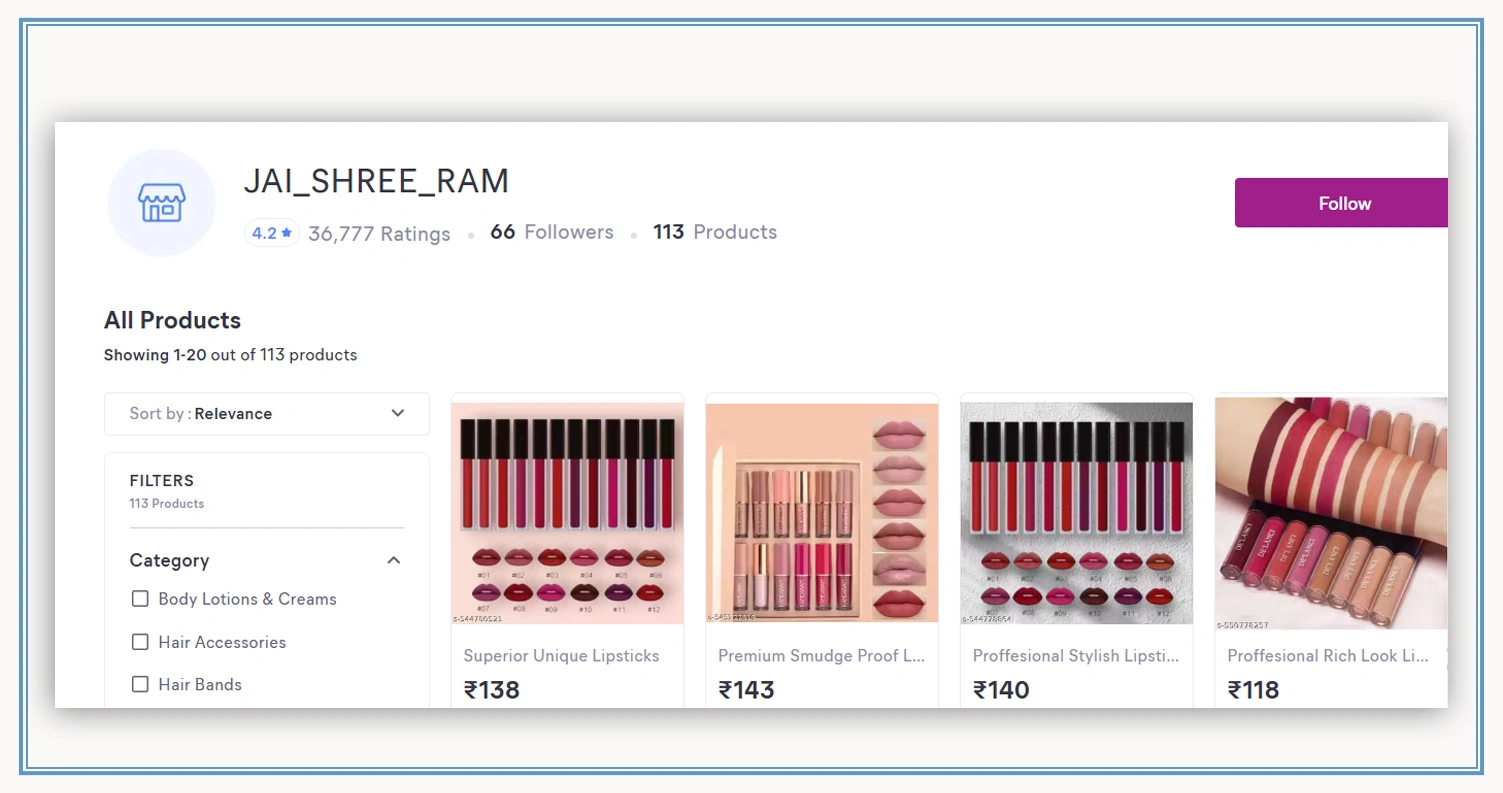

Meesho’s marketplace structure presents a distinct seller environment shaped by reseller networks, price sensitivity, and rapid product turnover. Scraped datasets indicate that sellers with focused assortments and faster fulfillment cycles outperform larger catalogs with inconsistent performance. Sellers maintaining limited but optimized SKU sets often achieve higher order velocity and better reseller engagement.

Advanced Meesho Seller Analytics With Web Scraping reveals that early review accumulation plays a critical role in seller traction. Products receiving consistent reviews within the first 30 days tend to achieve stronger organic visibility across reseller feeds. Additionally, sellers maintaining uniform pricing across regions reduce reseller friction and improve repeat order probability.

When organizations aim to Extract Seller Data From Meesho Marketplace, they can monitor fulfillment speed, return rates, and catalog churn over time. Data shows that sellers dispatching orders within 24–36 hours maintain lower return ratios and higher reseller trust. Scraped insights also highlight that sellers focusing on trend-aligned categories adapt faster to shifting demand cycles.

| Seller Attribute | Top Performers | Average Performers |

|---|---|---|

| Reviews per SKU (30 days) | 45+ | 18 |

| Fulfillment Time | 24–36 hrs | 48–72 hrs |

| Catalog Size | 30–50 SKUs | 80+ SKUs |

| Return Rate | 4% | 9% |

These insights help businesses identify emerging sellers early and align sourcing, partnerships, and category strategies with measurable marketplace behavior.

Cross-Marketplace Seller Evaluation for Competitive Positioning

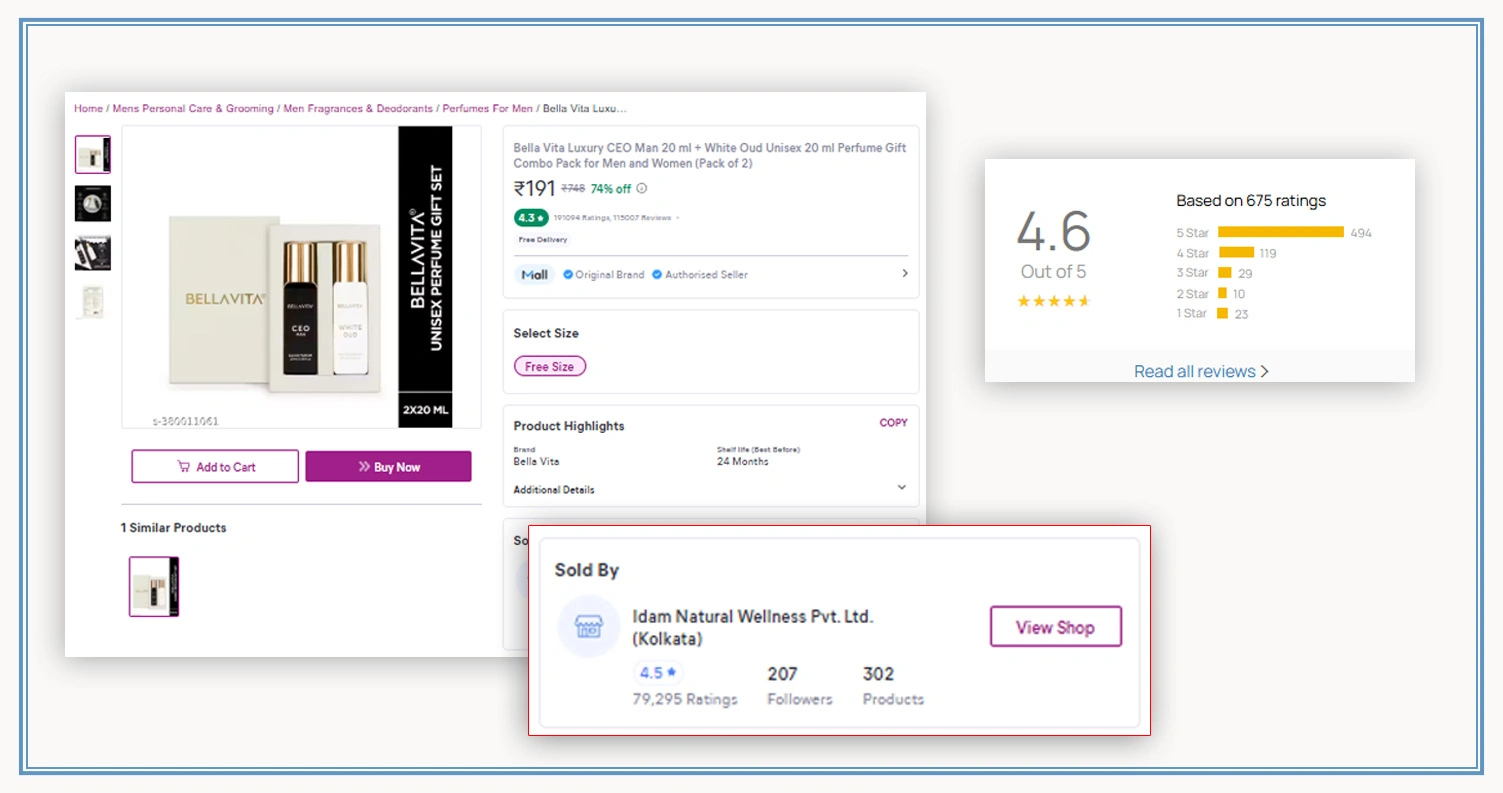

Seller performance varies significantly between marketplaces due to differences in buyer intent, pricing tolerance, and platform algorithms. Scraped datasets show that strategies successful on Snapdeal may not translate directly to Meesho without operational adjustments. This makes cross-platform benchmarking essential for accurate seller evaluation.

Organizations that Compare Seller Performance Across Snapdeal and Meesho uncover distinct behavioral contrasts. Snapdeal rewards structured catalogs, consistent ratings, and competitive pricing parity, while Meesho prioritizes fast-moving inventory, affordability, and fulfillment speed.

Structured analysis also reveals that sellers maintaining platform-specific strategies experience higher conversion stability. Businesses leveraging Marketplace Seller Performance Insights can identify sellers with adaptable operational models rather than platform-dependent success.

| Benchmark Area | Snapdeal Preference | Meesho Preference |

|---|---|---|

| Pricing Approach | Competitive parity | Value-driven |

| Catalog Strategy | Broad assortment | Focused SKUs |

| Customer Feedback | Rating stability | Review velocity |

| Delivery Expectation | Standard | Rapid dispatch |

By aligning seller strategies with platform-specific expectations, businesses reduce performance volatility and improve marketplace scalability with precision-driven decision-making.

How Mobile App Scraping Can Help You?

Modern marketplaces generate massive volumes of seller-level data that are not readily accessible through standard interfaces. In practice, Analyzing Online Seller Performance Using Scraped Data enables continuous tracking of seller behavior, pricing discipline, and listing quality without manual intervention.

Key advantages include:

- Monitoring seller ranking movement over time.

- Identifying pricing response patterns during promotions.

- Evaluating catalog health and update consistency.

- Tracking review growth and sentiment direction.

- Measuring stock availability and fulfillment reliability.

- Detecting emerging sellers early in key categories.

When combined with Extract Seller Data From Meesho Marketplace, organizations can design platform-specific strategies that improve seller partnerships, competitive positioning, and revenue forecasting accuracy.

Conclusion

Marketplace competition continues to intensify as seller ecosystems evolve rapidly across platforms. By applying Analyzing Online Seller Performance Using Scraped Data, decision-makers can move beyond surface-level metrics and focus on actionable performance drivers that consistently shape marketplace outcomes.

Strategic clarity improves when insights are aligned with Compare Seller Performance Across Snapdeal and Meesho, enabling smarter investments, seller selection, and operational planning. Contact Mobile App Scraping today to start building accurate, scalable seller performance intelligence.