How Does Extracting Liquor Seller Data From DoorDash Uncover 28% Pricing Volatility and Inventory Gaps?

Introduction

The surge in on-demand alcohol delivery has transformed how consumers evaluate pricing, brand options, and local availability across digital marketplaces. By Extracting Liquor Seller Data From DoorDash at scale, these hidden fluctuations become visible, enabling brands, distributors, and analysts to move beyond manual monitoring and delayed insights to make faster, data-driven decisions.

DoorDash, as a dominant delivery platform, aggregates hundreds of liquor sellers across neighborhoods, making it a rich but complex data source. Without structured monitoring, these variations are nearly impossible to quantify accurately. This is where Liquor Delivery App Scraping Services play a critical role by transforming scattered app listings into reliable intelligence.

By systematically studying seller-level information, businesses can identify hidden pricing volatility, track out-of-stock trends, and evaluate competitive positioning with precision. This blog explores how structured data analysis uncovers a documented 28% pricing fluctuation and recurring inventory gaps, while outlining practical ways data-driven insights can improve alcohol retail decision-making.

Local Seller Pricing Patterns Across Urban Zones

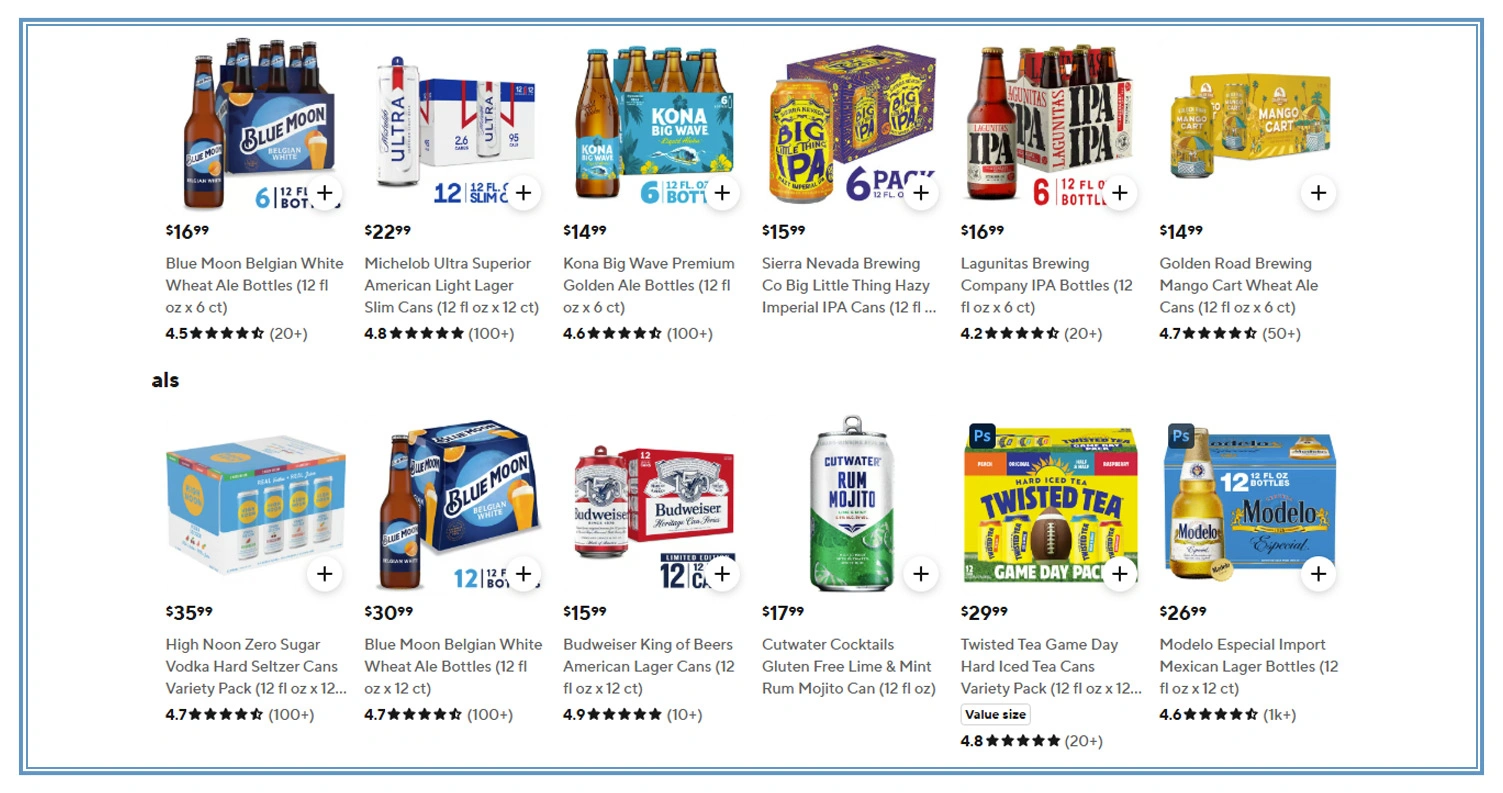

Alcohol pricing across delivery platforms reflects localized seller behavior rather than uniform brand control. This inconsistency creates confusion for brands attempting to maintain pricing discipline and for consumers comparing options within short delivery radii. When examined through Alcohol Delivery Market Analysis, these fluctuations reveal how hyperlocal competition influences margins and buyer decisions.

Specialty liquor stores frequently adjust prices during high-demand windows such as evenings or weekends, while hybrid retailers rely on bundled strategies that indirectly affect alcohol pricing. Insights gathered using

Grocery Delivery App Scraping Services make it possible to separate grocery-led pricing logic from liquor-only sellers, enabling more accurate benchmarking.

The following table outlines typical pricing dispersion observed across seller types:

| Seller Type | Average Base Price | Peak Price Shift | Weekly Variability |

|---|---|---|---|

| Specialty Liquor Store | ₹1,420 | +22% | High |

| Hybrid Retailer | ₹1,360 | +15% | Medium |

| Local Independent | ₹1,510 | +28% | Very High |

Understanding these patterns allows brands to detect undercutting risks and helps sellers assess whether aggressive price adjustments are improving volume or eroding long-term value. With structured observation, pricing decisions become measurable, comparable, and aligned with localized consumer behavior.

Inventory Visibility And Stock Consistency Challenges

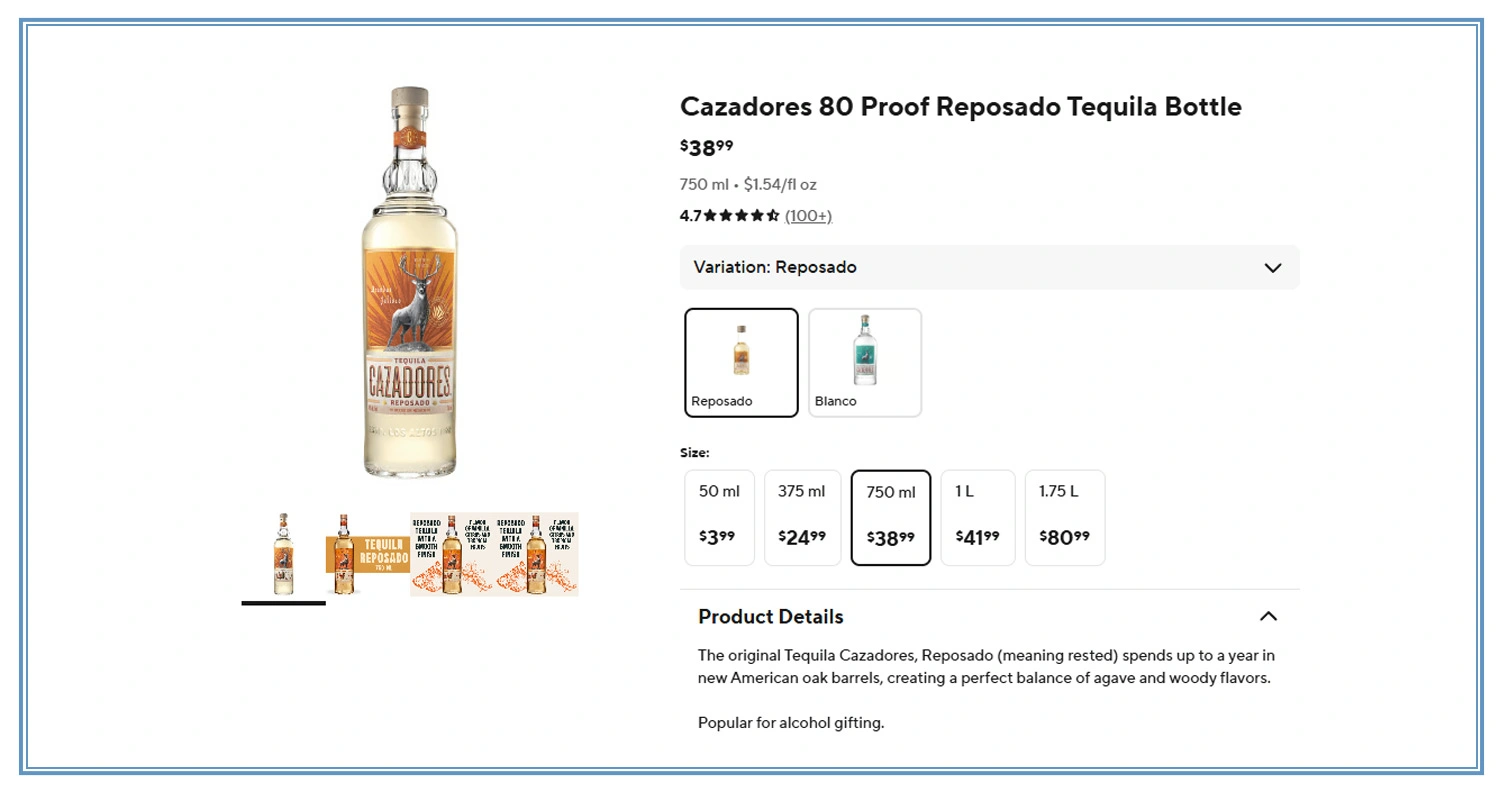

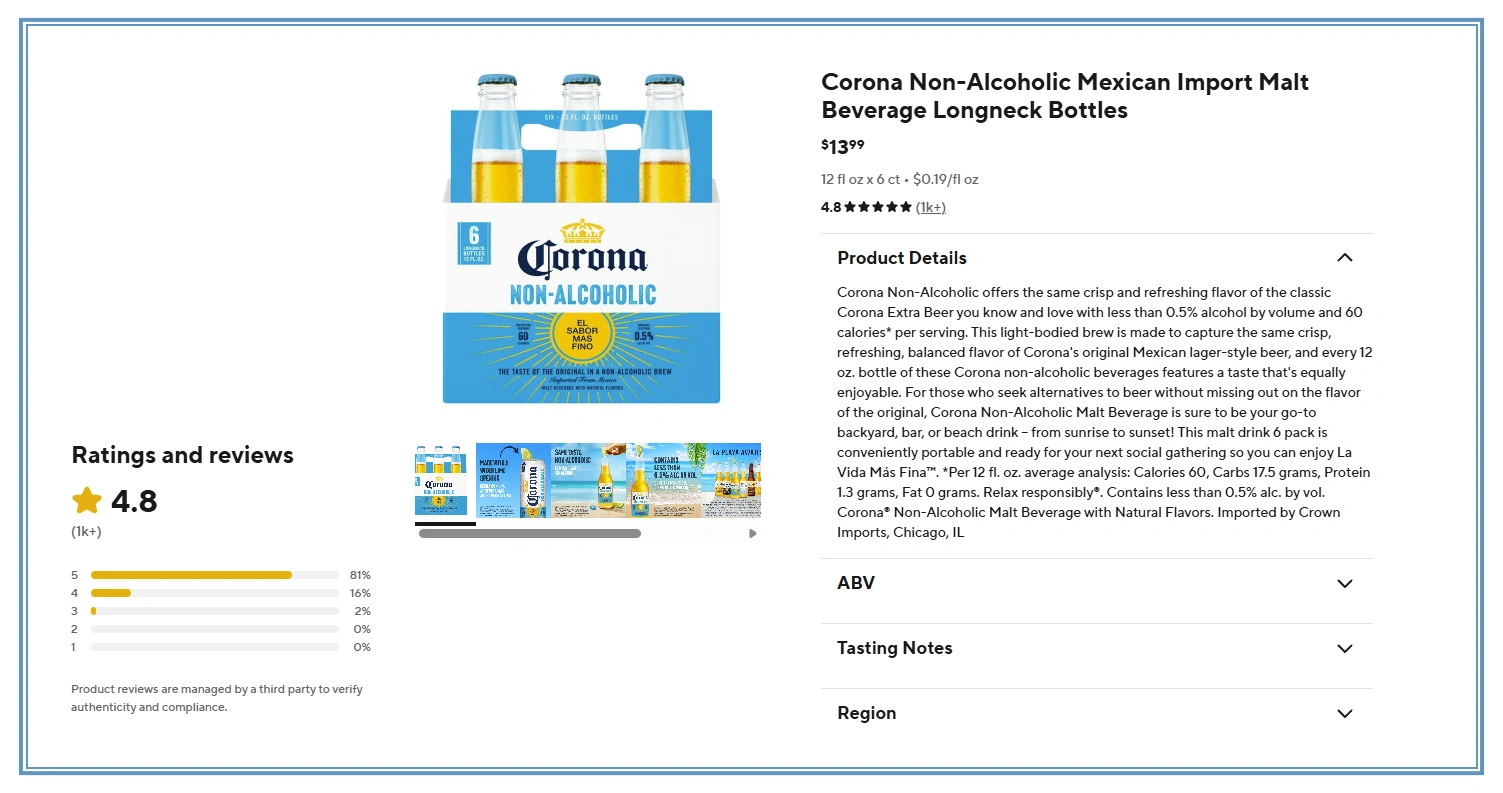

Availability is a decisive factor in alcohol delivery performance, often outweighing price sensitivity during peak demand periods. Sellers frequently face challenges maintaining consistent stock across fast-moving and secondary SKUs, resulting in missed orders and forced substitutions. When reviewed using DoorDash Liquor Pricing and Availability Analysis, recurring inventory gaps become clearly visible across neighborhoods and timeframes.

Data patterns show that weekend demand spikes amplify stock-out frequency, particularly for popular whiskey, vodka, and beer multipacks. Sellers may prioritize top sellers while neglecting broader assortment depth, causing uneven brand exposure. These gaps also affect consumer trust, as listed availability does not always reflect actual fulfillment capability.

The table below summarizes common availability issues identified through structured tracking:

| Issue Category | Occurrence Rate | Primary Impact |

|---|---|---|

| Weekend Stock-Outs | High | Lost peak revenue |

| Assortment Imbalance | Medium | Reduced brand visibility |

| Listing Discrepancies | Medium | Order cancellations |

By addressing these blind spots, distributors can plan replenishment more accurately, while brands can focus promotional efforts on sellers with consistent availability. Sellers, in turn, benefit from clearer inventory planning that aligns digital listings with physical stock, reducing operational friction and improving customer satisfaction.

Competitive Signals Derived From Seller Behavior

Seller activity on delivery platforms generates continuous competitive signals that reflect real-time market dynamics. Pricing reactions, assortment adjustments, and response speed to demand shifts all indicate how sellers compete within dense urban zones. Access to Real-Time Liquor Pricing Data makes it possible to observe these behaviors as they unfold rather than after trends have passed.

Analysis shows that sellers who adjust prices quickly in response to nearby competition achieve higher order completion rates and improved visibility within app rankings. Slower responders often lose share even when offering comparable products. When these observations are consolidated into Structured Alcohol Retail Datasets, they become actionable inputs for strategic planning.

The table below highlights key competitive indicators identified through seller monitoring:

| Competitive Indicator | Observed Insight | Strategic Application |

|---|---|---|

| Price Reaction Speed | Faster sellers outperform | Dynamic pricing decisions |

| Brand Concentration | Localized brand dominance | Regional promotions |

| Assortment Stability | Higher repeat ordering rates | Seller prioritization |

These insights help brands refine regional positioning, support sellers with data-backed guidance, and anticipate short-term market shifts. Over time, structured competitive intelligence strengthens negotiation power, improves assortment planning, and supports sustainable growth within app-driven alcohol delivery environments.

How Mobile App Scraping Can Help You?

When applied correctly, Extracting Liquor Seller Data From DoorDash enables continuous monitoring of seller behavior, pricing shifts, and availability changes across locations. Instead of relying on delayed reports, stakeholders gain access to timely, structured insights that reflect real consumer-facing conditions.

Key advantages include:

- Consistent monitoring of seller listings across regions.

- Early detection of pricing anomalies and sudden changes.

- Identification of recurring stock-out patterns.

- Comparative assessment of competing sellers.

- Improved accuracy in demand forecasting.

- Stronger data support for strategic planning.

When these outputs are organized through Custom DoorDash Alcohol Data Extraction, businesses can align pricing, inventory, and promotional strategies with actual market behavior rather than assumptions.

Conclusion

Data-driven visibility is now critical for understanding today’s alcohol delivery landscape. Analyzing seller-level trends brings clear insights into pricing fluctuations, availability gaps, and regional performance variations, all unified within Structured Alcohol Retail Datasets that enable confident, data-backed strategic decisions.

As competition intensifies, relying on intuition alone is no longer sufficient. With Extracting Liquor Seller Data From DoorDash, brands and sellers can respond faster to market shifts using Real-Time Liquor Pricing Data. Connect with Mobile App Scraping today to get started.