How Does Extracting Redfin Housing Data for Real Estate Insights Uncover 20% Investment Opportunities?

Introduction

The real estate landscape in the United States is rapidly evolving, with market fluctuations creating opportunities for strategic investors. By Extracting Redfin Housing Data for Real Estate Insights, analysts and property investors can identify trends that traditional methods often overlook. The integration of digital analytics into real estate allows for precise monitoring of pricing trends, sales velocity, and neighborhood growth.

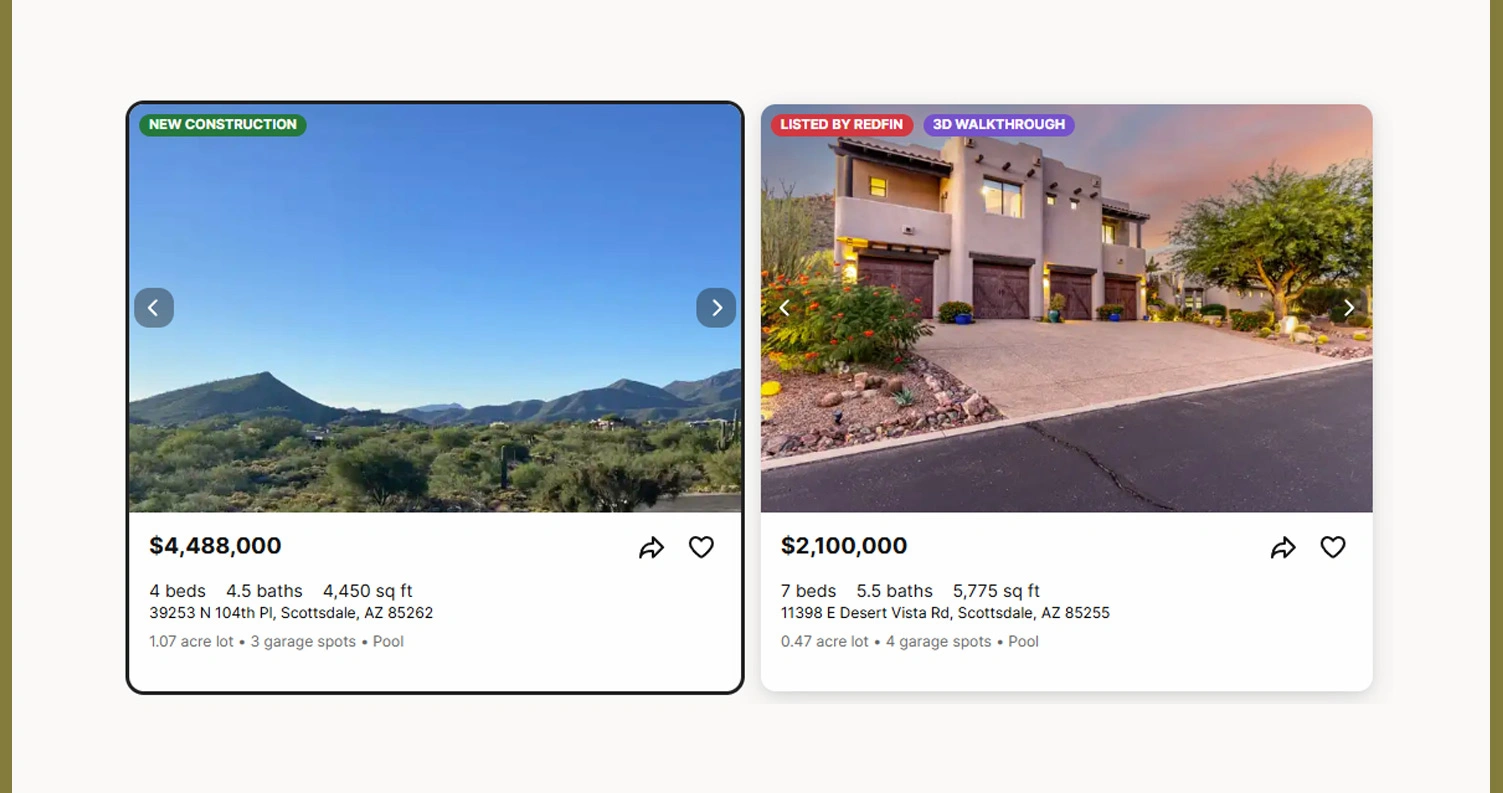

One effective approach involves Redfin Real Estate Data Scraping, which enables investors to access structured information directly from listing platforms. This includes property features, historical pricing, and demand indicators. Such real-time data ensures market insights are current, allowing investors to respond quickly to emerging opportunities and avoid potential risks.

Additionally, Real Estate Data Intelligence Using Redfin provides actionable insights to forecast trends and predict high-demand neighborhoods. By consolidating and analyzing property and demographic data, investors gain a holistic view of the market. This empowers better decision-making and enhances the potential to identify properties with above-average ROI, ultimately leading to smarter portfolio management strategies.

How Detailed Analysis Helps Understand Market Patterns?

Investors often struggle to anticipate price trends, gauge neighborhood growth, and benchmark properties accurately. Using Redfin Datasets, it becomes possible to assess inventory fluctuations, property appreciation, and demographic trends effectively. This data supports strategic decision-making and helps prioritize high-potential areas for investment.

| Parameter | Current Data | Year-on-Year Change | Insights |

|---|---|---|---|

| Median Home Price | $455,000 | +7.5% | Suburban growth showing strong upward trend |

| Inventory Levels | 12,800 homes | -4% | Tight supply suggests competitive buying environment |

| Days on Market | 36 days | -9% | Faster sales indicate strong buyer interest |

| Rental Yield | 5.9% | +0.3% | Increased rental demand enhances ROI |

| Foreclosure Rate | 1.3% | -0.2% | Lower distressed property risk |

By applying Redfin Data Scraping for Property Market Analysis, investors can efficiently compare multiple properties and evaluate potential ROI. Historical trends combined with current market data allow identification of undervalued properties that may appreciate faster than the overall market.

Additionally, insights from property-level analysis enable investors to perform scenario modeling. Factors like neighborhood growth, school quality, and local amenities can be quantified to understand their impact on property appreciation. This level of detailed analysis ensures decisions are backed by data rather than assumptions.

Incorporating Real Estate Data Intelligence Using Redfin further allows investors to identify emerging neighborhoods before they peak. Predictive insights highlight areas with higher demand, providing a strategic advantage. Investors equipped with such analytical tools can reduce risk exposure and optimize portfolio performance.

Techniques For Improving Investment Decisions Efficiently

Real estate investors face challenges such as delayed market data, inconsistent listing updates, and incomplete property information. Utilizing Popular Real Estate Data Scraping allows for continuous monitoring of new listings, price adjustments, and market trends. Real-time monitoring ensures that opportunities are captured promptly, and investment choices are data-driven.

| Metric | Real-Time Data | Previous Month | Interpretation |

|---|---|---|---|

| New Listings | 1,340 | 1,210 | Emerging inventory signals new opportunities |

| Price Reductions | 430 | 510 | Negotiation potential for investors |

| Open House Frequency | 78 | 64 | Popular neighborhoods attracting more buyers |

| Average Sq Ft Price | $322 | $311 | Property appreciation per square foot |

| Mortgage Rate Trends | 6.1% | 6.4% | Decreasing rates can encourage purchases |

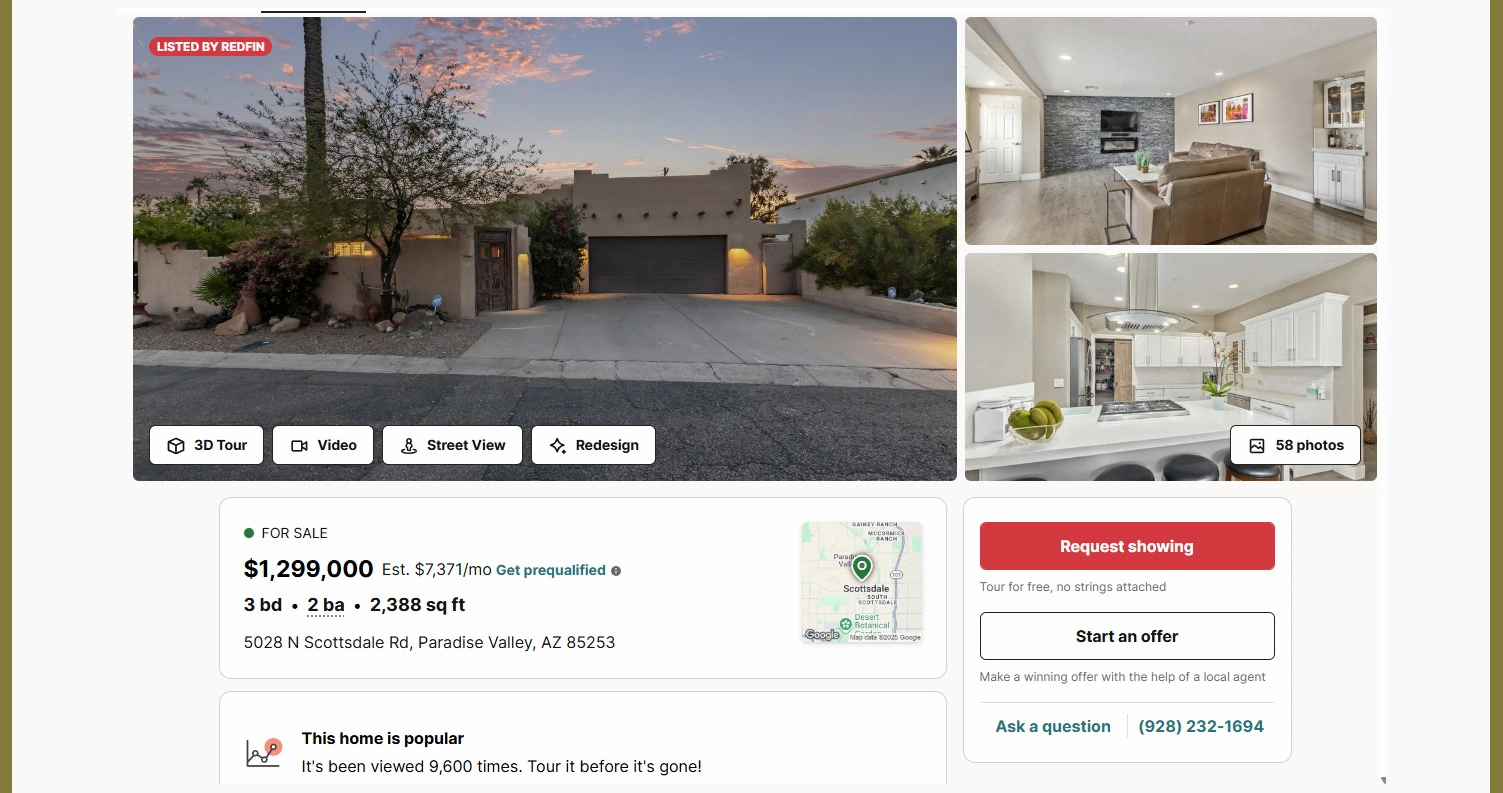

With Redfin Property Data Extractor, investors can automate comparisons of multiple properties and evaluate projected returns more efficiently. By combining these insights with Real-Time Real Estate Data Collection From Redfin, decisions reflect the most accurate, up-to-date market information.

This approach allows investors to detect anomalies, such as sudden price drops or surges in specific areas, enabling timely acquisition strategies. Evaluating properties in real-time provides clarity about potential gains and risks.

Furthermore, predictive analytics supported by these tools helps investors optimize their portfolios. For example, by tracking historical trends and current inventory dynamics, investors can forecast high-demand areas and focus capital on properties with maximum return potential. Integration of these insights into investment strategies ensures a proactive approach, which is crucial for competitive markets.

Methods For Maximizing Returns Through Property Analysis

Maximizing ROI requires understanding property potential, rental demand, and competitive positioning. With Real Estate App Data Scraping Services, investors can monitor occupancy rates, tenant behavior, and neighborhood trends. This supports refined investment strategies and data-driven decision-making.

| ROI Factor | Current Insights | Benchmark | Recommendation |

|---|---|---|---|

| Average Rent Growth | 4.1% | 3.6% | Focus on high appreciation regions |

| Vacancy Rate | 5.8% | 7% | Lower vacancies indicate strong rental demand |

| Renovation Impact | +16% | +11% | Minor renovations improve returns significantly |

| Price-to-Rent Ratio | 17.5 | 19.8 | Rental market profitability remains high |

| Investment Score | 86/100 | 74 | Above average performance relative to market |

Integration with Redfin API for Real Estate Analytics allows for automated property evaluation and ROI forecasting. By leveraging these analytics, investors can identify undervalued assets and optimize capital allocation.

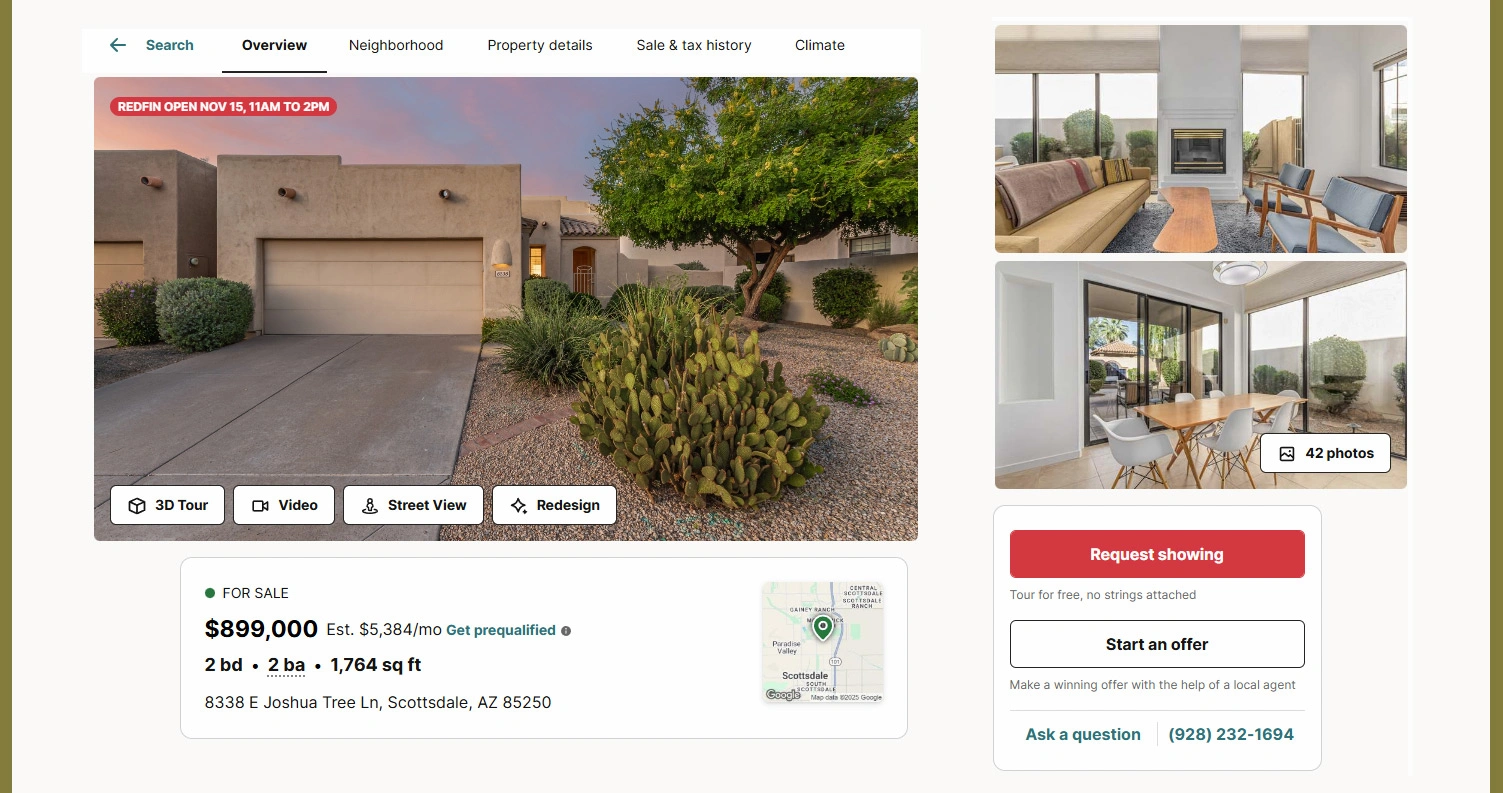

Moreover, using to Extract Property Data From Redfin Listings enables detailed insights into amenities, neighborhood quality, and local market dynamics. This level of analysis informs investment, renovation, and marketing strategies. Consequently, data-driven property management enhances revenue streams and reduces risk exposure, ensuring higher profitability.

Investors applying these methods can achieve a competitive edge in property markets. Strategic data utilization translates raw listing information into actionable insights, enabling smarter, targeted investments that maximize ROI potential.

How Mobile App Scraping Can Help You?

Mobile applications have become critical tools for real estate investors, offering instant access to property data and market analytics. By employing Extracting Redfin Housing Data for Real Estate Insights, investors can gain actionable insights directly from app interfaces, bypassing manual searches and delayed reporting.

- Monitor property listings continuously.

- Track price changes automatically.

- Compare multiple locations efficiently.

- Aggregate neighborhood and demographic data.

- Analyze historical property trends.

- Generate instant ROI projections.

With these capabilities, investors can make informed decisions without relying on outdated or incomplete data. Additionally, integrating Redfin Property Data Extractor into your workflows ensures seamless access to real-time property metrics and market intelligence.

Conclusion

The integration of Extracting Redfin Housing Data for Real Estate Insights into investment workflows empowers investors to uncover hidden opportunities and optimize portfolio performance. By leveraging comprehensive data analysis, predictive metrics, and market trends, decision-makers can strategically identify properties with the highest growth potential.

In addition, utilizing Redfin Data Scraping for Property Market Analysis enables a deeper understanding of property dynamics, rental trends, and neighborhood evolution. Contact Mobile App Scraping today to Start transforming your investment strategy today by implementing advanced data solutions for smarter property decisions.