How to Use FairPrice Data for Competitive Analysis to Boost 37% Margin Growth in 2026 Market Shares?

Introduction

In 2026, grocery e-commerce is becoming more aggressive than ever, with price wars, flash discounts, and rapid inventory shifts shaping how customers make buying decisions. Retailers and online grocery brands are no longer competing only on product range, but also on micro-level pricing decisions, real-time availability, and customer preference trends.

FairPrice has become one of the most valuable sources of retail pricing and grocery trend information, especially for brands aiming to understand product-level price movement, demand shifts, and promotional cycles. When businesses consistently Use FairPrice Data for Competitive Analysis, they can identify which SKUs are being aggressively discounted, which categories are trending upward, and where competitors are gaining customer attention.

This is where Grocery App Data Extraction becomes essential for analysts and pricing teams. With smart competitive intelligence, brands can forecast pricing movement, strengthen inventory planning, and drive stronger profit margins through more accurate business decisions.

Finding Profit Leaks Through Smarter Pricing Comparisons

Profit erosion often begins when grocery brands adjust prices without understanding competitor intent. Industry research indicates that nearly 23% of retail discounting decisions are made without real competitor pressure, meaning brands frequently reduce pricing even when the market does not demand it.

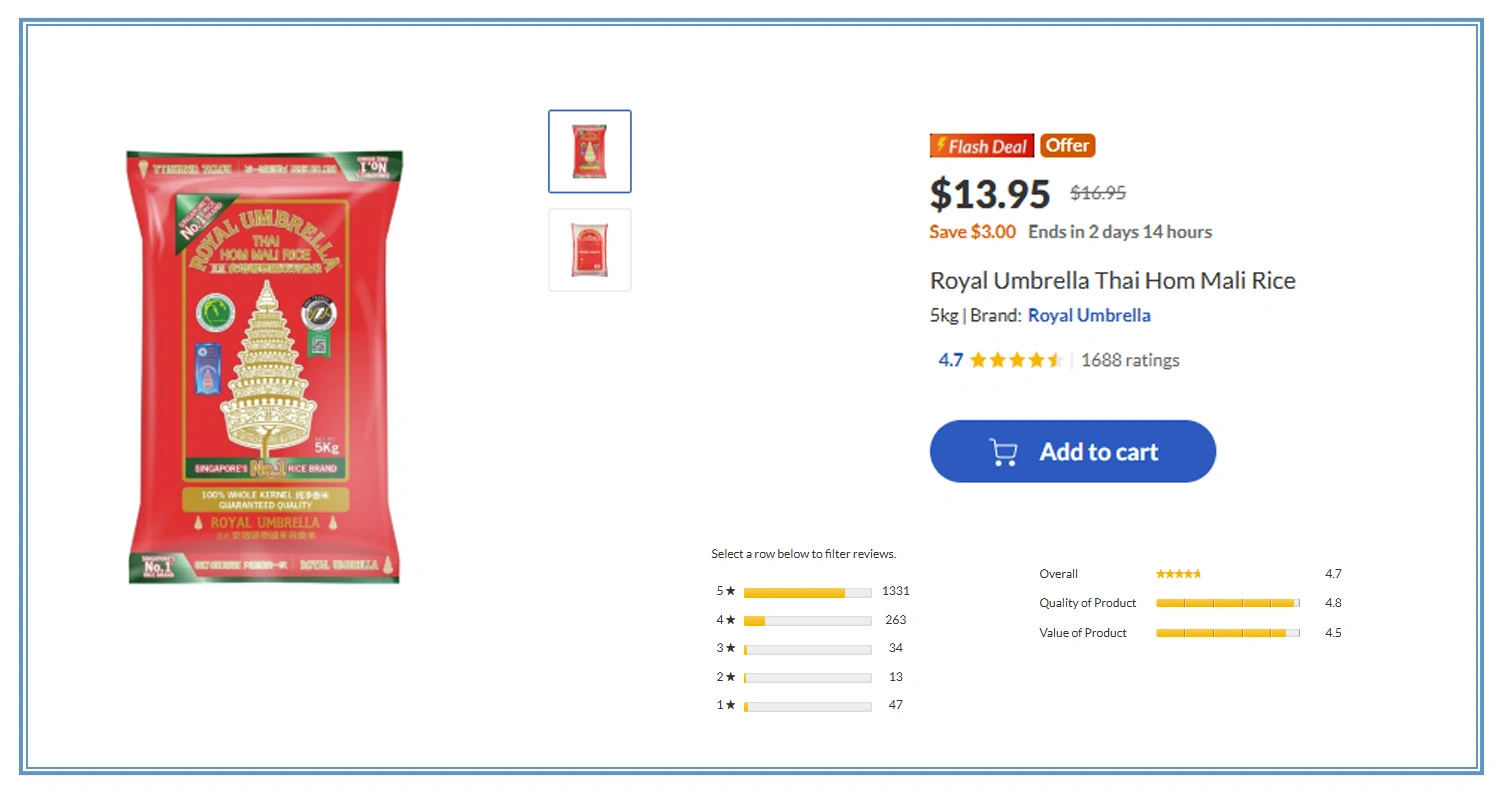

A structured pricing benchmark helps businesses identify where they are overpriced, underpriced, or reacting too late. With FairPrice Competitive Pricing Analysis, e-commerce teams can track how often prices change, which categories receive frequent promotions, and where pricing patterns repeat. This supports better decision-making instead of rushed reactions.

Additionally, by combining competitor benchmarking with a Price Optimization Service, brands can apply discounts selectively and protect their margin without losing conversions. This prevents panic-based discounting and supports stable category profitability.

Pricing Comparison Table:

| Pricing Factor | Manual Approach | Data-Based Approach |

|---|---|---|

| Price Change Tracking | Occasional checks | Continuous monitoring |

| Reaction Speed | 7–10 days | 1–2 days |

| Margin Stability | Unpredictable | More controlled |

| Discount Decisions | Guess-based | Competitor-driven |

| Conversion Impact | Low improvement | 12%–20% uplift |

With the right competitive approach, brands can reduce unnecessary promotions and improve profitability while maintaining customer trust in pricing.

Understanding Shopper Demand Through Category Signals

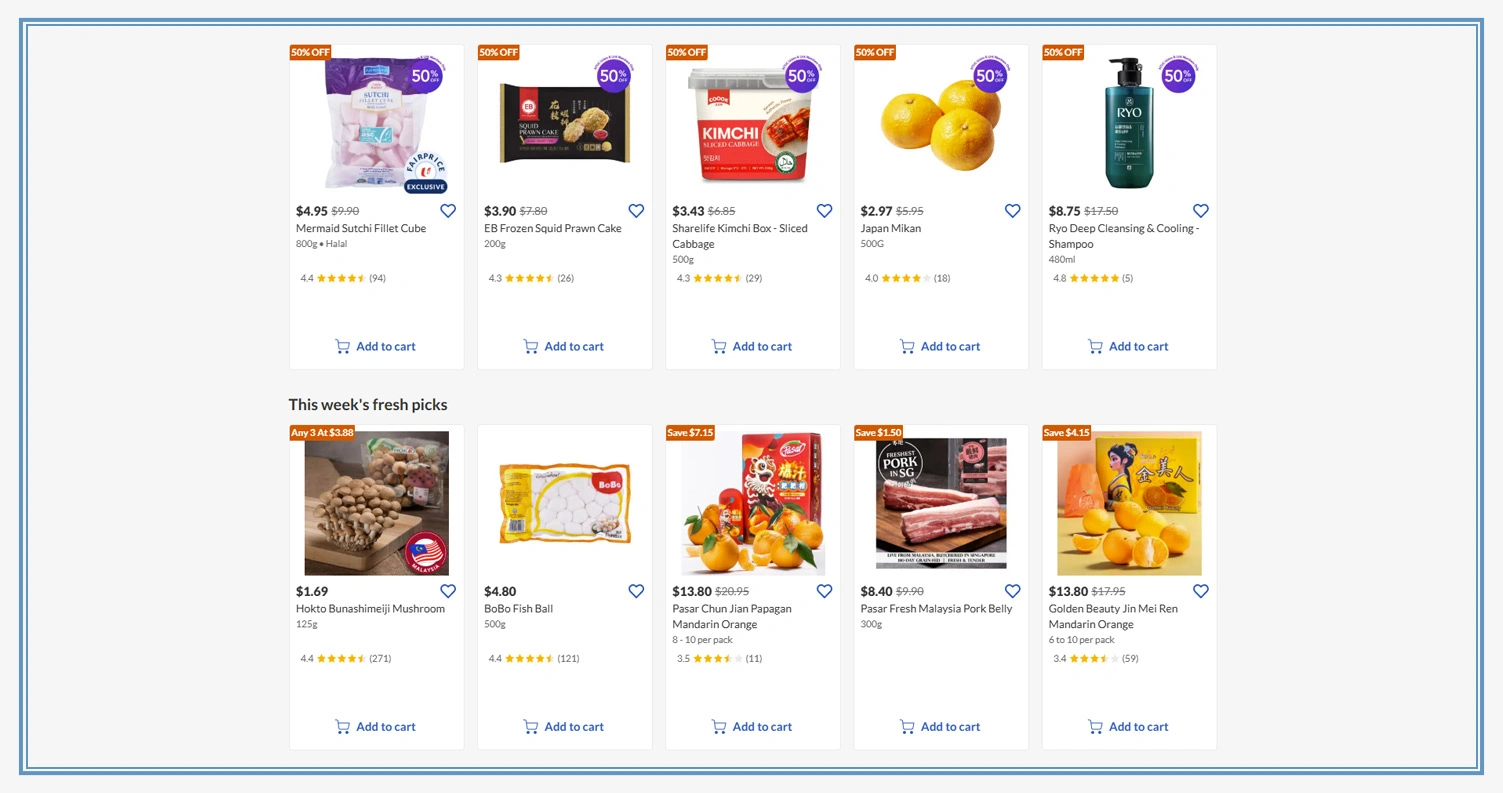

Pricing alone does not determine grocery success. Consumer buying patterns change rapidly, influenced by seasonal habits, festive demand, and shifting lifestyle preferences. Retail studies show that nearly 40% of grocery buying decisions are influenced by promotions and product visibility, meaning demand is directly connected to how competitors highlight and price items.

By using FairPrice Grocery Data Scraping, businesses can capture structured information on product rankings, stock availability, category expansion, and promotional rotations. This provides a clear view of what FairPrice is pushing most aggressively and which product segments are gaining traction.

Tracking availability is equally important. Frequent stockouts often indicate fast-moving SKUs, while consistent restocking highlights stable demand. Teams that analyze these patterns gain better forecasting accuracy and reduce dead stock.

Demand Behavior Tracking Table:

| Demand Signal | What It Indicates | Business Benefit |

|---|---|---|

| Frequent Stockouts | High customer demand | Better forecasting |

| Product Rank Changes | Shifting popularity | Faster campaign planning |

| Discount Bundles | Cart expansion focus | Upselling improvement |

| Category Growth | Emerging trends | Early product expansion |

| Seasonal Promotions | Time-based buying | Smarter inventory planning |

With structured demand monitoring, brands can improve planning accuracy, reduce inventory waste, and respond to market shifts faster.

Strengthening Market Positioning With Data Planning

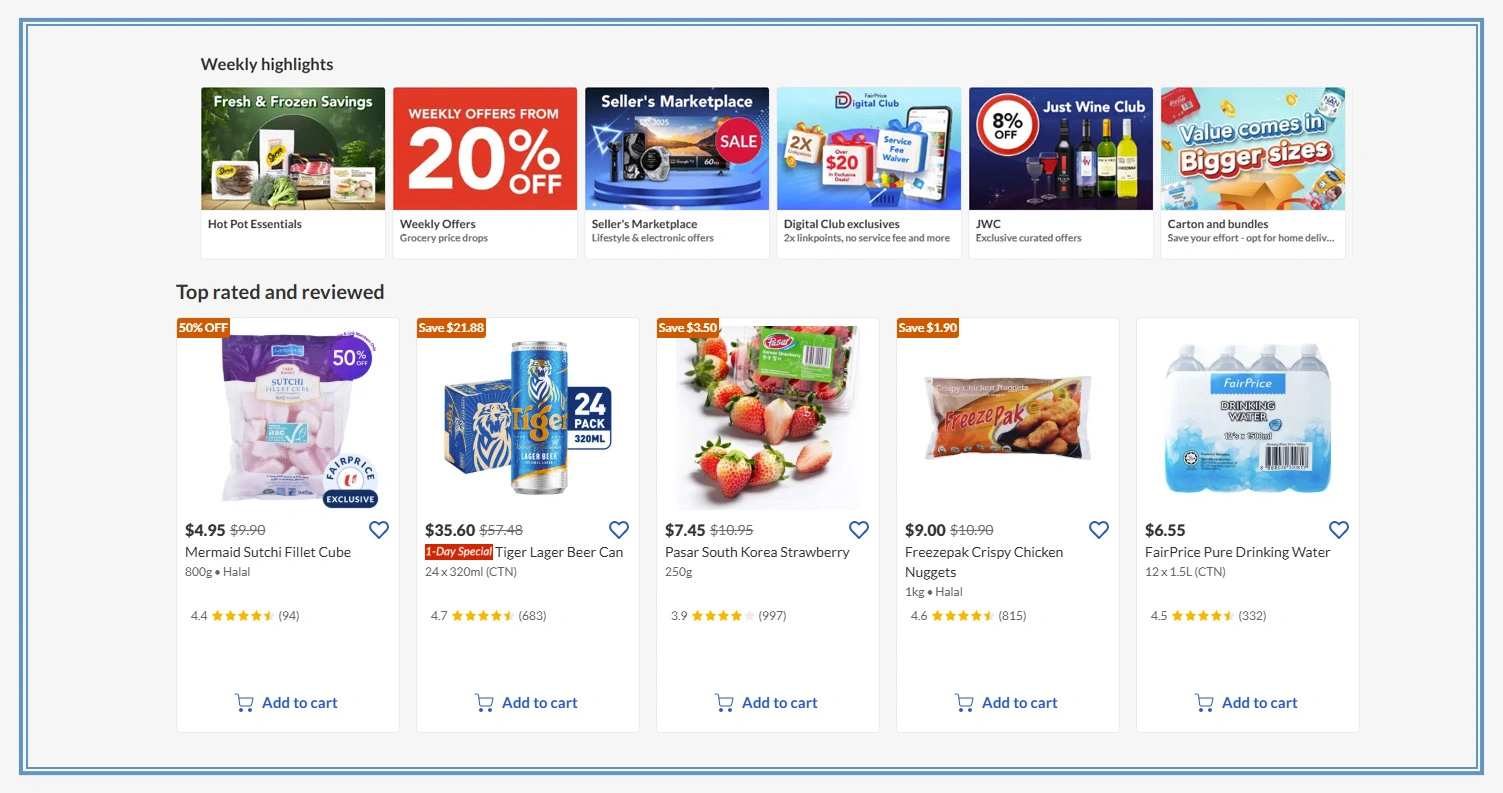

In 2026 grocery competition, market share growth is no longer driven by quarterly strategy alone. Competitors change pricing, bundles, and promotions frequently, forcing brands to respond quickly. Analysts report that companies using automated competitor tracking improve response time by 28% compared to manual monitoring.

A well-structured strategy requires monitoring competitor patterns continuously. Using Real-Time FairPrice Price Monitoring, teams can track sudden pricing changes, identify repeated discount cycles, and understand which categories FairPrice is prioritizing.

To build reliable competitor intelligence, companies also depend on FairPrice Price Scraping for structured extraction of product-level prices, offers, and stock updates. When teams analyze long-term movements, they can identify which promotions repeat every few weeks and which categories show aggressive price competition.

Market Share Strategy Table:

| Strategy Area | Traditional Planning | Data-Based Planning |

|---|---|---|

| Promotion Decisions | Monthly fixed plan | Weekly adaptive plan |

| Pricing Adjustments | Manual checks | Automated alerts |

| Category Expansion | Internal sales only | Competitor trend-based |

| Discount Timing | Random | Pattern-driven |

| Market Share Growth | Slow improvement | 20%–35% faster |

With smarter competitive planning, brands can respond faster, reduce margin loss, and position themselves strongly for sustainable market expansion.

How Mobile App Scraping Can Help You?

Many grocery businesses struggle because competitor intelligence is incomplete, outdated, or inconsistent. Instead of relying on monthly research, brands can Use FairPrice Data for Competitive Analysis to understand real-time competitor behavior and identify where pricing adjustments are truly necessary.

How It Supports Competitive Growth:

- Tracks competitor product listings daily for faster response.

- Captures promotional cycles and discount timing changes.

- Improves pricing decisions based on competitor movements.

- Helps monitor stock availability trends for better forecasting.

- Supports product catalog expansion using demand signals.

- Enables structured reporting for category and pricing teams.

By automating app-level intelligence, businesses can also build FairPrice Pricing Strategy Insights that support smarter planning, stronger promotional control, and improved margin stability across multiple grocery categories.

Conclusion

Competitive grocery growth in 2026 requires more than just discounting products. When organizations Use FairPrice Data for Competitive Analysis, they build a measurable advantage through structured competitor tracking and smarter category strategy planning.

Retailers that invest in FairPrice Price Scraping can monitor pricing fluctuations, promotion shifts, and stock movement patterns at scale, allowing them to react faster than the market. Partner with Mobile App Scraping today and request a customized scraping solution that fits your business needs.