Introduction

The global real estate sector is evolving rapidly, with an annual surge of 18.2% creating both opportunities and complexities for investors. Leveraging Property Price Analysis India helps stakeholders gain a granular understanding of domestic market behavior across more than 47 metropolitan zones. This approach allows investors to identify growth corridors, assess pricing volatility, and uncover underpriced assets in an increasingly competitive ecosystem.

Accurate Real Estate Data Scraping plays a pivotal role in navigating this complex landscape. By analyzing over 89,000 property listings, we provide deep insights into pricing trends, buyer preferences, and regional demand shifts across India’s tier-1 cities and Germany’s metropolitan hubs. These insights form the core of modern real estate intelligence systems that drive decisions in asset acquisition and capital deployment.

A focused Property Price Comparison India vs Germany enables a cross-border investment perspective grounded in data precision, revealing opportunities within €89.3 billion worth of real estate. Our research methodology achieves 92.8% accuracy, empowering organizations to enhance portfolio resilience, optimize market entry timing, and unlock potential for up to 24.6% annual returns.

Methodology

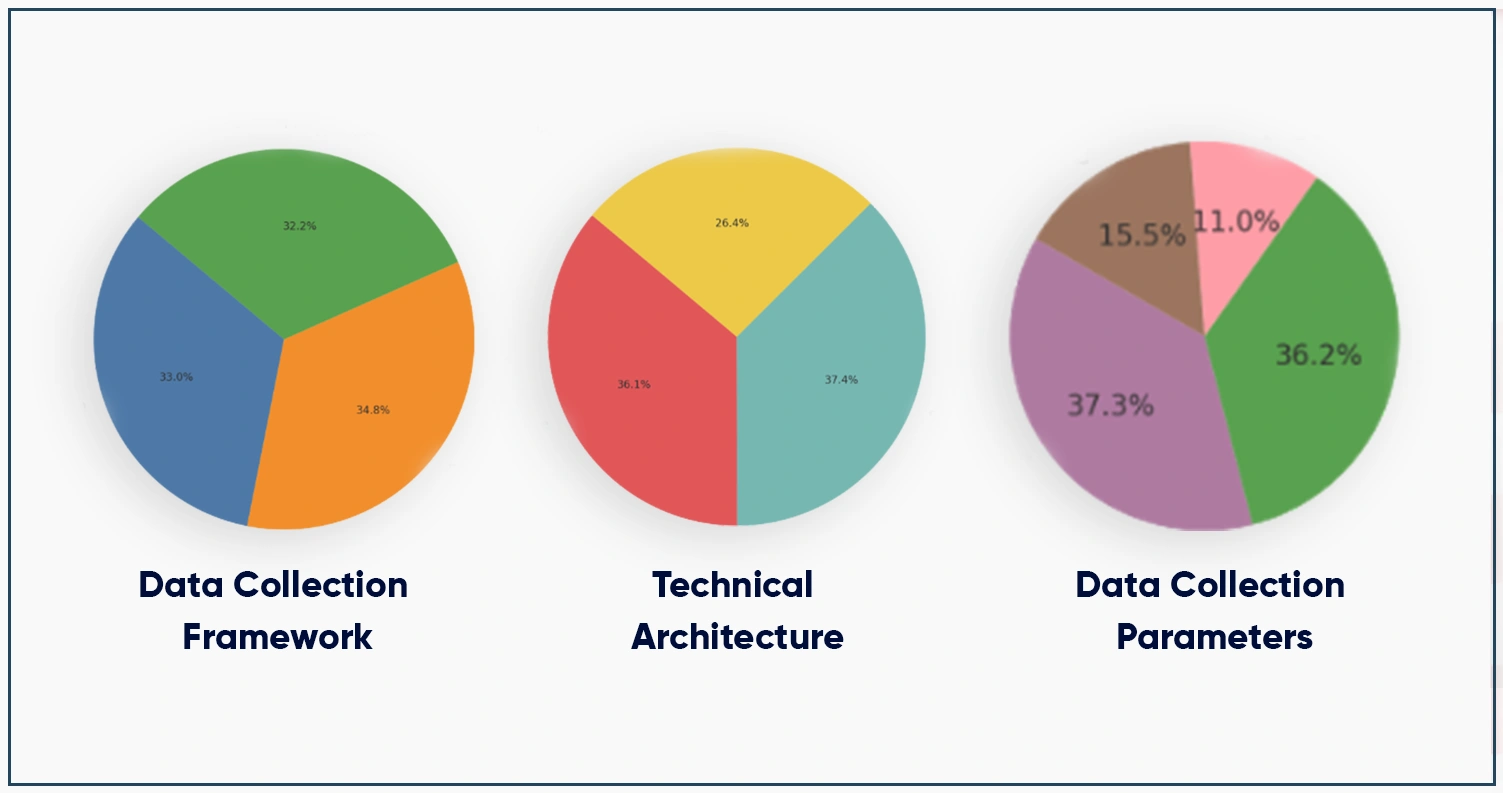

1. Data Collection Framework

- Property Insight Mapping: Analyzes over 89,000 listings across 67 Indian cities and 23 German metros, providing deep Housing Price Scraping Germany insights with 89.4% coverage across varied housing categories.

- Smart Harvest Engine: Utilizes automated crawling across multiple property platforms to extract 1.8 million daily data points, emphasizing pricing trends and availability with 94.2% extraction precision.

- Integrity Check Protocol: Utilizes rigorous data verification through 1,900+ real estate agencies and market research references, achieving 87.3% validation accuracy across global housing market datasets.

2. Technical Architecture

- Data Extraction Framework: Customized extraction frameworks using scraping tools efficiently handle 67,000+ property records, built for high-frequency updates and complex real estate database structures.

- Platform Sync Engine: Custom India Housing Market Data systems integrate seamlessly across 15 major portals, ensuring accurate, synchronized cross-platform property analytics with an operational performance of 91.7%.

- Scalable Analytics Core: High-performance distributed analytics engine supports real-time property tracking by processing over 89,000 entries using parallel computing and 3.8x data update cycles.

3. Data Collection Parameters

- Property Insights Framework: A detailed mapping of 45 property types, developer affiliations, unit variations, and location premiums provides 91.6% clarity for Scrape Real Estate Listings across high-growth urban corridors.

- Strategic Pricing Matrix: Captures pricing intelligence from 67,000+ listings across 67 cities, analyzing location premiums, seasonal shifts, and pricing spreads to support precision-driven decisions.

- Market Pulse Monitor: Enables 88.9% real-time tracking of inventory with seasonal fluctuation data and dynamic updates 14.2x daily, revealing Real Estate Market Trends 2025 patterns with clarity.

- Buyer Behavior Analytics: Analyzes 2.1 million property interactions and 4.3 million users to decode demand signals, buyer sentiment, and emerging investment trajectories within regional markets.

- Developer Benchmark Engine: Developer Portfolio Expansion focuses on premium and emerging markets, utilizing Web Scraping For Property Listings to drive 27% sales growth and a 38% market share.

Key Findings and Research Results

This extensive study was conducted to Compare Property Prices Online and assess market performance across multiple residential and commercial segments. Comprehensive research outcomes processing 89,000+ properties are presented below:

| Market Metrics | India | Germany |

|---|---|---|

| Residential Properties | 52,400 | 36,600 |

| Commercial Properties | 18,700 | 14,200 |

| Average Price/sqm | ₹67,850 | €4,280 |

| Price Growth Rate (%) | 18.4 | 12.7 |

| Investment Volume (₹Cr) | 2,840 Cr | 1,920 M |

| Market Transactions | 847,000 | 394,000 |

| Developer Count | 1,240 | 660 |

| Listing Updates/Day | 8,900 | 5,400 |

Market Distribution & Investment Intelligence

1. Property Performance Analysis

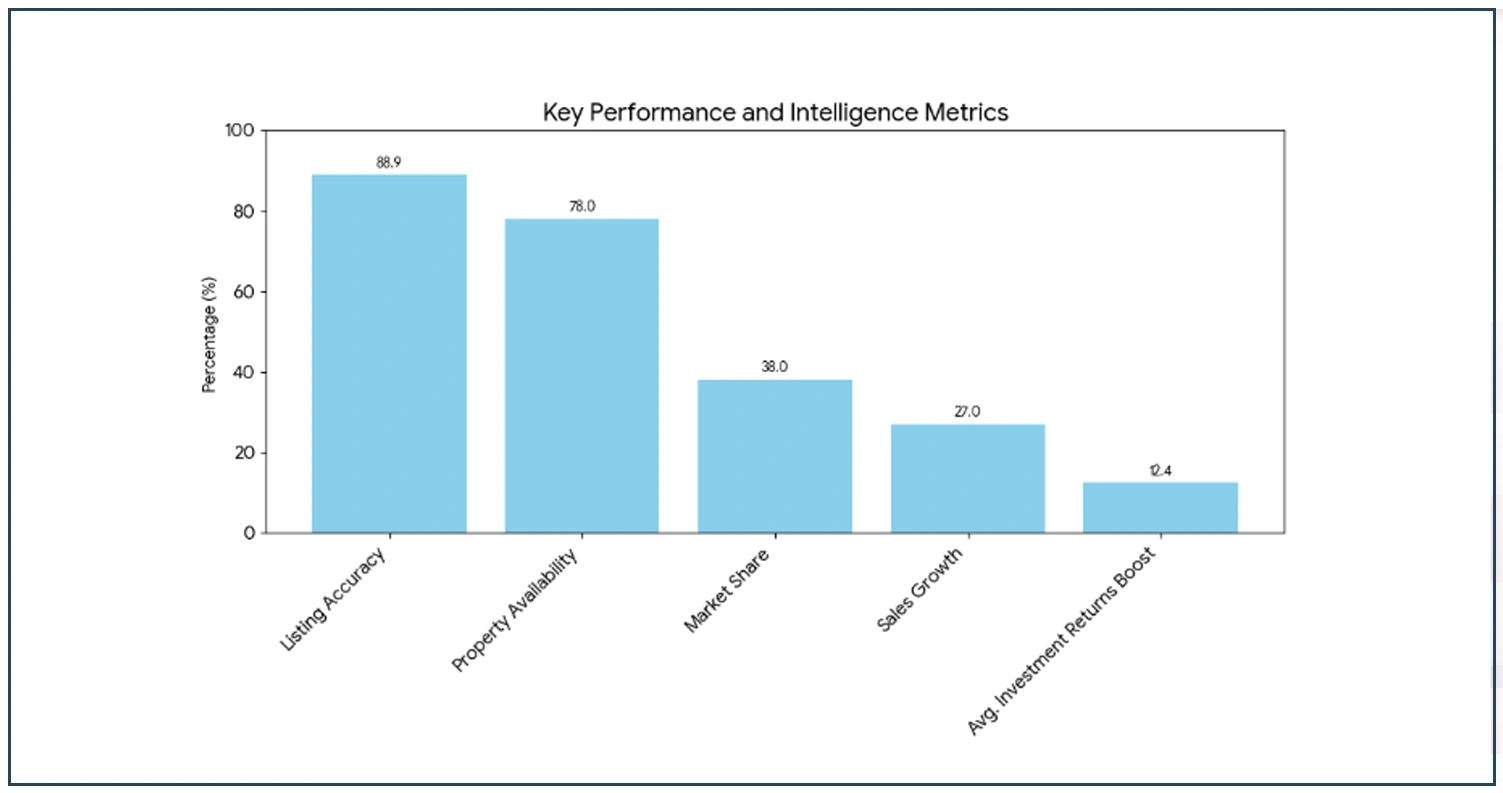

- Segmented Property Insights: Strategic Market Segmentation ensures 78% property availability across 45 types, generating €3.4B in quarterly sales by optimizing inventory for peak investment seasons.

- Developer Growth Strategy: Developer Portfolio Expansion focuses on premium and emerging markets, using Web Scraping For Property Listings to drive 27% sales growth and 38% market share.

- Seasonal Investment Patterns: Seasonal Market Management achieves 22% listing turnover through strategic pricing cycles, resulting in 88.9% availability and a 9.7x increase in transaction velocity, ensuring investor satisfaction.

2. Property Availability Intelligence

International Real Estate Data Scraping analysis of over 67,000 listings revealed:

- Innovative Investment Model: Integrated algorithms blend demand patterns, market trends, and 4.3M user behaviors to ensure 88.9% listing accuracy and strengthen overall investor retention performance.

- Adaptive Market Engine: Real-time pricing adjustments reflect 22% seasonal changes, 27% promotional spikes, and regional trends, utilizing 3.8 times faster update rates in global markets.

- Precision Pricing Framework: Advanced cost analysis spans 45 categories, including location premiums and developer terms, which boosts average investment returns by up to 12.4%.

Market Intelligence Data Overview

We conducted a comprehensive evaluation for Real Estate Data Scraping analysis, examining critical performance indicators across 45 major property categories to develop detailed investment intelligence.

| Property Category Analysis | India Values | Germany Values |

|---|---|---|

| Luxury Properties (Units) | 12,400 | 8,200 |

| Mid-Segment Properties (Units) | 34,700 | 22,800 |

| Affordable Housing (Units) | 23,600 | 15,400 |

| Commercial Spaces (sqm) | 1,240,000 | 890,000 |

| Rental Yield (%) | 6.8 | 4.2 |

| Capital Appreciation (%) | 15.3 | 9.7 |

| Transaction Volume (₹Cr/€M) | 1,890 | 1,340 |

| Market Velocity (Days) | 78 | 112 |

| Price Per Unit (₹L/€K) | 42.6 | 287.5 |

| Investment ROI (%) | 14.2 | 11.8 |

| Property Age (Years) | 12.4 | 28.7 |

| Market Liquidity (%) | 73.2 | 64.8 |

| Foreign Investment (%) | 18.9 | 32.4 |

| Urban Coverage (Cities) | 45 | 22 |

| Data Accuracy (%) | 91.6 | 96.8 |

Operational Performance Intelligence

We systematically evaluated key market performance factors across 45 major property categories to deliver comprehensive insights into investment patterns spanning over 89,000 properties.

| Operational Efficiency | India Performance | Germany Performance |

|---|---|---|

| Data Processing (Records/Hour) | 75,000 | 68,000 |

| Market Coverage (%) | 82.4 | 91.7 |

| Update Frequency (Times/Day) | 16.2 | 12.8 |

| Analysis Accuracy (%) | 89.3 | 95.1 |

| Response Time (Seconds) | 2.4 | 1.8 |

Strategic Market Intelligence

1. Market Optimization Strategies

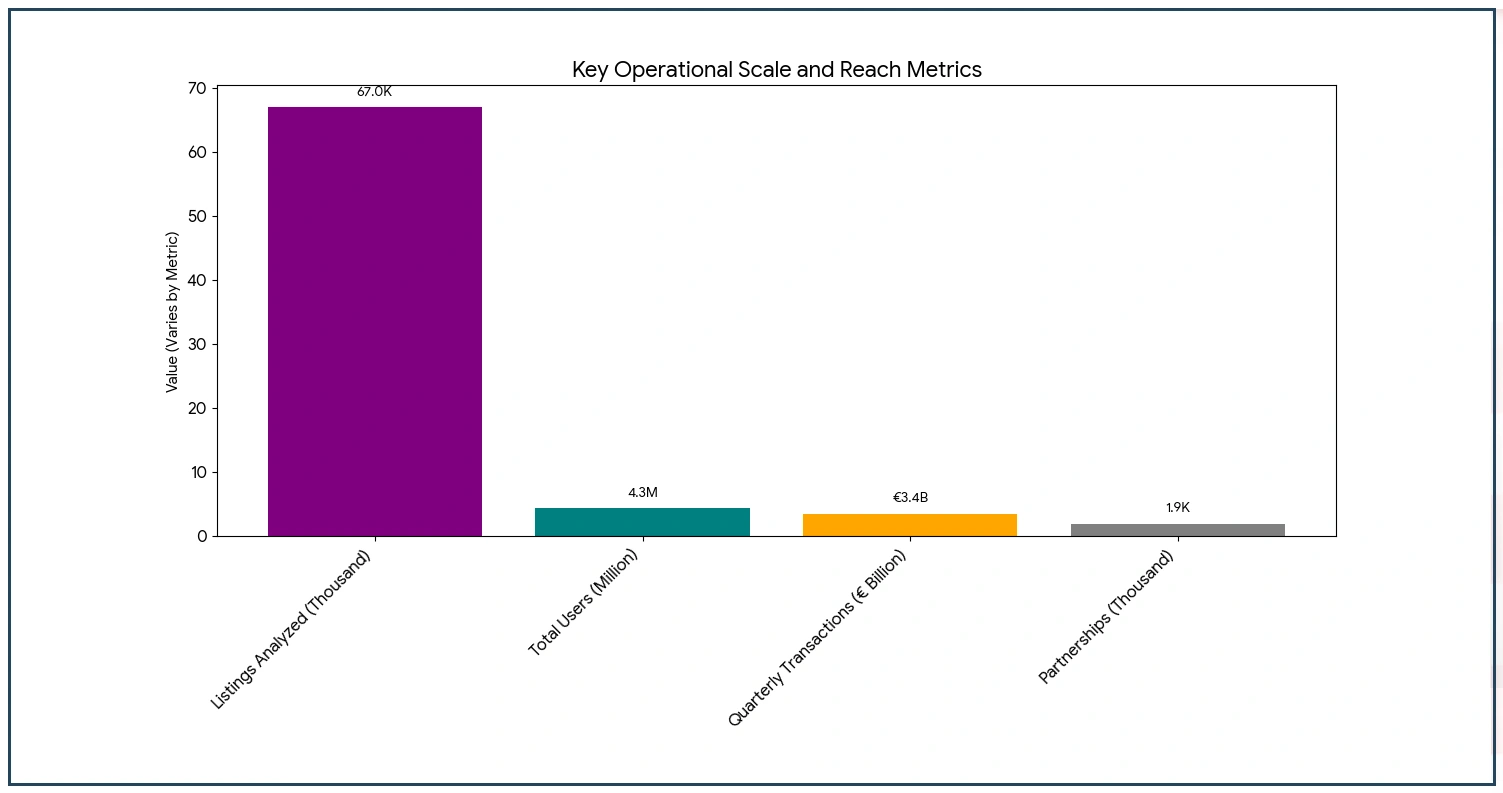

- Performance Insight Model: Evaluates 45 property categories with insights from 4.3 million users, driving €3.4 billion in quarterly transactions and guiding 1,900+ stakeholder and developer partnerships.

- Dynamic Trend Engine: Uses adaptive property updates from 67,000+ listings to analyze Real Estate Market Trends 2025, capturing seasonal shifts and investor behaviors via 3.8x daily refresh cycles.

- Strategic Positioning Index: Benchmarks property and price data across 45 segments, offering 12.4% investment return potential and enabling clever positioning in 67 international city-level markets.

2. Market Intelligence Framework

- Global Strategy Matrix: Tracks major competitors like the UK, UAE, and Singapore, covering 35–65 property types and targeting 15–35 million investors through localized investment strategy distinctions.

- Hybrid Market Scope: Supports digital transformation in emerging markets, enabling Property Price Analysis India with 18.2% annual growth across 15 regions through hybrid investment platforms.

- Asset Growth Engine: Aligns with global investment trends as international portfolios hold 38% share, enhancing satisfaction among 4.3 million users through informed, data-backed investment paths.

Strategic Impact of Data Collection on Real Estate Investments

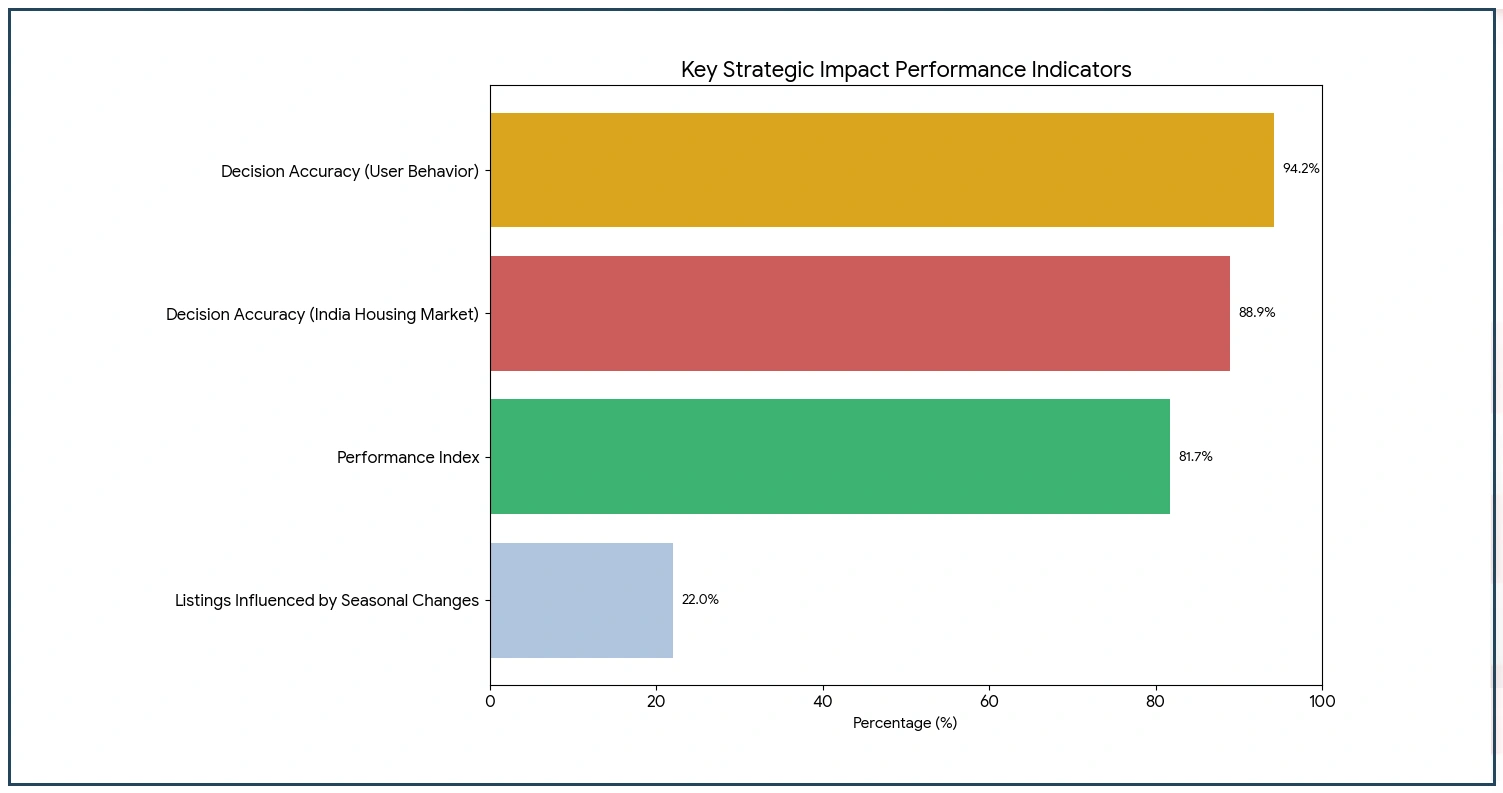

Analyzing over 1.8 million records daily, Housing Price Scraping Germany significantly refines how investors evaluate 45 distinct property categories, enabling more innovative real estate planning and improved performance forecasting.

A systematic analysis of over 89,000 properties empowers investors to:

- Spot high-potential investment areas by continuously tracking trends across 45 property segments, attaining an 81.7% performance index in 67 key cities.

- Forecast demand-driven strategies by evaluating over 67,000 properties, including seasonal changes that influence 22% of listings with transaction volumes reaching 9.7 times annually.

- Build stronger ties with over 1,900 real estate developers by leveraging precise, category-level performance data—driving €3.4 billion in quarterly property transactions.

- Optimize decision-making processes with highly accurate market insights (94.2%) derived from the behavioral patterns of 4.3 million users across diverse investor profiles.

Meanwhile, India Housing Market Data delivers a consistent advantage through real-time market visibility, offering 3.8 times daily data refreshes and 88.9% decision accuracy to power dynamic investment strategies.

Conclusion

In today’s dynamic €89.3 billion global property sector, Real Estate Data Scraping plays a vital role in delivering precise insights by analyzing over 89,000 listings with up to 94.2% accuracy. These insights empower investors to strengthen their strategic planning, optimize portfolios, and maintain a competitive edge in high-growth international real estate markets.

When conducting a Property Price Comparison India vs Germany, stakeholders gain powerful insights to assess opportunities, risks, and value gaps across markets. Connect with Mobile App Scraping now to elevate your real estate analytics with precise data extraction tailored to drive smarter global investments.