What Can Online Pooja Essentials Data Scraping for Seasonal Demand Analysis Show 28% Festive Prices?

Introduction

India’s festive calendar drives massive spikes in demand for pooja essentials such as incense sticks, diyas, agarbatti, kumkum, samagri kits, idols, and sacred oils. In a digital-first retail environment, this approach leads to frequent stockouts, overstocking, and missed pricing opportunities during high-intent buying periods like Diwali, Navratri, Ganesh Chaturthi, and Raksha Bandhan.

This is where Online Pooja Essentials Data Scraping for Seasonal Demand Analysis becomes a game-changer. By continuously collecting real-time pricing, availability, and demand signals from major marketplaces and grocery apps, businesses can build accurate seasonal models instead of static forecasts. These insights help retailers identify which products surge first, which SKUs experience price inflation, and which items lose traction after peak days.

With the support of Ecommerce App Scraping Services, brands can track regional pricing variations, festive discount strategies, and competitor stock levels across multiple platforms. As religious ecommerce continues to grow at double-digit rates annually, data-driven seasonal planning is no longer optional—it is essential for sustaining margins and maximizing festive revenue.

Tracking Price Shifts During Festive Peaks

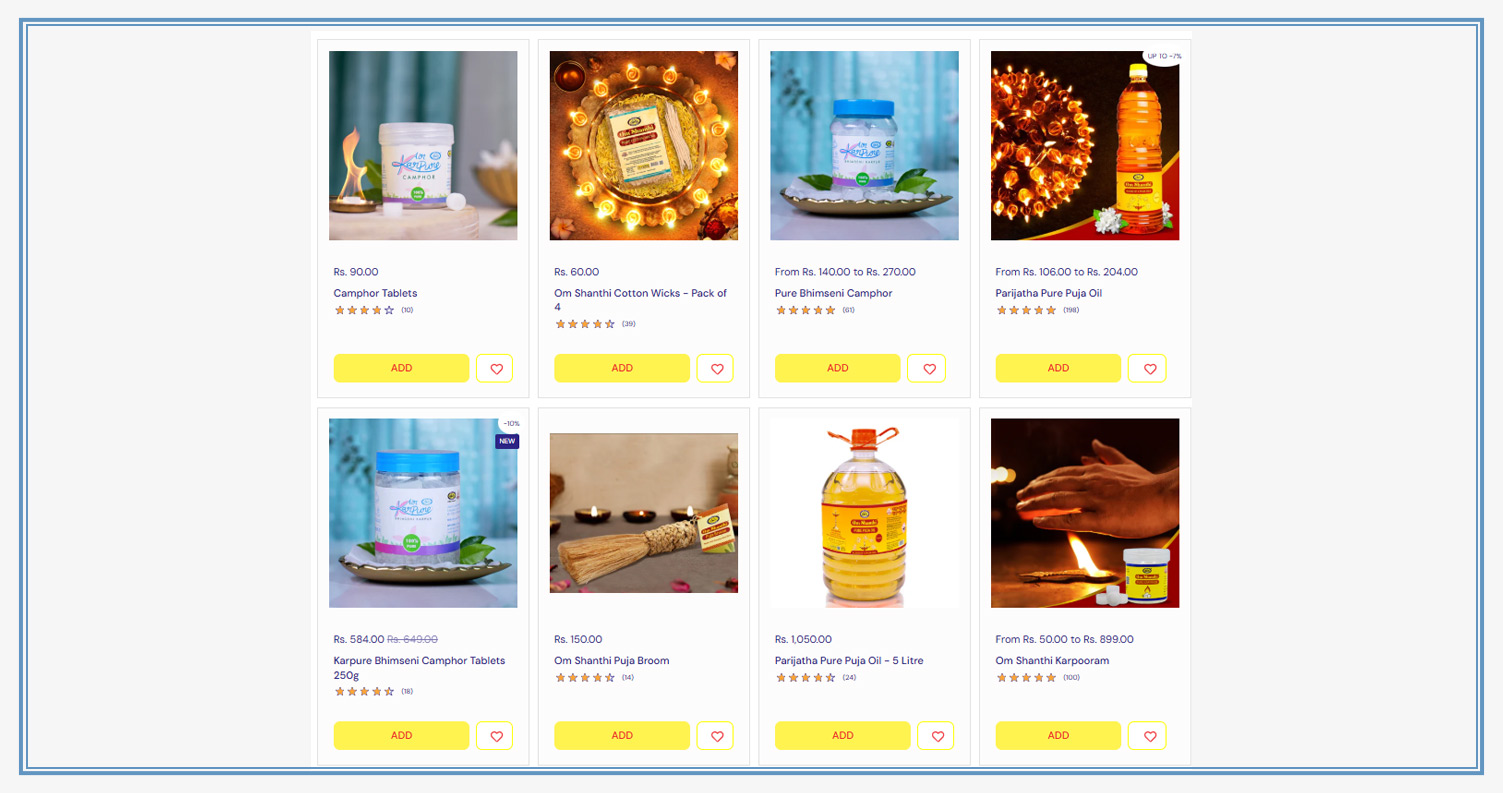

Festive periods bring rapid and often unpredictable pricing changes across devotional product categories. Items such as diyas, camphor, agarbatti, ghee lamps, and samagri kits typically see noticeable cost escalations in the final weeks leading up to major festivals like Diwali and Navratri. This is why building visibility into Festive Demand and Price Trends for Religious Products is critical for sustainable seasonal planning.

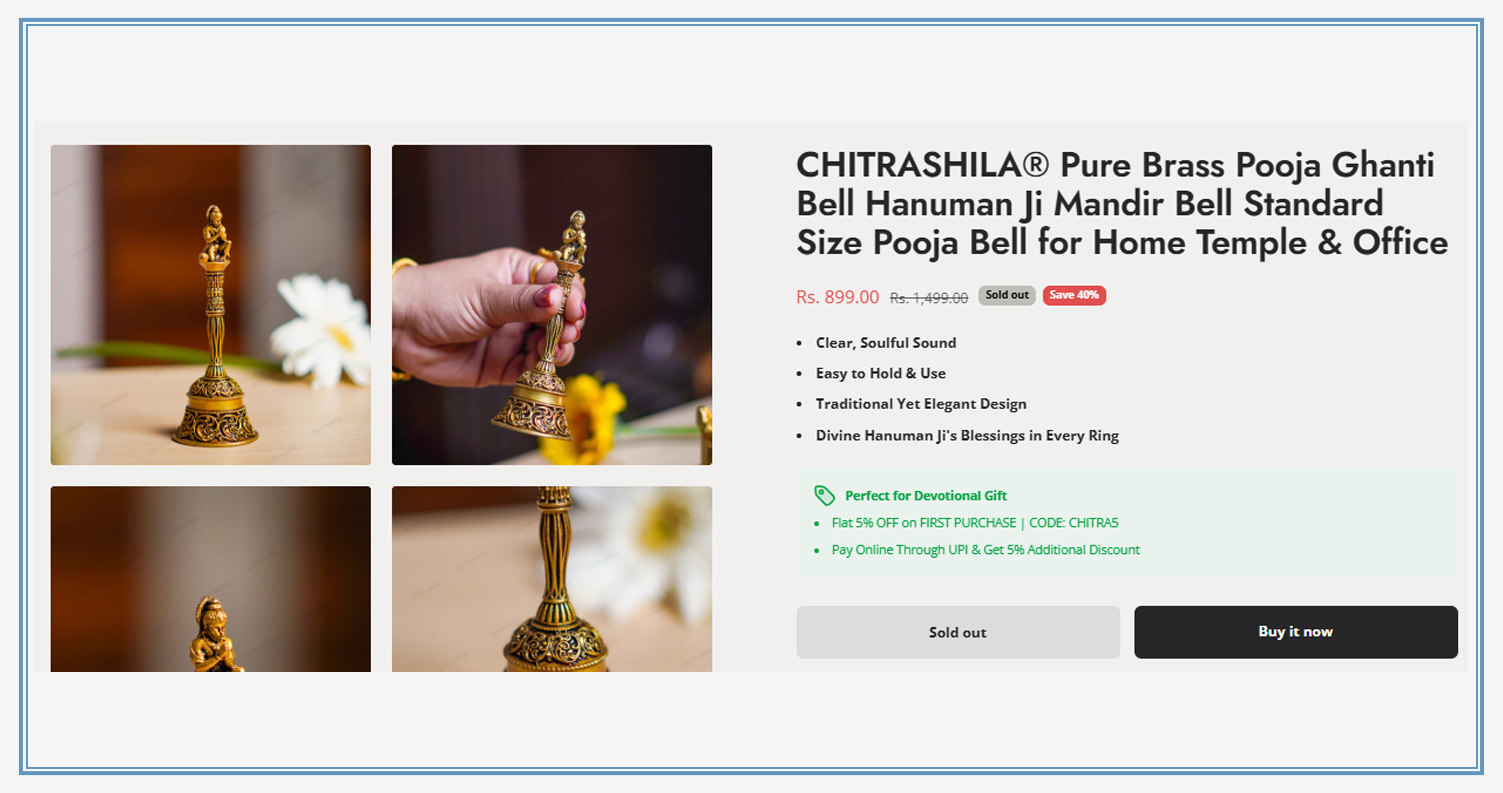

Through structured religious marketplace monitoring and competitive data capture, brands can track real-time SKU-level pricing shifts across multiple ecommerce platforms. This helps identify early price inflation windows, peak demand timing, and the exact point when consumer price sensitivity starts declining. Using Religious Products Data Scraping, businesses gain access to time-stamped historical price movements that reveal predictable seasonal behavior patterns.

For example, pricing benchmarks derived from Amazon E-Commerce Datasets show that diya prices tend to increase sharply within the last 7–10 days before Diwali, while incense sticks experience their first price bump nearly two weeks earlier. This early insight allows retailers to secure inventory in advance and reduce last-minute procurement premiums.

Sample Price Trend Table (Festive Window):

| Product Category | Pre-Festival Price | Peak Price | % Increase |

|---|---|---|---|

| Clay Diyas | ₹18/unit | ₹23/unit | 27.7% |

| Agarbatti Packs | ₹95/pack | ₹118/pack | 24.2% |

| Camphor Tablets | ₹65/pack | ₹82/pack | 26.1% |

| Samagri Kits | ₹320/kit | ₹410/kit | 28.1% |

By analyzing these seasonal shifts, retailers can pre-book high-volume inventory before supplier costs spike and time promotional activity more effectively. Brands applying this pricing intelligence framework reported up to 19% better gross margins during peak festival cycles while minimizing last-minute supply chain disruptions.

Anticipating Regional Buying Behavior Patterns

Festive demand follows repeatable yet evolving patterns influenced by region, festival type, income levels, and cultural preferences. Understanding when and where these surges will occur is essential for aligning inventory placement and marketing campaigns. By applying Ecommerce Demand Forecasting for Religious Items, retailers can move from reactive replenishment to predictive stocking strategies.

Data models built on app search trends, add-to-cart frequency, checkout completions, and stockout signals enable early detection of product-level demand acceleration. These insights help brands identify which SKUs are likely to peak first and which categories will dominate in different regions. For instance, during Navratri, western India shows stronger diya demand, while eastern regions favor kumkum and samagri bundles.

Seasonal Demand Analysis Using Data supports dynamic inventory redistribution across fulfillment centers. Retailers can proactively move high-demand products closer to target regions, cutting delivery timelines and reducing logistics costs. This data-backed inventory mobility also minimizes overstock risk in slower-moving geographies.

Sample Regional Demand Forecast Table:

| Region | Leading Product Type | Demand Growth | Stockout Risk |

|---|---|---|---|

| West India | Diyas | 44% | High |

| North India | Agarbatti | 31% | Medium |

| East India | Kumkum | 38% | High |

| South India | Ghee Lamps | 27% | Medium |

Retailers using predictive demand intelligence have reported 23% fewer stockouts and 17% higher fulfillment success during festival weeks. These forecasting capabilities also strengthen vendor negotiations, as businesses can lock procurement contracts 3–4 weeks earlier when wholesale prices remain stable. This turns festive volatility into a structured planning advantage rather than an operational risk.

Designing Smarter Festive Promotion Strategies

Festive discounting often underperforms when promotions are applied uniformly across all product categories. Data-driven segmentation enables retailers to apply targeted offers only where price sensitivity is high and demand elasticity justifies a discount. With the help of Religious Ecommerce Data Analytics, brands can benchmark competitor promotions, analyze SKU-level elasticity, and optimize discount depth.

By comparing historical performance data with real-time competitor pricing, retailers can identify which products respond positively to modest discounts and which maintain strong sales even at stable pricing. This prevents unnecessary margin erosion on high-demand essentials while improving volume movement for slow-selling SKUs.

Sample Promotional Optimization Table:

| Product Type | Competitor Avg Discount | Suggested Discount | Margin Impact |

|---|---|---|---|

| Diyas | 18% | 14% | +6% |

| Agarbatti | 22% | 17% | +5% |

| Samagri Kits | 15% | 12% | +4% |

| Camphor | 20% | 16% | +7% |

Retailers using promotional intelligence frameworks have achieved up to 28% improvement in festive campaign ROI. Data-backed promotion planning transforms festive campaigns from guesswork into a controlled, revenue-optimized growth engine that balances customer acquisition with long-term profitability.

How Mobile App Scraping Can Help You?

Festive retail success now depends on precision, not approximation. With Online Pooja Essentials Data Scraping for Seasonal Demand Analysis, businesses can track real-time pricing, inventory availability, discount changes, and regional demand variations across leading ecommerce and grocery apps.

Key Benefits Include:

- Monitoring real-time price movements across multiple platforms.

- Identifying high-demand SKUs before peak festival days.

- Optimizing inventory allocation by region.

- Improving vendor negotiation power.

- Reducing stockouts and overstocking risks.

- Enhancing festive campaign ROI.

This data-first approach supports long-term scalability and consistent festive profitability. When paired with Religious Ecommerce Data Analytics, we become a strategic foundation for sustainable growth in the devotional retail segment.

Conclusion

Festive retail success today depends on how intelligently brands respond to dynamic market signals. By adopting Online Pooja Essentials Data Scraping for Seasonal Demand Analysis, retailers can shift from reactive planning to proactive execution, ensuring optimal pricing, inventory readiness, and customer satisfaction throughout high-demand festive cycles.

When combined with Ecommerce Demand Forecasting for Religious Items, businesses unlock a repeatable framework for consistent festive revenue growth. Partner with Mobile App Scraping to build accurate demand forecasts, optimize pricing strategies, and maximize festive sales performance.