How Can Oriflame Data Extraction for Beauty Trend Analysis Reveal 35% Promotion Growth Insights?

Introduction

The global beauty and personal care market is evolving rapidly, driven by digital-first consumers, seasonal trends, and aggressive promotional strategies. Brands like Oriflame operate across multiple regions, channels, and product categories, making it challenging to maintain consistent pricing intelligence and promotional effectiveness. Decision-makers increasingly rely on structured datasets to identify patterns that are not visible through manual tracking or internal sales reports alone.

Extracting and aligning this data across markets allows teams to understand how discounts influence sales velocity, which product categories respond best to campaigns, and how regional demand shifts over time. By integrating

E-Commerce Datasets from multiple digital touchpoints, companies can compare historical and real-time trends to improve campaign planning.

Oriflame Data Extraction for Beauty Trend Analysis plays a critical role in transforming scattered digital signals into meaningful insights. It helps marketing, pricing, and strategy teams measure promotional uplift, identify underperforming SKUs, and detect early trend signals. When data-backed insights guide promotional planning, brands often see measurable improvements in engagement, conversions, and campaign ROI—sometimes as high as 35% growth in promotion effectiveness.

Understanding Regional Promotional Performance Variations Clearly

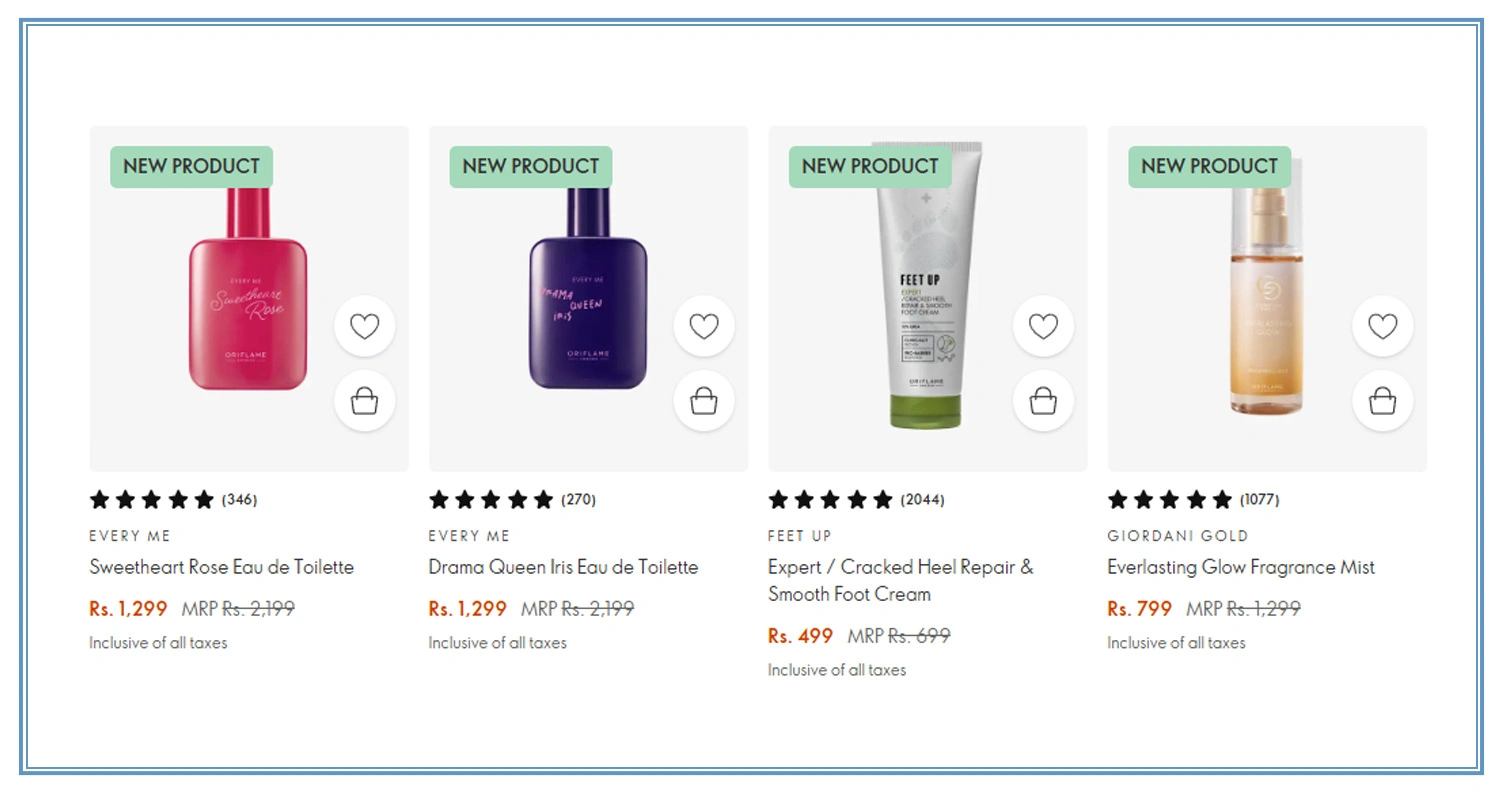

Global beauty brands often observe that identical promotional strategies deliver inconsistent outcomes across regions. This inconsistency is usually driven by cultural buying behavior, local pricing sensitivity, seasonal demand, and platform-specific visibility. Without structured comparative analysis, teams rely on assumptions rather than measurable signals, leading to inefficient discount planning and uneven revenue impact.

A structured approach using Oriflame Beauty Product Pricing and Discount Analysis allows organizations to evaluate how discount depth, campaign duration, and product categories perform across different geographic markets. When this insight is supported by Ecommerce App Scraping-Services, brands can also track app-exclusive campaigns that often outperform web-based promotions but remain hidden from traditional analytics systems.

By aligning regional insights with historical campaign data, decision-makers can refine future promotions with precision rather than experimentation. This minimizes revenue leakage caused by over-discounting while improving conversion consistency. Over time, brands gain clarity on which markets require aggressive incentives and which perform better with value-based messaging.

Regional Promotion Performance Snapshot:

| Market Region | Avg Discount Level | Conversion Response | Revenue Outcome |

|---|---|---|---|

| Western Europe | Moderate | Stable uplift | Balanced |

| Southeast Asia | High | Strong uplift | High growth |

| Middle East | Low | Limited response | Underperforming |

This comparative view enables smarter regional prioritization and more predictable promotional outcomes.

Monitoring Pricing Shifts During Competitive Cycles

Beauty product pricing fluctuates rapidly due to seasonal launches, limited-time offers, and competitive pressure. Static reviews conducted after campaigns end fail to capture critical mid-cycle adjustments that significantly influence consumer behavior. Brands that lack continuous monitoring often miss peak pricing windows that drive optimal conversions.

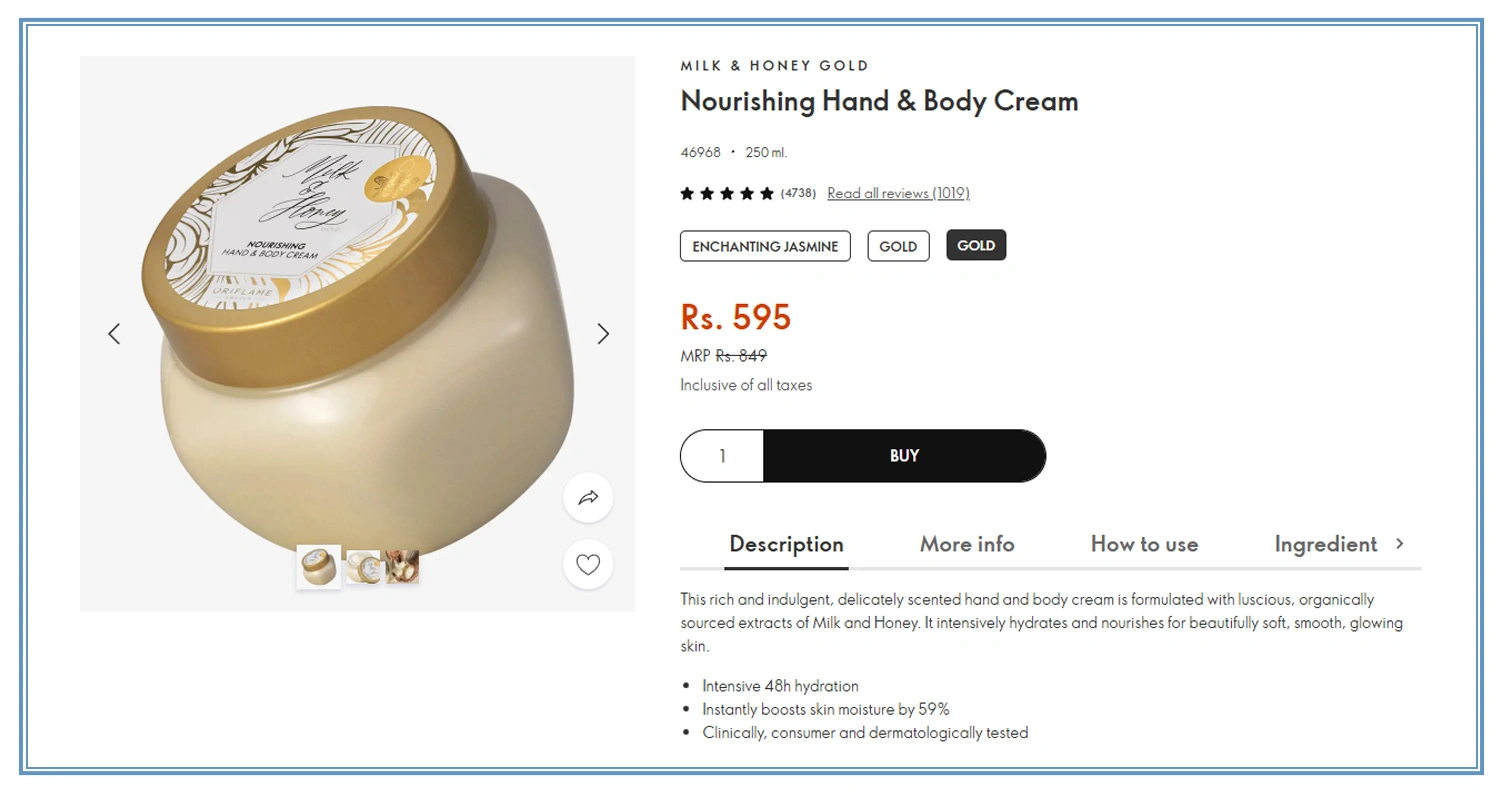

Access to Real-Time Cosmetics Pricing Data helps teams track live price movements, promotional overlaps, and stock-driven price changes across platforms. This visibility allows brands to correlate pricing actions with immediate demand fluctuations and identify price thresholds that trigger buying decisions. Instead of reacting post-campaign, teams can adjust pricing strategies during active promotions to improve performance.

Continuous tracking also highlights margin risks caused by excessive discounting. While deep price cuts may increase order volume, they do not always translate into sustainable revenue growth. By analyzing pricing elasticity across categories, brands can strike a balance between competitiveness and profitability.

Pricing Impact on Consumer Demand:

| Price Adjustment | Demand Change | Margin Effect |

|---|---|---|

| Minor reduction | Gradual rise | Stable |

| Mid-range cut | Strong increase | Controlled |

| Heavy discount | Sharp spike | Margin pressure |

Such structured insights enable pricing teams to make timely, data-backed decisions that align promotional intensity with long-term business goals.

Converting Raw Market Signals Into Strategy

Collecting large volumes of digital product information is only the first step. The real challenge lies in converting scattered data points into structured insights that support planning, forecasting, and execution. Many organizations struggle because raw data lacks consistency, categorization, and historical context.

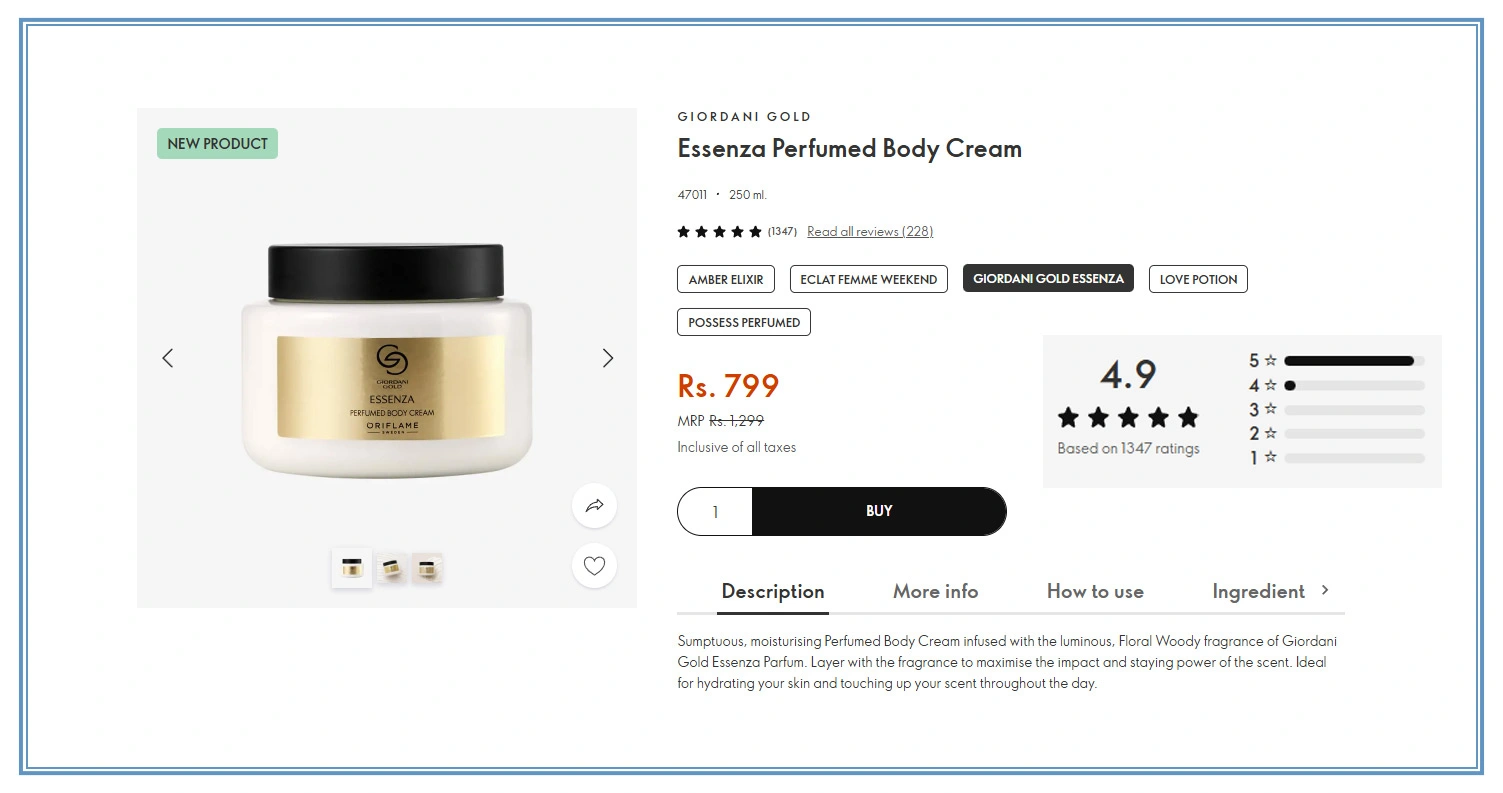

Through Oriflame Data Extraction, brands can standardize product attributes, promotional timelines, and pricing histories across markets. When this structured data feeds into Beauty Product Data Analysis, teams can evaluate long-term performance trends rather than isolated campaign results. This approach reveals which product categories consistently outperform during promotions and which rely heavily on price reductions to drive sales.

When combined with Beauty Industry Data Scraping, organizations gain broader market context, allowing them to benchmark internal performance against category-level behavior. This reduces guesswork and enables predictive planning based on proven patterns rather than assumptions.

Insight Transformation Framework:

| Data Input | Analytical Output | Strategic Application |

|---|---|---|

| Promotion history | Performance benchmarks | Campaign planning |

| Pricing trends | Elasticity insights | Price optimization |

| Category demand | Growth indicators | Inventory alignment |

By structuring insights effectively, brands transition from reactive decision-making to scalable, insight-led growth strategies.

How Mobile App Scraping Can Help You?

Capturing these insights requires specialized approaches beyond traditional web monitoring. In this context, Oriflame Data Extraction for Beauty Trend Analysis becomes essential for understanding app-level pricing behavior and promotion mechanics.

Key advantages include:

- Capturing app-exclusive offers and flash deals.

- Monitoring region-specific pricing variations.

- Tracking product visibility and ranking changes.

- Identifying promotion timing patterns.

- Comparing app and web price differences.

- Supporting faster data-driven decisions.

By combining these capabilities with structured Beauty Product Data Analysis, brands gain a clearer view of mobile-first consumer behavior and promotional effectiveness.

Conclusion

Data-driven beauty brands outperform competitors by aligning promotions with real consumer demand signals. When insights from Oriflame Data Extraction for Beauty Trend Analysis guide pricing and campaign decisions, teams can systematically improve promotion outcomes and reduce guesswork.

A structured approach supported by Beauty Industry Data Scraping enables brands to rMobile App ScrapingMobile App Scraping today and transform your beauty intelligence strategy.