How does Pincode-Level Real Estate Market Intelligence Drive 42% Smarter Property Pricing Insights?

Introduction

India’s real estate market is no longer driven only by city-level trends. This is why pincode-based analysis is becoming the backbone of smarter valuation and investment planning. Investors, developers, and brokers now require data that reflects real buyer behavior, seller intent, and competitive listings within each locality.

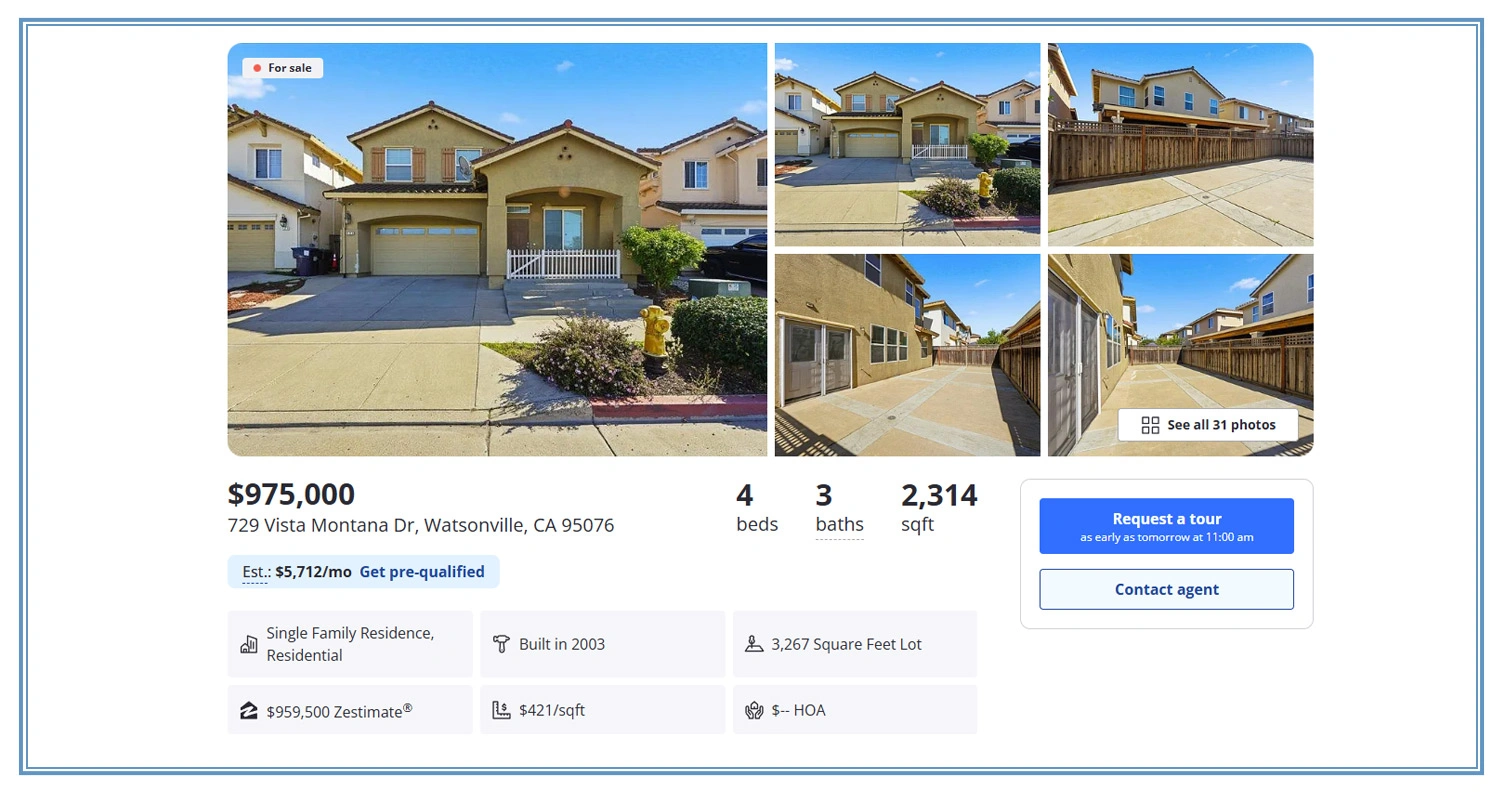

Modern property portals provide massive volumes of listings, but manually monitoring thousands of apartments, villas, and commercial properties across cities is inefficient. With structured Real Estate Data Extraction, businesses can evaluate listings based on pincode clusters, compare price movements, and identify underpriced opportunities faster.

By combining listing trends, rental movements, demand density, and inventory changes, Pincode-Level Real Estate Market Intelligence enables pricing teams to avoid assumptions and rely on factual market indicators. This approach transforms decision-making into a data-driven system where hyperlocal insights become the foundation for faster deals and better ROI.

Why Localized Pricing Shifts Need Deeper Tracking?

India’s real estate market behaves differently at every micro-location, and this is exactly why city-wide averages often mislead buyers, investors, and brokers. Even within the same neighborhood, adjacent pincodes can show major differences in demand, resale value, and inventory absorption.

To solve this, analysts increasingly depend on Web Scraping Real Estate Datasets that capture listing prices, carpet area, project age, furnishing details, and builder reputation across major property portals. This structured data makes it easier to evaluate which micro-market is overpriced and which is undervalued.

Market research in 2026 indicates that buyers using localized comparisons make around 42% smarter pricing decisions and reduce negotiation delays by nearly 30%. This is because micro-level data reveals patterns that broader reports cannot detect. It also helps brokers recommend better deals and helps developers avoid pricing errors during new launches.

| Market Challenge | What Usually Goes Wrong | How Data Helps Solve It |

|---|---|---|

| General city pricing benchmarks | Leads to incorrect valuation | Highlights true micro-market shifts |

| Hidden oversupply zones | Investors misjudge demand | Detects inventory saturation early |

| Incorrect resale expectations | Sellers overprice properties | Improves realistic resale benchmarks |

| Missed growth corridors | Buyers enter late | Identifies fast-rising locations sooner |

When businesses apply Property Price Intelligence Solutions, they can create stronger valuation models that reflect real demand instead of assumptions. Over time, this improves forecasting accuracy and reduces the risk of investing in oversupplied pockets.

How Rental Trends Reveal Hidden Demand?

Rental markets in India shift rapidly based on IT expansion, transit connectivity, student migration, and commercial development. However, many investors still evaluate properties only on resale appreciation while ignoring rental yield stability. This often results in lower ROI because appreciation may take years, while rental demand changes within months.

With Property Market Insights by Pincode, analysts can monitor rent fluctuations, listing velocity, vacancy cycles, and tenant preference patterns. In cities like Pune, Bengaluru, Hyderabad, and NCR, rental prices have been observed to rise between 18% and 25% in certain high-demand clusters within a year.

A recent housing analysis report found that yield-focused micro-markets can deliver up to 35% stronger long-term returns compared to appreciation-only strategies. By applying Track Property Prices Across Pincodes, businesses can also compare rent-to-sale ratios more accurately and identify rental pockets with lower vacancy risks.

| Rental Issue | Business Risk | Why Micro-Level Data Matters |

|---|---|---|

| Wrong rental yield assumptions | Lower expected ROI | Enables accurate yield comparison |

| Misjudged tenant demand | Long vacancy periods | Improves demand forecasting |

| Sudden seasonal rent spikes | Pricing instability | Helps predict market fluctuations |

| Tenant preference mismatch | Reduced conversions | Supports better listing positioning |

Such micro-market clarity supports smarter decisions for landlords, property managers, and brokers who need to price rentals competitively. It also helps investors select properties that generate stable income even when resale pricing remains flat.

Identifying Unreliable Listings and Price Manipulation

Online property portals in India often contain duplicate listings, outdated availability, and artificially inflated prices. These issues create confusion for buyers and distort valuation models for analysts, developers, and financial institutions. In competitive metro regions, many brokers repost the same inventory multiple times with adjusted pricing, which makes market pricing appear higher than reality.

Using Pincode Wise Listings Data Extraction, businesses can track listing authenticity, compare duplicate properties, and detect irregular price movement patterns within the same locality cluster. This is essential for building accurate valuation engines and reducing the impact of misleading data.

When companies invest in Real Estate Data Scraping Services India, they can create consistent monitoring systems that flag suspicious price spikes, identify stale inventory, and validate real-time availability. This improves decision-making for loan approvals, investment planning, and resale benchmarking.

| Market Manipulation Issue | Common Cause | What Data Validation Solves |

|---|---|---|

| Artificial price spikes | Broker-driven inflation | Detects abnormal pricing patterns |

| Duplicate property listings | Reposting inventory | Matches listings using attributes |

| Stale availability | Slow platform updates | Flags outdated inventory quickly |

| Misleading premium claims | Fake property upgrades | Identifies inconsistent listing values |

Additionally, combining this intelligence with Real Estate Data Scraping helps analysts build cleaner datasets that improve trust and strengthen forecasting accuracy.

How Mobile App Scraping Can Help You?

Modern property decisions require fast access to structured information, but most real estate portals and apps display critical details in fragmented formats. This is why Pincode-Level Real Estate Market Intelligence is increasingly being built using mobile-first datasets, where listings update faster than websites and user activity signals are richer.

Key Benefits of Mobile App Data Collection:

- Captures fresh listing changes faster than desktop platforms.

- Improves detection of duplicates and outdated inventory.

- Helps track real-time rent and resale shifts.

- Supports micro-market demand forecasting.

- Enhances property recommendation accuracy.

- Enables better benchmarking for project launch pricing.

With Real Estate Data Scraping Services India, organizations can build consistent pipelines for structured data collection across multiple platforms while ensuring scalability for thousands of listings daily.

Conclusion

Real estate profitability is no longer dependent on broad city-level assumptions. Accurate pricing requires deeper locality visibility, and that is exactly where Pincode-Level Real Estate Market Intelligence becomes the strongest asset for investors, brokers, builders, and analytics firms seeking better forecasting accuracy and reduced valuation risk.

When micro-market trends are tracked daily, businesses can avoid misleading listing inflation, detect demand surges early, and build smarter property pricing strategies using Property Market Insights by Pincode across both rental and resale segments. Connect with Mobile App Scraping today and start building a smarter real estate strategy with precision-driven pincode analytics.