What Drives PropertyShark Data Scraping for Valuation & Trends Insights to Map 73% Ownership Trends?

Introduction

With millions of records updated regularly, PropertyShark has become a powerful source of truth for investors, analysts, brokers, and real estate intelligence platforms. Using PropertyShark Data Scraping for Valuation & Trends Insights, companies can now decode deep layers of ownership activity, property characteristics, historic transactions, zoning details, and valuation patterns.

However, traditional manual research often fails to capture the scale, depth, and dynamic nature of property updates. Automated extraction from trusted portals delivers structured property insights that reveal emerging market behavior with far greater clarity. When integrated with AI-led analytics, this creates a unified ecosystem of valuation metrics and ownership signals that businesses depend on to refine forecasting accuracy.

Whether evaluating risk, expanding into new neighborhoods, or mapping ownership density, automated intelligence ensures that real-time movements are never missed. Combining automation with PropertyShark API Data helps businesses understand 73% broader ownership trends with unmatched reliability. This approach offers the accuracy required for high-value decisions while reducing operational load, supporting smarter real estate strategy development across markets.

Comprehensive Insights Supporting Ownership Trend Interpretation

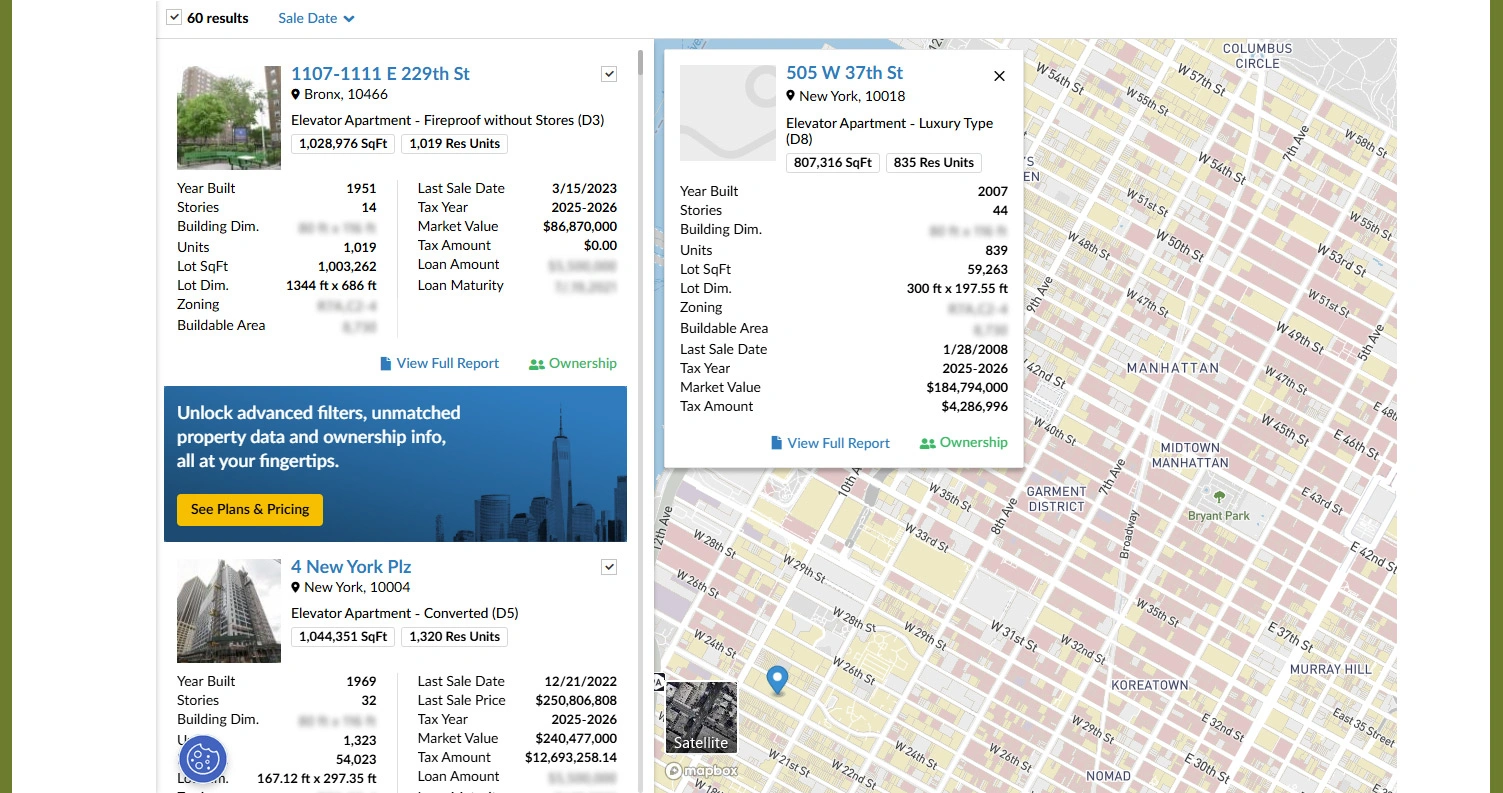

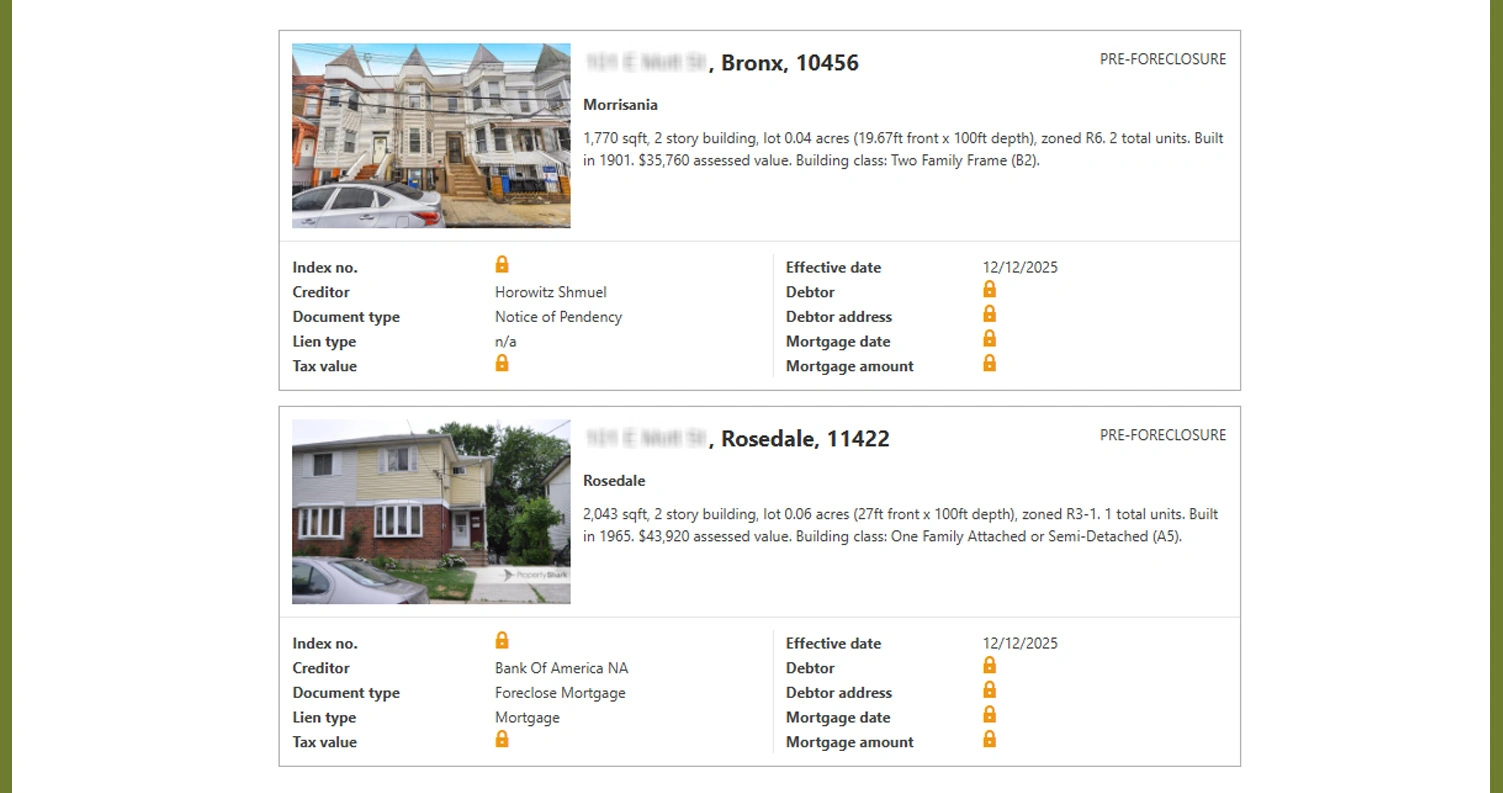

Analyzing ownership activity requires structured visibility across property transfers, historic movements, financial signals, and demographic shifts influencing market behavior. Using automated extraction methods, organizations can organize fragmented records into coherent views that reveal whether ownership shifts are driven by individual buyers, investment groups, estates, or corporate entities.

Consistent data processing enables analysts to monitor multi-family conversions, foreclosure activity, land acquisition patterns, and repeat transactions. These insights help identify high-activity clusters and neighborhoods experiencing early signs of growth or distress. With structured Real Estate Data Extraction, firms can maintain continuity in trend analysis without delays created by manual monitoring.

Automated monitoring also supports segmentation based on buyer profiles, making it easier to categorize owners by tenure, acquisition type, and geographic spread. This directly influences strategic market planning and risk evaluation. The intelligence gathered through Web Scraping PropertyShark Real Estate Ownership Data further refines ownership segmentation and provides consistent clarity needed for investment scoring.

Key ownership metrics captured automatically:

| Insight Type | Value Delivered |

|---|---|

| Ownership Transfers | Detects investor-driven acquisitions |

| Historical Sales Activity | Tracks appreciation trends |

| Mortgage & Lien Records | Evaluates financial risks |

| Property Features | Supports valuation accuracy |

| Zoning Classifications | Identifies development potential |

Additionally, insights extracted from Web Scraping PropertyShark for Property Attributes, Ownership, and Sales Trends allow organizations to interpret ownership stability and track localized shifts to support stronger long-term decision-making.

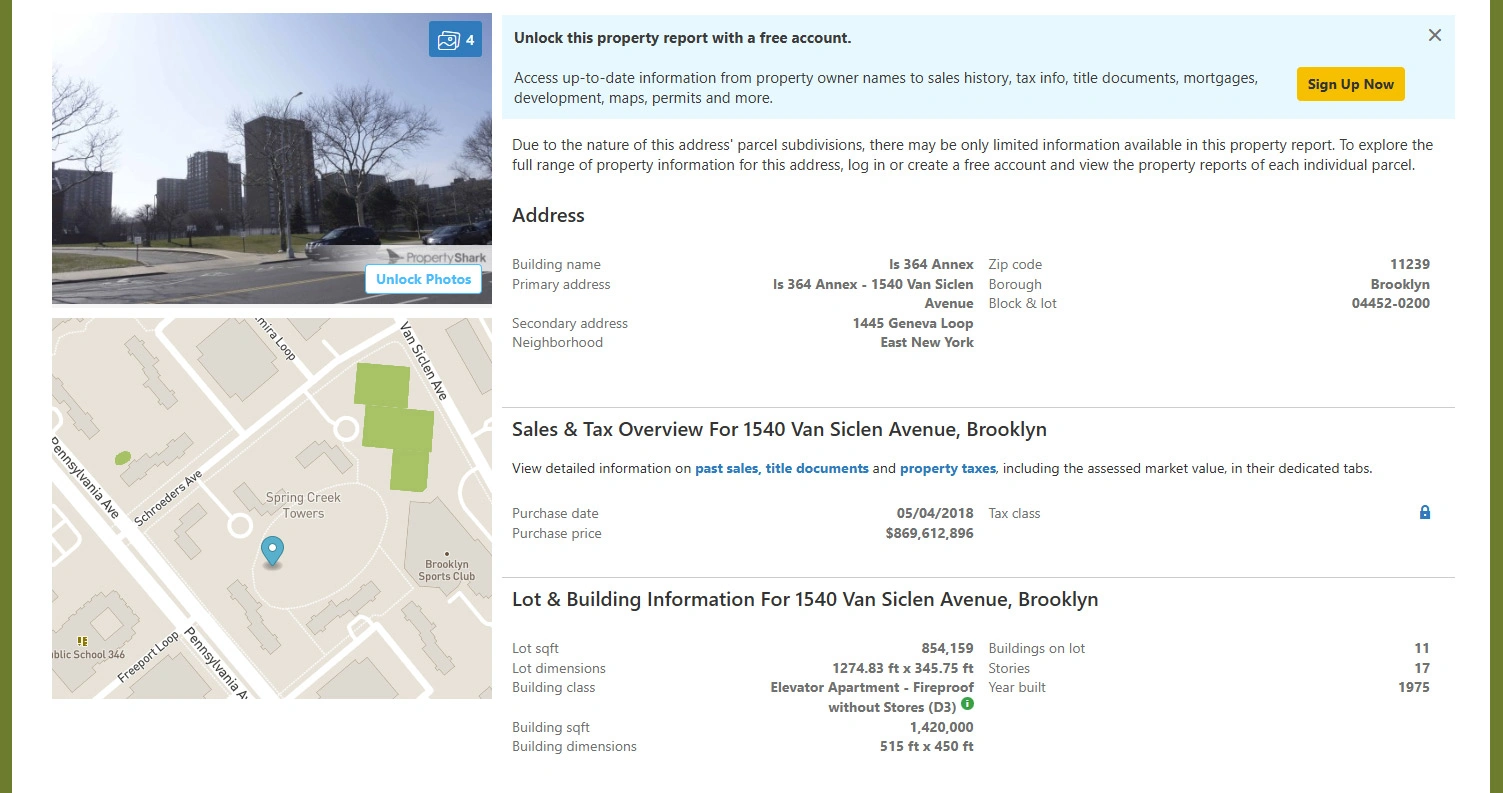

Valuation Indicators Strengthened Through Structured Market Mapping

Accurate valuation analysis depends heavily on reliable historical records, transactional activity, property features, and neighborhood-level patterns. By organizing these signals into structured datasets, firms can understand pricing fluctuations and benchmark properties with greater consistency. Automated processing enables deeper interpretation of long-term trends, comparable sales, and building characteristics that influence valuation scoring across different market scenarios.

Handling extensive information becomes more efficient when companies rely on systems that manage large Real Estate Datasets. This helps analysts evaluate price acceleration, demand surges, and seasonal behavior across micro-markets. It also allows businesses to build predictive models that map appreciation phases and identify undervalued pockets.

Listing-level insights extracted through PropertyShark Property Listings Scraper provide essential details about exposure periods, listing cycles, and attributes required for establishing accurate comparison models. These elements form the foundation of precise market benchmarking and valuation prediction.

Valuation Insights Collected Automatically :

| Valuation Metric | Analytical Benefit |

|---|---|

| Comparable Sales | Enhances market benchmarking |

| Assessed Values | Identifies growth opportunities |

| Building Specs | Refines pricing estimates |

| Market Trend Lines | Tracks seasonal fluctuations |

| Transaction Timelines | Measures market momentum |

Additionally, intelligence obtained through Real Estate Valuation Data via PropertyShark enables companies to align valuation models with ongoing pricing behavior for better investment assessment.

Strategic Market Pattern Identification Strengthening Key Decisions

Understanding neighborhood dynamics, ownership transitions, buyer shifts, and price behavior requires consistent monitoring across multiple data points. Automated extraction ensures a structured, reliable flow of real-time signals that highlight demand surges, absorption trends, and listing cycles.

One of the core benefits of automation is its ability to process property intelligence at high frequency and adapt quickly to changes in listing activity or buyer distribution. With continuous input supported by Web Scraping Services, organizations can identify price accelerations, shifting investor interest, or new construction pressures earlier than competitors.

Tracking ownership density, listing volumes, and price ranges helps firms determine neighborhood stability and future trend directions. This further supports segmentation by buyer category and highlights pockets transitioning into newer market phases. When combined with listing-level information, extracted intelligence supports both short-term strategic responses and long-term growth forecasting.

Pattern-based Market Insights Extracted Automatically

| Market Pattern | Strategic Value |

|---|---|

| Ownership Density | Assesses neighborhood stability |

| Price Shifts | Predicts demand cycles |

| New Construction | Indicates development interest |

| Listing Activity | Measures absorption pressure |

| Buyer Profile Changes | Reveals market transformation |

Finally, insights refined through to Extract PropertyShark Real Estate App Data ensure organizations can map market transitions effectively and support decision-making based on clear, structured signals.

How Mobile App Scraping Can Help You?

With the scalable power of PropertyShark Data Scraping for Valuation & Trends Insights integrated into mobile app environments, businesses can monitor market behavior, ownership shifts, and valuation signals directly through app-based dashboards.

Our approach includes:

- Monitoring local property activity with uninterrupted data updates.

- Tracking price shifts and ownership changes effortlessly.

- Supporting investment research with structured intelligence.

- Enhancing neighborhood-level market clarity at scale.

- Improving decision cycles with high-frequency information.

- Delivering real-time datasets directly to user dashboards.

Mobile extraction also allows seamless integration with internal analytics systems. By enabling data-driven monitoring, firms can strengthen portfolio planning and accelerate market evaluations, supported by insights built from to Extract PropertyShark Real Estate App Data.

Conclusion

Real estate strategies continue to evolve as markets shift, and investors need sharper intelligence to identify growth opportunities. Automated extraction combined with PropertyShark Data Scraping for Valuation & Trends Insights supports this need by transforming raw property information into high-impact insights that define market clarity and ownership visibility.

Consistent insights extracted through Real Estate Valuation Data via PropertyShark allow companies to make informed decisions backed by structured valuation and transaction intelligence. Contact Mobile App Scraping today to build custom extraction solutions tailored for deep real estate intelligence.