How Re/Max API Data Scraping for Property Market Insights Drives 25% Smarter Real Estate Valuations?

Introduction

The global real estate market is evolving rapidly, driven by data-backed decisions rather than intuition-based assumptions. Investors, brokers, and valuation professionals increasingly rely on structured property intelligence to understand pricing dynamics, demand fluctuations, and buyer behavior. In this environment, Re/Max API Data Scraping for Property Market Insights has emerged as a reliable method to transform scattered listing information into actionable market intelligence.

Modern analytics powered by API-based extraction eliminate the delays caused by manual research while ensuring real-time visibility into local and regional markets. For example, integrating regional data such as Remax Argentina API Data enables analysts to study emerging markets, identify underpriced zones, and evaluate seasonal demand shifts with greater precision.

As property markets become more competitive, data timeliness and accuracy directly influence investment outcomes. Organizations adopting automated data intelligence workflows report faster deal evaluations, improved pricing confidence, and reduced valuation errors. This blog explores how structured Re/Max property intelligence addresses key valuation challenges and drives measurable improvements across real estate decision-making.

Reducing Valuation Gaps Across Regional Property Markets

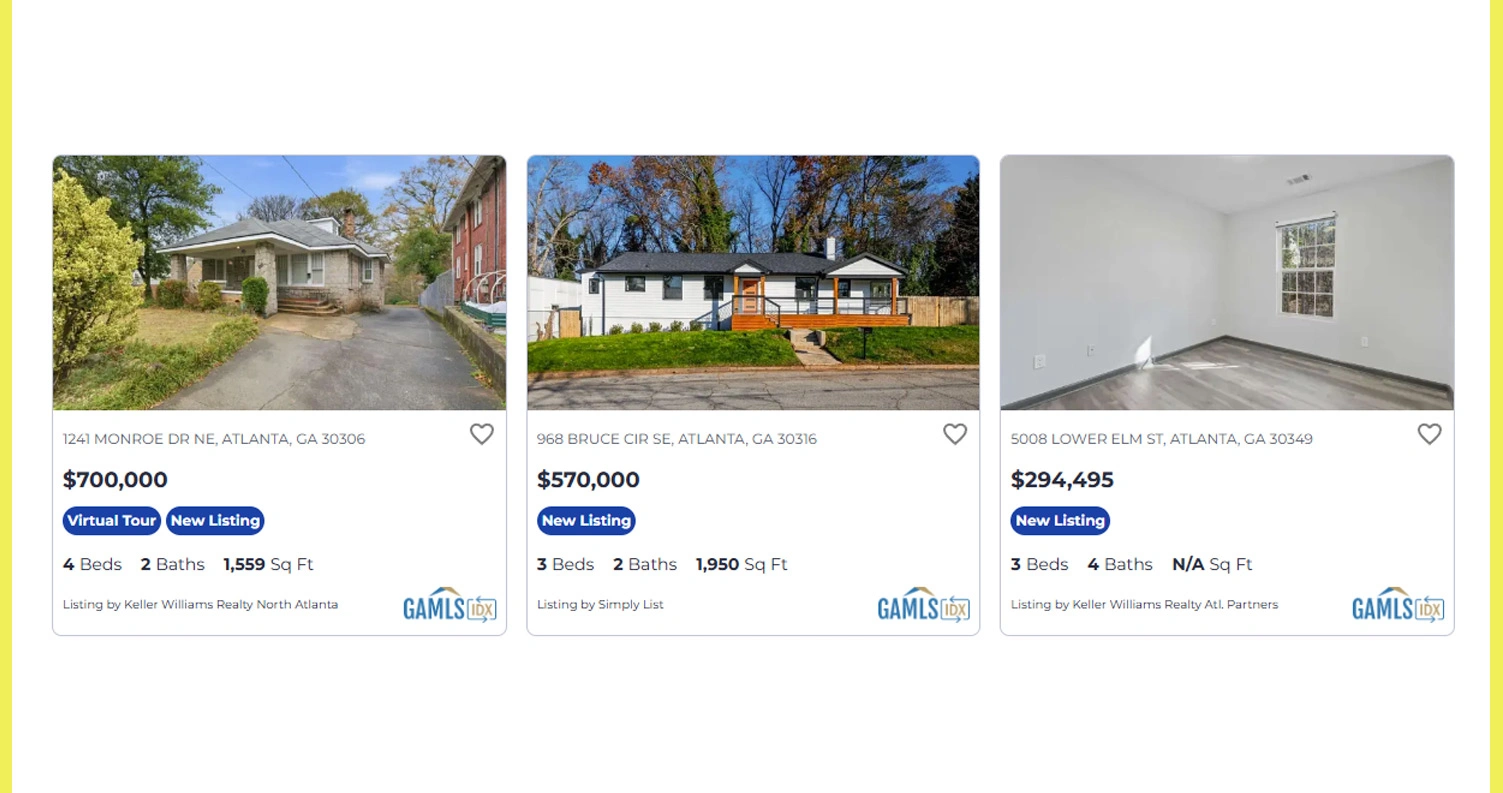

Inconsistent property valuation across regions remains a critical challenge for real estate professionals. These gaps become more pronounced when analysts rely on scattered sources instead of a unified intelligence framework. By implementing Real Estate Data Extraction, organizations can consolidate listing attributes, historical pricing, and location-based indicators into structured datasets that improve valuation consistency.

When enriched with Re/Max Real Estate Data Extraction, valuation teams gain access to standardized property details such as floor size, amenities, pricing history, and neighborhood context. This structured approach minimizes subjectivity and ensures comparable valuation logic across markets. According to industry benchmarks, firms using automated extraction experience nearly 24% fewer valuation discrepancies compared to manual workflows.

A unified data pipeline also enhances lender confidence and reduces negotiation friction between buyers and sellers. Analysts can compare similar properties across regions using identical parameters, eliminating pricing bias caused by missing or outdated inputs. As markets fluctuate rapidly, access to refreshed intelligence ensures valuations remain aligned with current demand signals rather than historical assumptions.

Valuation Consistency Comparison:

| Evaluation Factor | Fragmented Data | Structured Intelligence |

|---|---|---|

| Pricing Uniformity | Low | High |

| Attribute Completeness | Inconsistent | Standardized |

| Valuation Revisions | Frequent | Reduced |

| Market Confidence | Moderate | Strong |

By addressing regional data gaps through systematic intelligence, real estate teams improve pricing accuracy, strengthen trust with stakeholders, and support scalable valuation frameworks across diverse property markets.

Improving Market Visibility for Smarter Investment Decisions

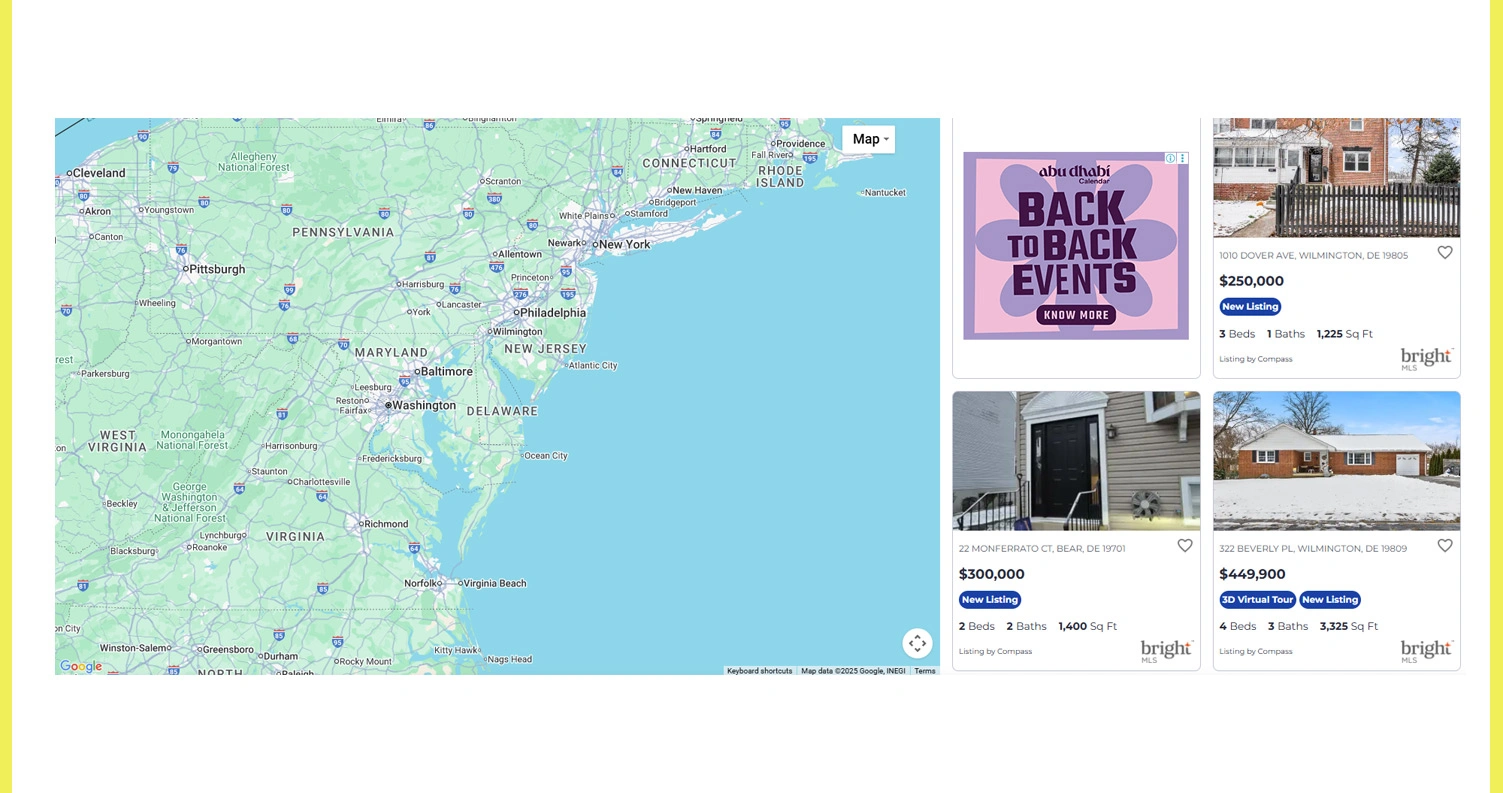

Limited visibility into evolving market trends often prevents investors from identifying early opportunities or mitigating risks. Without access to consolidated Real Estate Datasets, understanding long-term price behavior, absorption rates, and neighborhood performance becomes fragmented. This lack of clarity frequently results in reactive investment strategies rather than proactive planning.

Through Web Scraping Re/Max Property Listing Data, investors can monitor listing lifecycle patterns, price adjustments, and inventory movement across multiple locations. These insights help identify undervalued assets and emerging demand pockets before they become saturated. Research indicates that investors using structured listing intelligence improve forecast accuracy by nearly 27% compared to those relying on isolated market snapshots.

Data-driven visibility also supports comparative analysis between similar property types across different regions. By evaluating performance indicators over time, investors can assess market stability, rental yield potential, and appreciation trends with greater confidence.

Investment Insight Comparison:

| Insight Parameter | Limited Visibility | Data-Driven Visibility |

|---|---|---|

| Trend Recognition | Delayed | Early-stage |

| Risk Assessment | Subjective | Quantified |

| Forecast Accuracy | Moderate | High |

| Portfolio Stability | Variable | Improved |

Enhanced market visibility empowers investors to allocate capital strategically, reduce exposure to volatile segments, and align acquisition strategies with data-backed performance indicators.

Accelerating Pricing Intelligence and Market Responsiveness

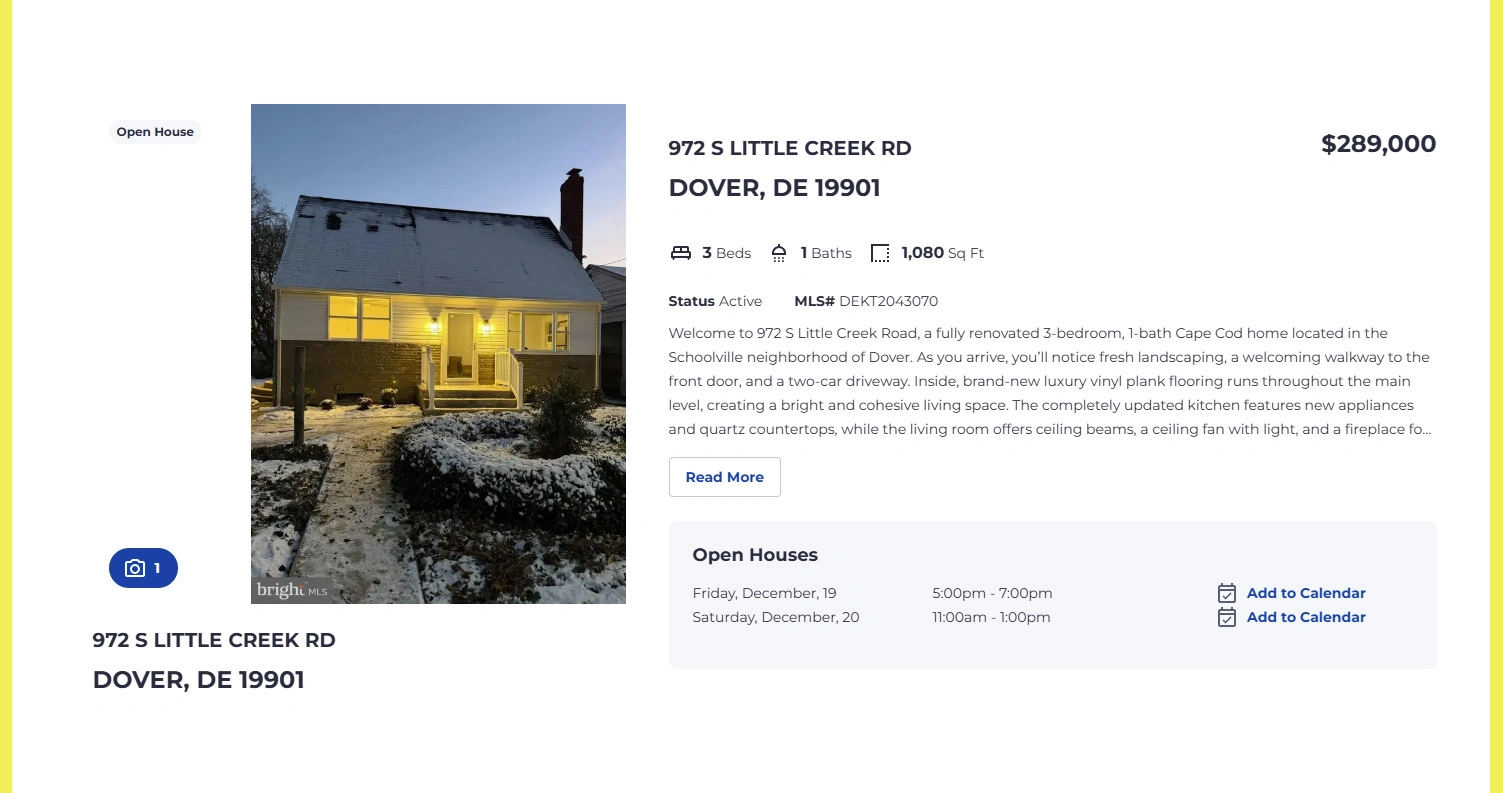

Delayed pricing updates can significantly impact deal velocity and revenue outcomes in fast-moving property markets. Manual monitoring methods often fail to capture real-time shifts in demand, leading to outdated valuations and missed opportunities. Integrating a Real Estate Data Extraction API allows organizations to maintain continuous access to listing updates, pricing changes, and market signals without operational delays.

With Automated Property Data Collection via Re/Max, brokers and analysts receive uninterrupted intelligence that reflects current market conditions. Studies show that properties priced using real-time data frameworks close up to 18% faster than those relying on periodic updates. This responsiveness improves negotiation outcomes and strengthens seller confidence.

Automation also reduces operational overhead by eliminating repetitive data collection tasks. Analysts can redirect efforts toward strategic evaluation rather than manual verification. As pricing intelligence becomes more dynamic, organizations can adjust listings instantly in response to competitive movements or demand surges.

Operational Efficiency Overview:

| Performance Metric | Manual Monitoring | Automated Intelligence |

|---|---|---|

| Update Frequency | Periodic | Continuous |

| Pricing Accuracy | Variable | Consistent |

| Analyst Effort | High | Optimized |

| Deal Closure Speed | Slower | Faster |

By accelerating access to accurate pricing signals, real estate teams enhance responsiveness, improve market alignment, and maintain competitive positioning in rapidly shifting environments.

How Mobile App Scraping Can Help You?

In an increasingly mobile-first ecosystem, real estate decisions are often influenced by app-based property discovery. Integrating mobile data streams with Re/Max API Data Scraping for Property Market Insights enables organizations to capture real-time user engagement patterns, listing popularity, and location-based demand signals that traditional web sources may miss.

Key advantages include:

- Faster identification of high-demand listings

- Improved accuracy in neighborhood-level analysis

- Enhanced understanding of buyer interaction patterns

- Reduced dependency on delayed desktop-only data

- Stronger alignment between pricing and user demand

- Scalable intelligence for multi-market expansion

By combining mobile intelligence with Scrape Re/Max Property Details and Market Analysis, organizations achieve a more complete view of property performance across platforms, ensuring valuations remain aligned with real buyer behavior.

Conclusion

Data-driven valuation is no longer optional in competitive property markets. By adopting Re/Max API Data Scraping for Property Market Insights, real estate professionals can significantly reduce pricing inaccuracies, enhance forecasting confidence, and support faster, more informed investment decisions across diverse markets.

A structured approach built on Property Market Analytics via Re/Max Data Scraping ensures sustainable valuation accuracy and operational efficiency. If you’re ready to transform property intelligence into measurable business outcomes, connect.with Mobile App Scraping today and start building smarter, insight-driven real estate strategies.