How to Scrape HouseSigma Real Estate Data for Trends & Buyer Behaviour to Track 69% Demand Fluctuations?

Introduction

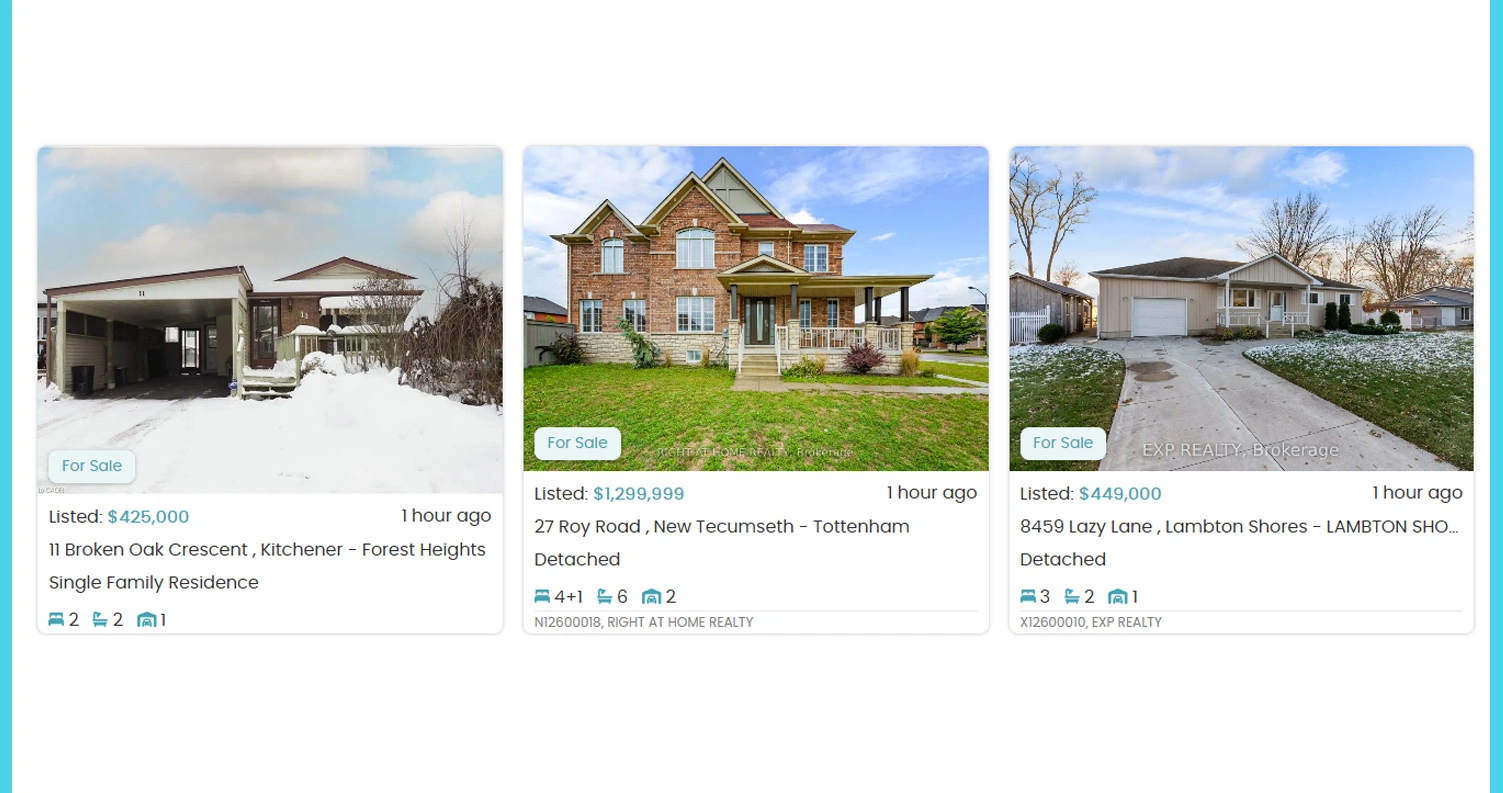

In today’s competitive real estate market, understanding buyer patterns and property trends is essential for investors agents and developers. By utilizing advanced tools to Scrape HouseSigma Real Estate Data for Trends & Buyer Behaviour stakeholders can gain actionable insights into demand fluctuations and pricing movements.

The capability to Scrape HouseSigma API Data allows professionals to collect comprehensive information from historical price trends to neighbourhood analytics without manual effort. For example agents monitoring residential listings can spot a 69% variation in demand for specific property types enabling proactive strategy adjustments.

By integrating HouseSigma Property Insights Extraction firms can forecast investment potential anticipate market swings and understand buyer priorities with greater accuracy. Collecting and analyzing this data regularly enables a deeper understanding of market patterns making property strategies more robust profitable and timely.

Understanding Market Volatility Through Data Analysis

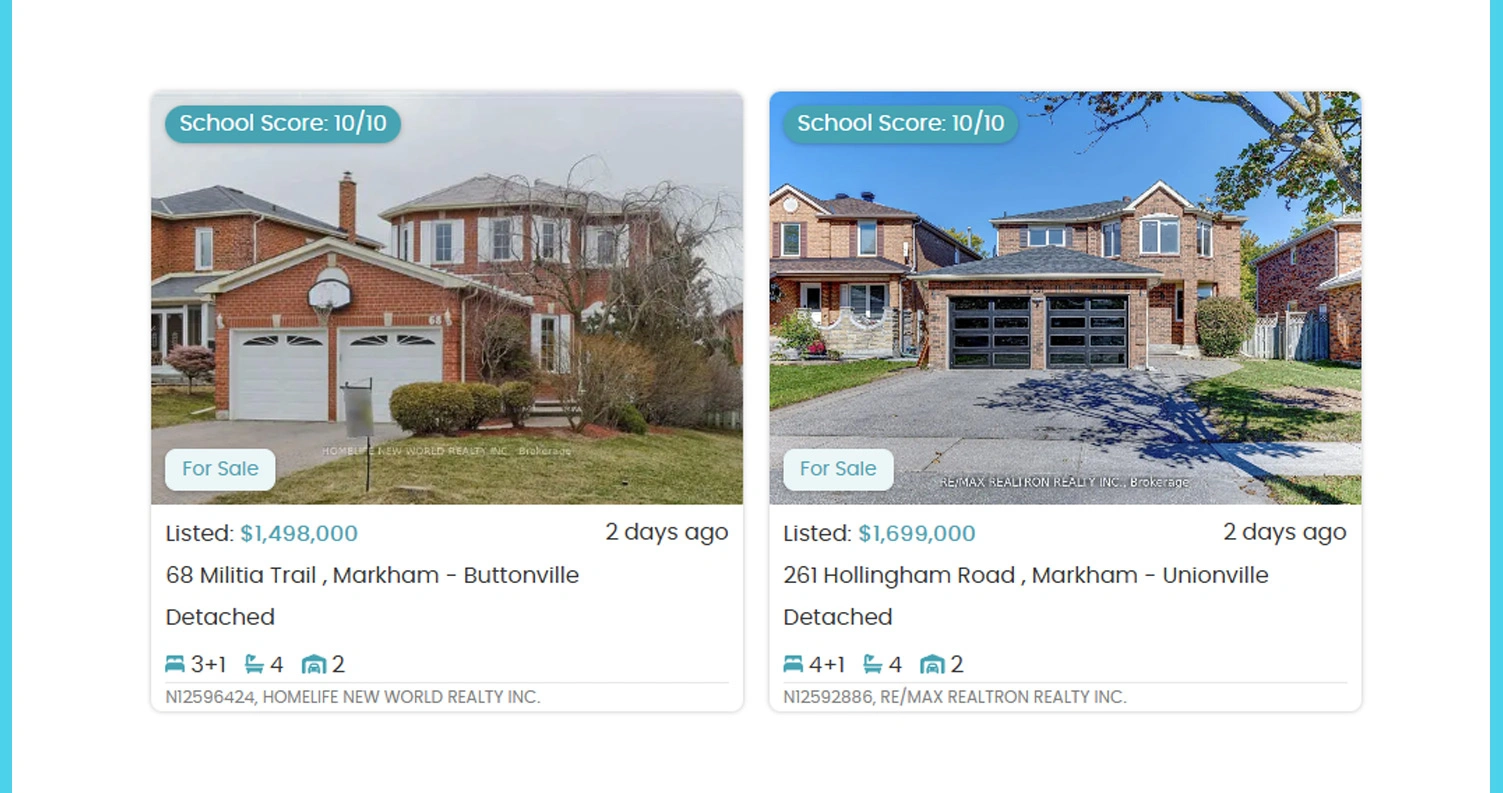

Real estate markets are known for their constant fluctuations making it critical for professionals to anticipate trends and respond strategically. By gathering structured data from reliable sources analysts can better understand neighbourhood dynamics property availability and emerging hotspots. Accessing data programmatically enables firms to track historical price movements current listings and buyer interest patterns without relying on manual processes.

| Metric | Current Trend | Percentage Change |

|---|---|---|

| Average Home Price | $950,000 | +12% |

| Condos Demand | High | +20% |

| New Listings | 320 | -8% |

| Average Days on Market | 42 | -15% |

By leveraging HouseSigma Pricing Trend Data Crawler agencies can model price trajectories and predict which areas are likely to experience growth or decline. This type of insight allows property managers and investors to make timely adjustments in marketing strategies acquisitions or resale approaches.

Tracking fluctuations in demand enables firms to spot gaps in supply identify lucrative investment opportunities and align portfolios with buyer preferences. Furthermore collecting data using Scrape Real Estate API Data ensures accuracy and timeliness reducing the risks associated with outdated or incomplete information.

Firms that systematically analyze market trends gain the advantage of forecasting potential shifts mitigating losses and optimizing decision-making processes. Overall data-driven approaches to market volatility allow organizations to maintain competitiveness and improve strategic planning.

Analyzing Buyer Preferences for Targeted Strategies

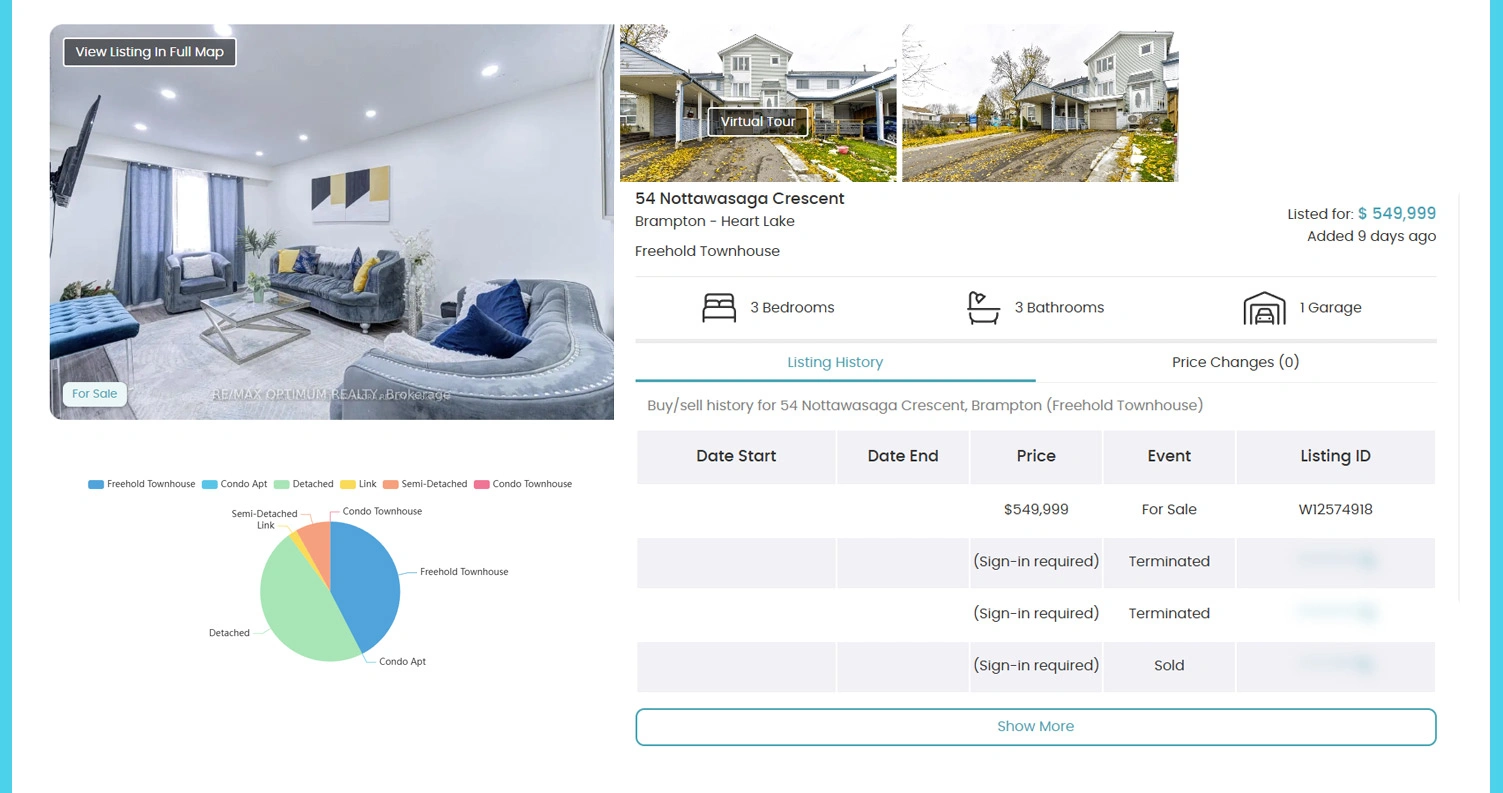

Understanding what drives property buyers is crucial for shaping effective marketing and pricing strategies. By tracking listing interactions preferred property types and regional trends businesses can adjust their approach to align with real demand. Implementing Real Estate App Data Extraction provides real-time insights into buyer behavior often offering more up-to-date information than traditional website analytics.

| Buyer Behaviour Metric | Observation | Impact |

|---|---|---|

| Preferred Property Type | Condos | +18% |

| Average Budget | $700k-$900k | +20% |

| Interest in Amenities | High | Improves resale value |

| Viewing Requests | 150/week | +25% |

Using HouseSigma Buyer Behavior Dataset Extraction companies gain insights into buyer priorities such as preferred neighbourhoods property size and investment potential. These insights help identify high-conversion listings reduce marketing waste and improve engagement with prospective buyers.

Moreover analyzing regional patterns allows firms to forecast emerging high-demand areas. Integrating buyer behaviour datasets with pricing information and property details creates a holistic view of market preferences. Companies can identify undervalued regions optimize listing strategies and enhance overall return on investment. These insights empower agents and investors to make informed decisions with confidence ultimately improving operational efficiency and strategic planning.

Enhancing Property Pricing Strategies for Maximum Returns

Accurate pricing is essential to maximize property returns and attract potential buyers efficiently. By analyzing competitive listings monitoring market demand and leveraging historical trends professionals can implement effective Price Optimization strategies. Structured data collection offers clear insights into price movements across regions and property types.

| Pricing Metric | Current Value | Suggested Adjustment |

|---|---|---|

| Average Listing Price | $950,000 | Maintain |

| High-Demand Areas | +20% Increase | |

| Low-Demand Areas | -15% Reduce | |

| Average ROI | 7.5% | +1.2% |

With HouseSigma Housing Intelligence Scraper investors and agents can identify pricing gaps monitor competitor adjustments and respond to changes promptly. This ensures listings remain competitive while maintaining profitability.

Additionally Web Scraping HouseSigma Pricing & Trend Reports provides valuable insights into seasonal or regional price variations helping businesses make data-driven decisions and optimize investment strategies. By combining property insights buyer behaviour and pricing trends firms can reduce negotiation cycles improve conversion rates and sustain portfolio competitiveness.

Continuous monitoring of pricing shifts allows proactive adjustments ensuring properties are positioned effectively in a dynamic market. Ultimately integrating such tools supports smarter pricing strategies higher returns and better alignment with market demand patterns.

How Mobile App Scraping Can Help You?

Integrating our solution into property intelligence frameworks allows businesses to Scrape HouseSigma Real Estate Data for Trends & Buyer Behaviour seamlessly. Mobile apps often provide real-time updates on property listings buyer interactions and market movements that websites might not reveal promptly.

Our approach includes:

- Capture listing updates instantly.

- Track buyer inquiries effectively.

- Monitor property price adjustments.

- Analyze competitor listings systematically.

- Identify emerging hotspots quickly.

- Forecast potential market fluctuations.

Using these insights firms can act faster than competitors and tailor strategies to current demand. Combining these capabilities with HouseSigma Property Insights Extraction enhances decision-making ensures accurate portfolio evaluation and supports predictive market analysis.

Conclusion

To maintain an edge in property markets organizations must integrate advanced intelligence tools that Scrape HouseSigma Real Estate Data for Trends & Buyer Behaviour efficiently. This enables a comprehensive understanding of demand fluctuations pricing movements and emerging hotspots.

Simultaneously leveraging HouseSigma Pricing Trend Data Crawler ensures real-time updates and accurate forecasting allowing firms to optimize investments and refine property strategies. Contact Mobile App Scraping today to enhance your real estate analytics capabilities and drive smarter market moves.