What Makes UCC Data Scraping for Corporate Listings Power 99% Compliance and Market Research?

Introduction

In an increasingly regulated corporate environment, access to accurate and timely filing data determines how confidently businesses can validate partners, assess exposure, and align with compliance frameworks. When processed at scale, these records shift from static documents into strategic intelligence assets that support audits, investment screening, and competitive benchmarking through UCC Data Scraping for Corporate Listings.

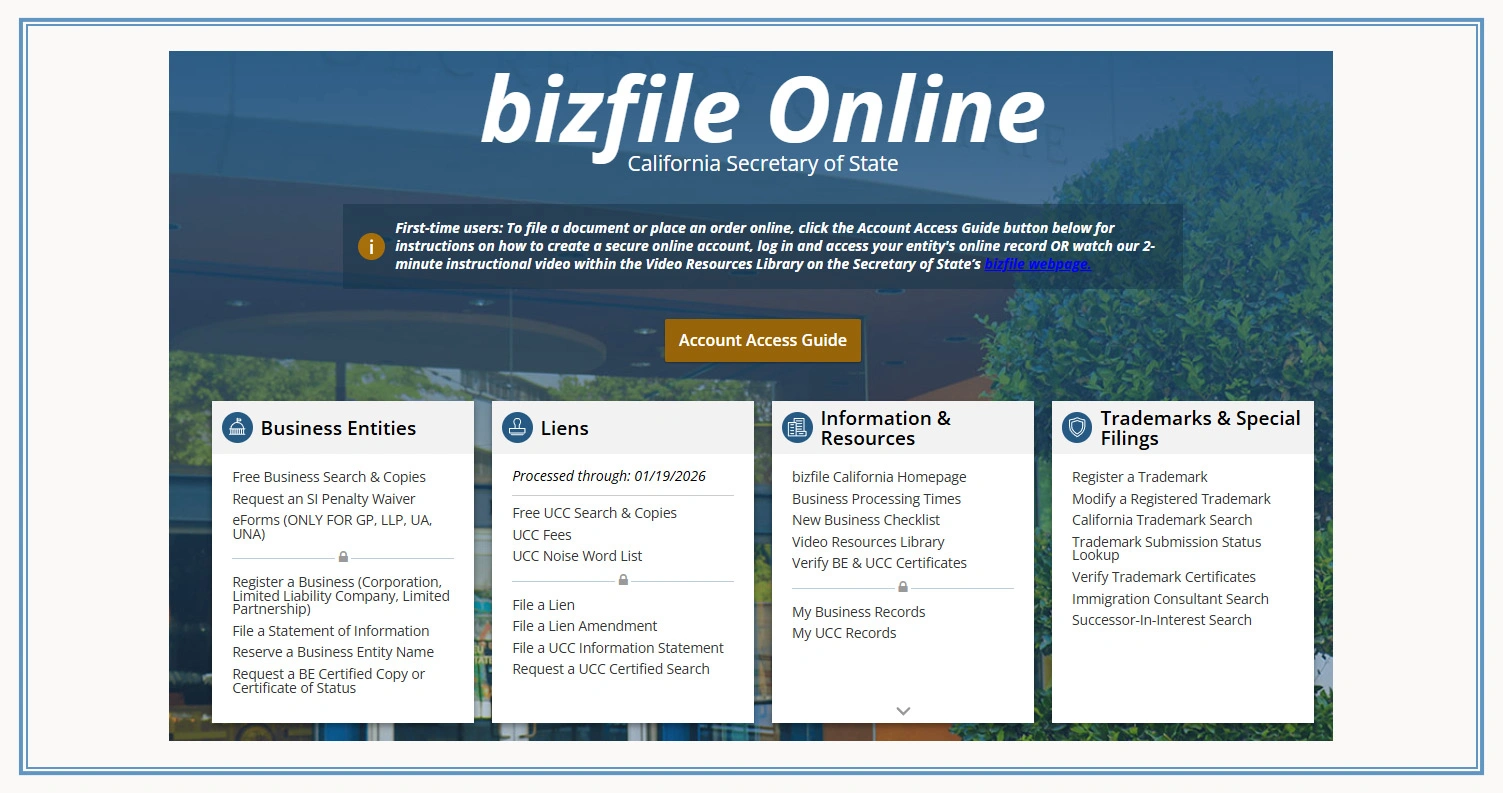

Modern research teams no longer rely solely on manual reviews or fragmented public portals. Instead, structured data pipelines help transform state-level filings into unified datasets, enabling faster verification cycles and deeper analytical clarity. Advanced workflows such as Automated UCC Data Collection allow organizations to eliminate data silos while maintaining high accuracy across jurisdictions.

Beyond traditional B2B use cases, insights derived from structured filings increasingly complement digital intelligence ecosystems, including Entertainment App Scraping Services, where corporate ownership and financial signals influence partnership and licensing decisions. As regulatory expectations tighten and market volatility increases, scalable UCC intelligence becomes foundational for data-driven decision-making, risk mitigation, and sustainable growth strategies across compliance and research teams.

Addressing Inconsistent Filing Visibility Across Jurisdictions

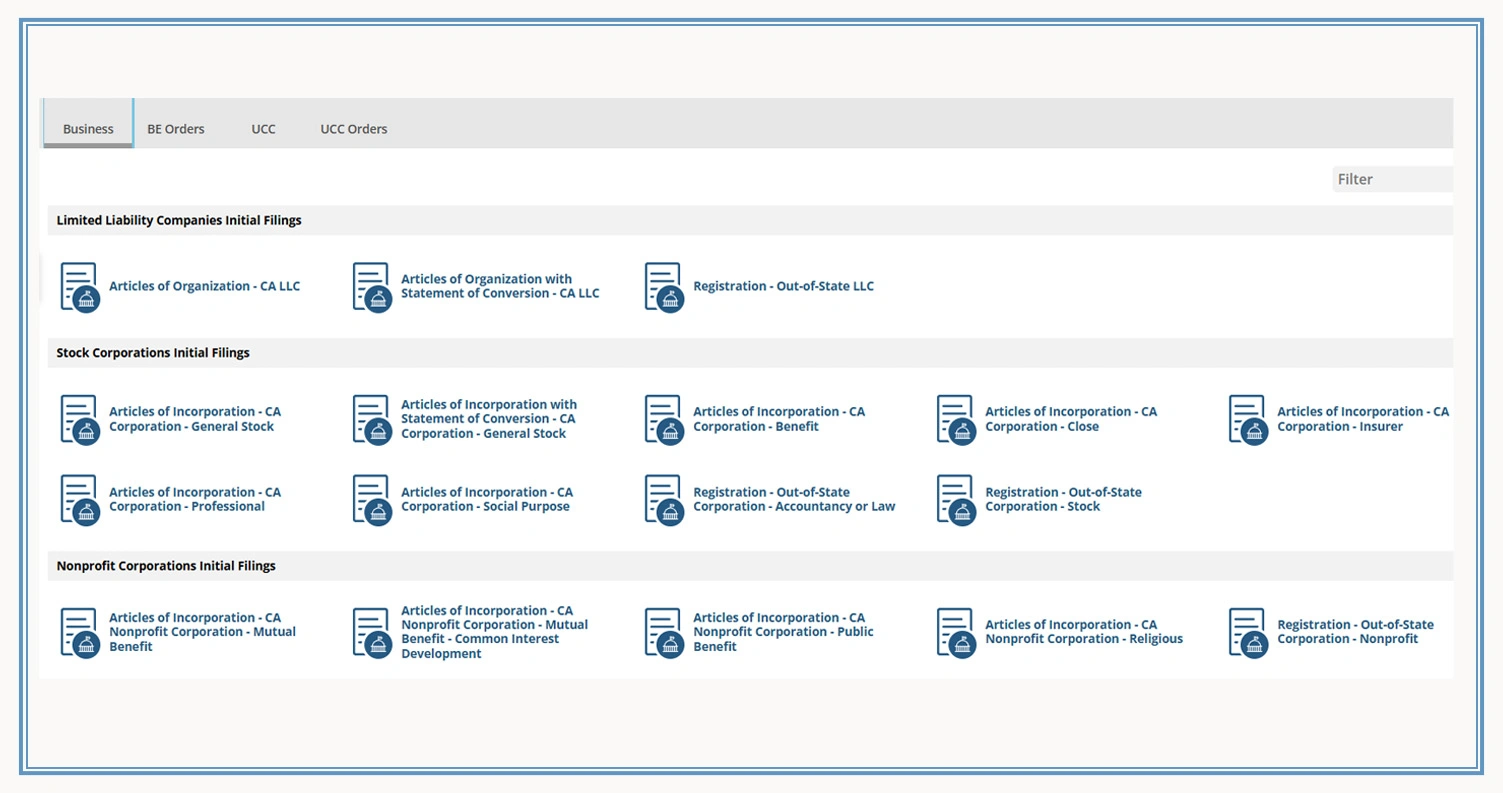

Organizations operating across multiple states often struggle with fragmented filing systems that vary in structure, accessibility, and update frequency. These inconsistencies make it difficult for compliance teams to maintain a reliable view of active liens, amendments, and terminations. Manual verification across state portals increases the likelihood of missed records, especially when filings are updated frequently or registered under alternate entity names.

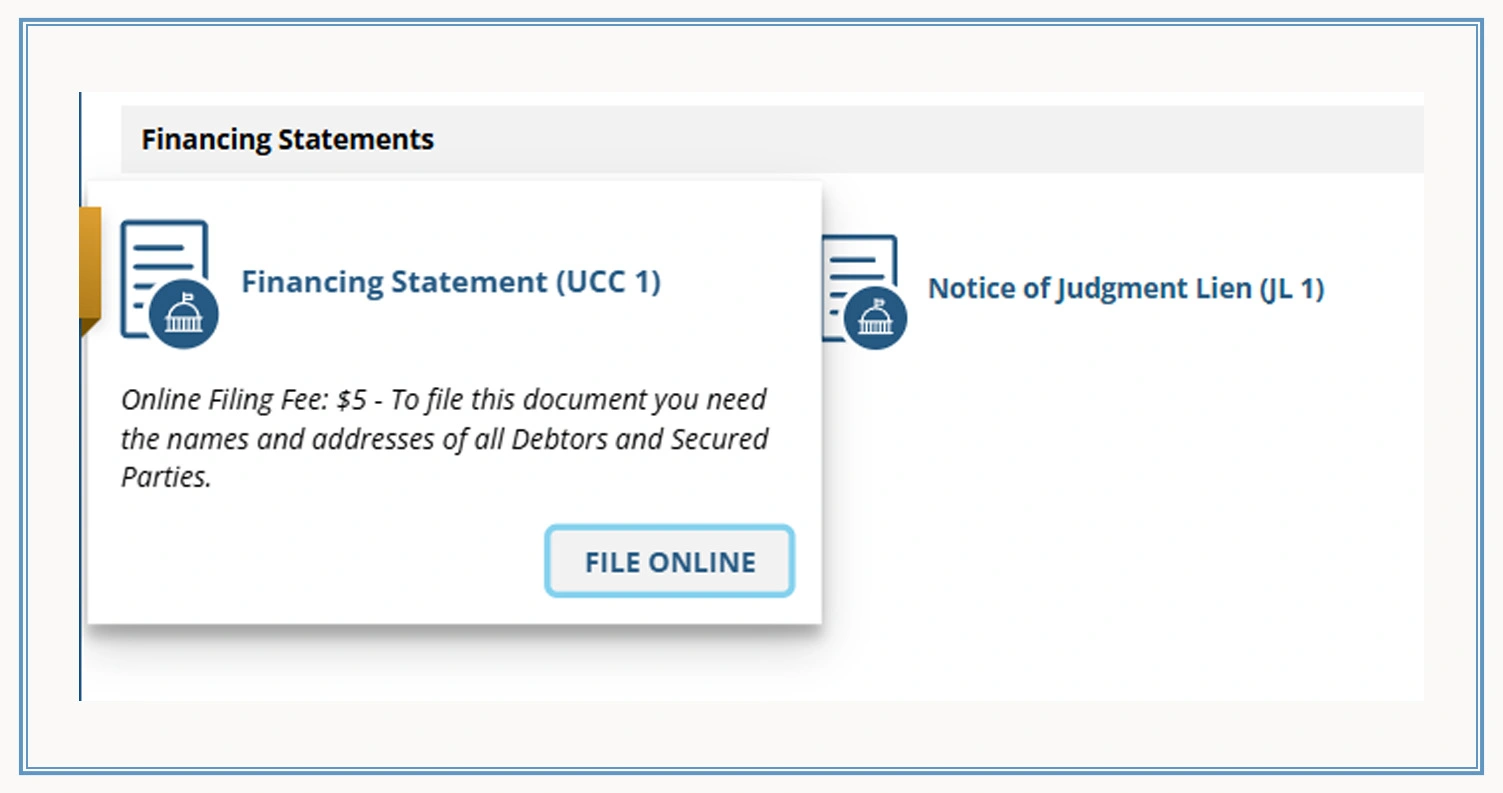

Applying structured workflows to Extract UCC Filings for Compliance Analysis allows businesses to consolidate disparate registries into a standardized dataset. This process supports faster reconciliation of filings while minimizing human error caused by inconsistent formats. When paired with Enterprise App Crawling Services, large volumes of public filing data can be processed continuously, ensuring timely visibility across jurisdictions without operational bottlenecks.

Filing Coverage Performance Comparison:

| Evaluation Metric | Manual Monitoring | Centralized Extraction |

|---|---|---|

| Multi-state filing visibility | Limited | Near-complete |

| Update identification speed | Several days | Same-day detection |

| Amendment tracking accuracy | Moderate | High |

Industry benchmarks indicate that organizations using centralized filing intelligence reduce compliance review cycles by more than 35%. Beyond efficiency gains, this structured visibility strengthens governance frameworks by ensuring filings remain current and verifiable. As regulatory expectations continue to intensify, eliminating jurisdictional blind spots becomes essential for sustaining operational credibility and minimizing compliance exposure.

Revealing Ownership Structures And Secured Relationships

Corporate ownership and secured party relationships are rarely transparent when viewed through traditional registries alone. UCC filings provide critical signals about who holds financial interests in assets, yet these insights often remain underutilized due to unstructured formats and inconsistent naming conventions. Without systematic analysis, organizations may overlook indirect exposure tied to subsidiaries, guarantors, or cross-collateralized assets.

Using automated methods to Scrape UCC Company Ownership Data enables analysts to identify relationships between borrowers, lenders, and collateral at scale. This structured visibility improves due diligence outcomes during mergers, vendor onboarding, and credit evaluations. By correlating filings across entities, analysts can detect financial dependencies that would otherwise remain hidden in surface-level company profiles.

Ownership Intelligence Enhancement Overview:

| Insight Category | Traditional Review | Structured Filing Data |

|---|---|---|

| Secured party identification | Partial | Comprehensive |

| Cross-entity relationship view | Low clarity | High clarity |

| Hidden obligation detection | Infrequent | Consistent |

Research across financial and procurement teams shows that enriched ownership mapping improves risk identification accuracy by nearly 40%. More importantly, it equips stakeholders with defensible evidence when evaluating long-term partnerships. As corporate structures grow more complex, filing-based ownership intelligence becomes a critical input for informed, data-backed decision-making.

Using Filing Signals To Interpret Market Behavior

Market research increasingly depends on alternative datasets that reveal behavioral signals before they surface in financial disclosures. UCC filings serve as early indicators of financing activity, asset acquisition, and operational restructuring. When analyzed over time, filing patterns reveal directional shifts that help researchers interpret competitive movements and capital allocation strategies.

Embedding Corporate Compliance Intelligence into analytical models allows research teams to align filing behavior with broader market trends. For example, increased financing activity may signal expansion, while termination clusters often precede divestment or market exits. These insights enhance forecasting precision by supplementing traditional metrics with real-world financial actions.

Filing-Based Market Indicators:

| Filing Activity Type | Interpreted Signal |

|---|---|

| New secured transactions | Growth momentum |

| Filing terminations | Strategic pullback |

| Collateral diversification | Business realignment |

Studies show that incorporating filing-derived indicators can improve market forecast reliability by nearly 30%. Beyond prediction accuracy, these insights support strategic timing for investments, pricing decisions, and competitive positioning. By translating regulatory records into market intelligence, research teams gain a clearer understanding of how financial behavior shapes industry dynamics.

How Mobile App Scraping Can Help You?

Modern compliance and research teams require adaptable data frameworks that operate seamlessly across platforms. Scalable extraction solutions transform filing intelligence into actionable datasets, especially when powered by UCC Data Scraping for Corporate Listings within mobile-first ecosystems.

Key advantages include:

- Faster verification across jurisdictions.

- Reduced dependency on manual lookups.

- Improved audit traceability.

- Consistent data normalization.

- Cross-platform intelligence access.

- Scalable analytics readiness.

This directly supports more accurate Business Risk Assessment Using UCC Data, allowing teams to anticipate exposure and respond proactively in dynamic regulatory environments.

Conclusion

Reliable filing intelligence has become essential for organizations navigating complex regulatory and competitive landscapes. When applied correctly, UCC Data Scraping for Corporate Listings transforms static public records into decision-ready insights that support compliance validation, partner evaluation, and market analysis with measurable precision.

At the same time, integrating filing intelligence into broader analytical ecosystems enhances Business Risk Assessment Using UCC Data, enabling organizations to act with confidence rather than assumption. Connect with Mobile App Scraping today and start building a compliance-ready, research-driven data foundation.