Introduction

Strategic property investment decisions in today's dynamic real estate market require precise data intelligence and comprehensive understanding of market movements. Real Estate App Data Scraping plays a pivotal role in enabling firms to refine their investment portfolios through evidence-based insights and analytical decision frameworks. As housing demand fluctuates across metropolitan areas and regional markets, immediate access to reliable property intelligence becomes crucial for sustaining competitive positioning and maximizing returns.

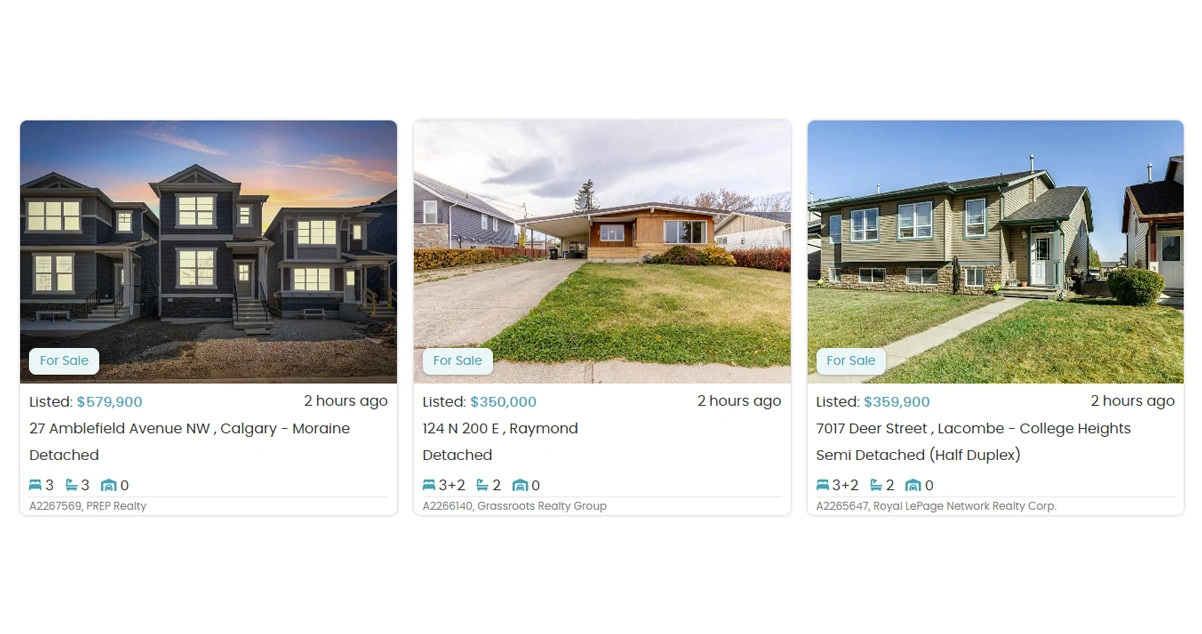

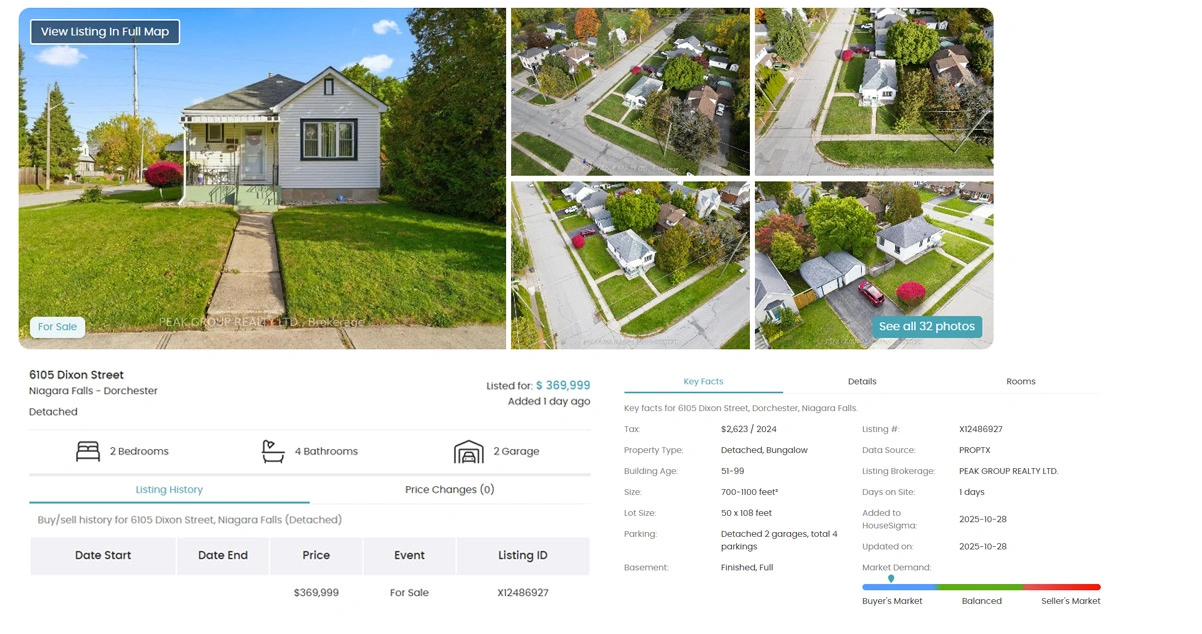

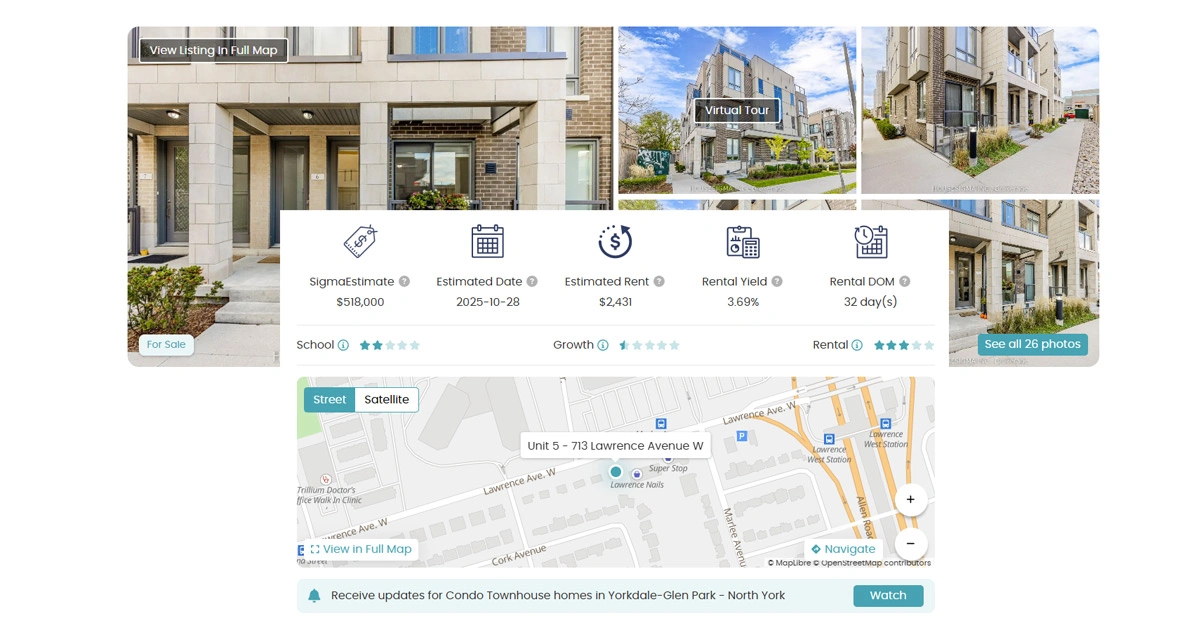

This case study examines how sophisticated data acquisition methodologies revolutionize investment planning through targeted intelligence operations. By implementing Web Scraping Property Trends with HouseSigma API, organizations achieve clear visibility into valuation patterns, market velocity indicators, and buyer behavioral insights. Establishing comprehensive extraction frameworks empowers real estate professionals to execute strategic decisions aligned with current market dynamics and investment objectives.

The Client

A prominent real estate investment firm specializing in residential property portfolios engaged our services to enhance their market analysis capabilities through Web Scraping Property Trends with HouseSigma API. They sought comprehensive understanding of evolving property valuations across key metropolitan regions to drive informed acquisition strategies and portfolio optimization.

The organization strategically implemented HouseSigma Data Scraper solutions to uncover critical intelligence surrounding market velocity metrics, track historical pricing movements, and identify emerging investment opportunities within Canada's competitive residential real estate landscape. Their focus centered on establishing sustainable competitive advantages through superior market intelligence capabilities.

The firm required a robust, enterprise-grade platform engineered to provide consistent and precise market data across diverse geographic markets, ensuring operational scalability while maintaining stringent accuracy standards for investment-grade analysis and strategic planning initiatives.

The Challenge

The client encountered significant obstacles navigating the rapidly evolving property market across multiple urban centers.

Critical barriers included:

- Fragmented property information across regional markets generated analytical gaps in performance evaluation, hindering efforts to implement HouseSigma API Integration for unified cross-market strategy and comprehensive investment intelligence frameworks.

- Traditional research approaches proved inadequate for capturing real-time market shifts, constraining the organization's capacity to leverage Real Estate Datasets for precise valuation modeling and accurate comparative market analysis.

- Absence of neighborhood-level demand indicators and micro-market insights diminished segmentation precision, impacting data-driven investment targeting despite significant variations in regional appreciation rates and demographic consumption patterns.

- Manual information gathering processes delayed critical investment decisions, restricting deployment of Automated Property Data Extraction From HouseSigma for rapid competitive assessment and enhancement of portfolio performance across priority investment zones.

These combined obstacles substantially limited the client's ability to optimize portfolio returns and maintain strategic market leadership.

The Solution

Our solution harnesses Track Property Trends Using HouseSigma API to streamline access to actionable real estate intelligence for precision investment strategy.

-

Property Intelligence Hub

Integrates automated extraction and advanced analytics utilizing HouseSigma API Integration to deliver granular, location-specific insights that optimize neighborhood-level investment decisions and eliminate manual research dependencies efficiently. -

Market Velocity Engine

A specialized platform that deploys HouseSigma Data Scraper technology to aggregate property valuations, inventory availability, and demand signals into structured datasets supporting responsive strategies and competitive positioning initiatives. -

Trend Forecasting System

Applies sophisticated algorithms to HouseSigma Property Dataset analysis, identifying seasonal fluctuations and emerging market patterns to support strategic acquisition timing and drive precise investment positioning in residential markets. -

Valuation Tracking Platform

Delivers continuous performance monitoring through Automated Property Data Extraction From HouseSigma, equipping investment teams with accurate, regional competitor intelligence for informed pricing decisions and agile portfolio management.

Implementation Process

We engineered a comprehensive, scalable infrastructure for uninterrupted data flow, ensuring responsive adaptation to shifting market conditions.

-

Unified Analytics Framework

A centralized architecture for multi-market comparison, providing structured access to property specifications, historical valuations, and inventory metrics across regions through Track Property Trends Using HouseSigma API for streamlined cross-market intelligence integration. -

Quality Assurance Pipeline

Processes raw information feeds with systematic validation and data enrichment protocols, ensuring accurate and consistent outputs for strategic interpretation via Price Monitoring capabilities across diverse regional datasets and market segments. -

Strategic Intelligence Platform

Converts refined information into actionable investment guidance, helping firms optimize strategy, enhance portfolio composition, and accelerate performance in the dynamic, high-stakes residential property competitive landscape.

Results & Impact

Our customized approach enabled superior decision-making, operational excellence, and refined investment planning through comprehensive market intelligence.

-

Investment Precision Enhancement

The client improved acquisition timing and valuation accuracy by deploying the HouseSigma Property Dataset, optimizing property selection across multiple markets based on refined neighborhood-level intelligence and comparative performance metrics. -

Geographic Strategy Optimization

By applying Web Scraping Property Trends with HouseSigma API, investment teams developed localized acquisition approaches, generating superior portfolio returns through demand pattern analysis and competitive benchmarking in targeted metropolitan segments. -

Market Responsiveness Advantage

Continuous monitoring of pricing trends, inventory levels, and demand indicators enabled sustained competitive edge, facilitating rapid strategic pivots in local property markets to preserve portfolio leadership and maximize appreciation potential. -

Predictive Analytics Capability

Regional market patterns were decoded to shape acquisition strategies and portfolio allocation decisions, enabling the client to execute targeted investments with enhanced precision through sophisticated geographic analytics and behavioral forecasting models.

Key Highlights

-

Comprehensive Property Intelligence

Provides Strategic Market Analysis by extracting HouseSigma API Integration data to enable high-confidence decisions using precise analytics derived from HouseSigma's extensive property database ecosystem and historical records. -

Continuous Market Monitoring

Facilitates Dynamic Tracking through Track Property Trends Using HouseSigma API, revealing shifting buyer patterns and valuation movements for accurate adjustments during critical transaction windows and investment cycles. -

Integrated Information Access

Ensures Streamlined Data Connectivity with Web Scraping Services utilizing Automated Property Data Extraction From HouseSigma, delivering instant access to pricing intelligence and availability metrics with superior reliability and system performance.

Client’s Testimonial

Integrating Web Scraping Property Trends with HouseSigma API through Mobile App Scraping has significantly enhanced our real estate investment insights. The precision and efficiency of the HouseSigma Data Scraper have empowered our team to identify emerging property opportunities faster and make more informed, data-driven investment decisions that elevate overall portfolio growth.

– Ethan Wallace, Director of Real Estate Analytics

Conclusion

In today’s evolving real estate landscape, leveraging Web Scraping Property Trends with HouseSigma API empowers investment professionals to identify lucrative opportunities and stay ahead of shifting market dynamics. By accessing real-time property data, firms can make smarter acquisition choices, strengthen their portfolio strategies, and maintain a competitive edge across varied regional markets.

Through advanced HouseSigma API Integration, our solutions uncover key insights into pricing behavior, buyer intent, and market movement—helping investors take data-driven actions that deliver tangible growth. Contact Mobile App Scraping today to explore how our customized data solutions can elevate your real estate intelligence and enhance your investment strategy.